Just over a week ago, Piper Sandler’s chief market technician Craig Johnson made an interesting prediction. According to his research, industrial stocks like Boeing (NYSE:BA) could surge in 2023, while tech plays such as Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) might sink into the abyss.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

He also believes the S&P 500 (SPX) could surge to 4,625 this year. Needless to say, the stock market is showing signs of a recovery. Key risk factors such as supply-chain woes and inflationary pressure are starting to moderate, which has drawn the attention of investors and analysts alike.

Even though Johnson hosts a prolific reputation as a stock analyst, his work assumes a technical vantage point. Thus, I decided to juxtapose his argument with fundamental features.

After carefully researching both stocks, I concluded that Johnson’s outlook on Boeing might be accurate; however, I dispute his stance on Alphabet, as I am bullish on its recovery potential. Here are a few key findings worth considering.

Boeing (BA)

Boeing was one of the big losers during the pandemic and beyond, as an array of lockdowns and travel restrictions dented the stock’s previous momentum. In addition, features such as recapitalization and recession risk exacerbated Boeing’s situation, seeing the stock’s five-year return come in at -35%.

Although times have been tough, Boeing’s troubles seem to be in the arrear. Thus, it’s likely an excellent rebound investment.

In recent news, Boeing delivered 69 airplanes in December, translating into a 40% year-over-year increase. Moreover, the company’s fourth-quarter deliveries amounted to a 60% year-over-year increase, illustrating accelerating growth.

Furthermore, Boeing recently received an order to sell 12 Chinook helicopters to the Egyptian Air Force. In isolation, this deal might not seem like much, yet, it conveys Boeing’s diverse range of revenue streams, which could increase its economies of scope in the coming years.

Many market participants remain cautious about the inflationary outlook, which is critical for Boeing as an asset-heavy enterprise. However, analysts at Jefferies believe inflationary pressure is behind us and that most input costs could settle lower in 2023. In a recently published note, the Wall Street investment bank stated, “For those that are reliant more on raw materials than labor, the deflationary environment for key inputs, such as metals and energy, will support further margin expansion into 2023.”

If input costs taper, Boeing could reach its five-year EBITDA margin of 2.64% once more, which could send the company’s stock price into stardom on the premise of improving profitability. Additionally, the company could reinstate its dividend, concurrently adding much appeal to investors’ expected returns.

Is BA Stock a Buy, According to Analysts?

Turning to Wall Street, Boeing earns a Moderate Buy consensus rating based on 10 Buys and four Holds assigned in the past three months. The average BA stock price target of $218.77 suggests 5.05% upside potential.

Alphabet (GOOGL)

It is easy to be pessimistic about Alphabet’s stock after it lost over 30% of its value in the past year. However, the stock market is a forward-looking vehicle that accounts for non-stationary macroeconomic variables.

Much of Alphabet’s destiny is related to the systemic environment. Technology stocks generally outperform the broader market whenever interest rates are on a downward trajectory. Last year’s benchmark rate policy was contractionary, whereas some are estimating that this year’s pace of rate hikes could slow down, which should support Alphabet as a growth stock.

A catalyst for change could be the rejuvenated advertising industry. Most corporations reduced their ad spending in 2022 amid geopolitical tensions and resilient inflation. However, factors such as tapering price levels and reopenings in China could instill confidence among business owners, subsequently supporting Alphabet’s core business model.

Furthermore, Alphabet’s impressive margins could reward investors this year as many investors could seek out “high-quality” stocks