It’s been a crazy few years in the industrial sector. A new report, out from Citigroup analyst Kyle Menges, takes especial note of the machinery segment, a set of industrial companies that build and market specialized heavy equipment for a wide variety of applications, from construction to agriculture, and pretty much everything in between.

The machinery segment built up heavy work backlogs during the pandemic lockdown period a few years ago, on the combination of increased demand and constrained supply chains. Since the lockdown policies were lifted, these companies have benefited from the high inflation regime and the imbalance between demand and supply, a set of circumstances that allowed them to realize expanded margins.

The situation is normalizing now, as machinery companies have mostly worked through their backlogs and are getting back to their pre-pandemic modes of operation. This opens up opportunities for investors, opportunities for share gains as high as 67% as Citi’s Menges points out.

He says of the sector, “We think machinery companies will sustain higher through-cycle margins as inflation settles. Over the last ~12 months, we have seen a rebalance of supply and demand not seen since the GFC (global financial crisis), although this time around was more a function of correcting from pandemic-induced disequilibrium. Even if we assume Machinery gross margins fall by the amount that they did during the GFC, that would still suggest a much higher floor for Machinery gross margins going forward compared to historical levels.”

We can follow some of Menges’ machinery sector picks using the TipRanks platform. According to the data, these shares have earned Buy-ratings and solid upsides from the analysts’ consensus, so let’s give them a closer look and find out why.

CNH Industrial (CNH)

The first stock we’ll look at here, CNH Industrial, is a designer and manufacturer of heavy equipment for the agribusiness and construction sectors. CNH is one of this niche’s older names, and its roots extend back to the 1840s. The company’s longevity backs up its solid reputation for quality with its customer base, the working farmers, builders, and contractors who make daily use of the company’s products.

Those products include lines of tractors, harvesting combines, tillers, bulldozers, excavators, and heavy-duty forklifts, to name just a few of the specialized vehicles that CNH produces. The company builds this line-up of heavy-duty equipment under several brand names, all with sound reputations in the business, such as Case IH, New Holland, and Steyr. CNH’s industrial vehicles are sold, used, and supported in some 170 countries around the world, and the company has industrial and financial operations in 32 countries. CNH is incorporated in the Netherlands, keeps its global headquarters in the UK, and trades its stock on Wall Street, making it a truly global enterprise.

This company is currently seeing some churn at the top, as outgoing CEO Scott Wine was replaced by Gerrit Marx effective on July 1. Mr. Marx takes over the top spot at CNH after serving as CEO of Iveco Group, the Italian multinational manufacturer of transport vehicles.

On the financial side, we find that CNH reported a decline in industry demand, year-over-year, during its last reported quarter, 1Q24 – a decline that points toward the normalization of the industry backlogs. The company’s consolidated revenue came to $4.8 billion, down 10% year-over-year, but beating the forecast by $180 million. The company’s quarterly bottom line came to 33 cents by non-GAAP measures, beating expectations by 7 cents per share. CNH reported a Q1 free cash flow absorption of $1.2 billion, and at the end of the quarter had $3.23 billion in cash and other liquid assets on hand.

This brings us to Kyle Menges’ coverage of the stock, which he sees headed for better days. Menges writes, “CNH is our top pick amongst our ag coverage. CNH stands out as the only ag OEM we cover that we expect to grow EPS next year. Our estimates reflect our confidence that incoming CEO Gerrit Marx can execute on significant cost savings initiatives that were already well underway under outgoing CEO Scott Wine. Our positive earnings outlook, taken together with the fact that CNH is currently an unloved stock (due to CEO transition concerns), creates plenty of upside from current levels, in our view.”

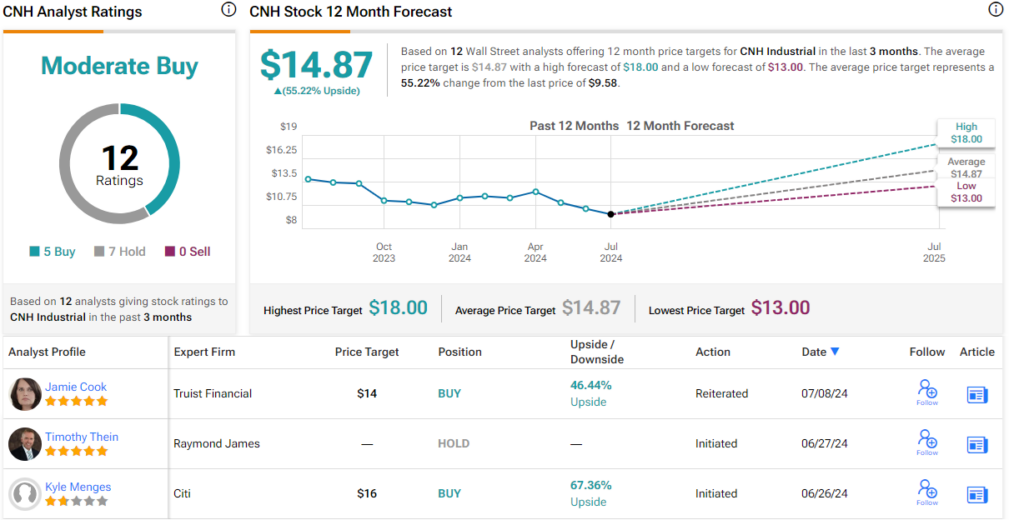

Tracking this forward, Menges goes on to rate CNH stock as a Buy, and sets a price target of $16, implying a robust upside potential of 67% on the one-year horizon. (To watch Menges’ track record, click here.)

Overall, CNH has a Moderate Buy consensus rating from the Street’s analysts, based on 12 recent reviews with a breakdown of 5 Buys to 7 Holds. The shares are priced at $9.58 and their average target price, $14.87, suggests that CNH will appreciate by 555% over the next 12 months. (See CNH Industrial’s stock forecast.)

Oshkosh Corporation (OSK)

The second stock we’ll look at here is Oshkosh Corporation, based in Oshkosh, Wisconsin, a town known for several eponymous manufacturing businesses. Oshkosh Corporation builds, markets, and distributes a range of specialty vehicles and vehicle bodies. The company’s product lines include electric vehicles and EV platforms; smart vehicle fleet augmented reality upgrades; AI-powered autonomous operation and active safety systems; advanced data analytics, product modeling, and logistics optimization; and digital manufacturing technology upgrades for factories – including wearable devices to enhance factory floor efficiency and safety.

Some numbers will show how this company has expanded its horizons beyond its small Midwestern city. The company has more than 17,000 employees, building products based on more than 800 patents. Its products are sold under 13 brands, and the company operates in 125 locations across 19 countries. Oshkosh’s operations and products can be found as far away from Wisconsin as Italy, India, Singapore, and Australia.

Oshkosh Corporation’s customer base includes other industrial manufacturers, as well as end users such as fire departments and the military. The company’s products are in high demand by the Department of Defense, for which Oshkosh produces the US Army’s 2.5- and 5-ton trucks, 10-ton trucks, tank transporters, and mine blast protected vehicles, to name just a few.

Turning to the financial releases, we find that in Q1 the company brought in $2.54 billion in sales revenue, a figure that was up almost 12% from the prior year and beat expectations by $50 million. At the bottom line, the company’s non-GAAP EPS of $2.89 was up more than 80% compared to the 1Q23 result, and was 64 cents per share ahead of the estimates.

In analyst Menges’ view, this adds up to a strong choice. He writes of the company, “OSK is our top pick in construction, driven by a robust outlook for its unique Vocational (~30% of sales) and Defense (~20% of sales) segments. We anticipate growth in these two segments to more than offset shallow sales declines in its Access segment (~50% of sales) in 2025 & 2026. This is driven by our view that rental fleet replacement demand is likely to provide a solid cushion to NA Access equipment sales over the next few years.”

Menges goes on to put a Buy rating here, and his price target, of $130, shows his confidence in a 27% gain for the stock over the coming year.

This is another stock with a Moderate Buy consensus rating from the Street, based on 10 analyst reviews, that include 4 Buys, 5 Holds, and 1 Sell. The shares are currently trading for $102.38 and have an average target price of $131.11, implying a one-year upside potential of 28%. (See Oshkosh’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.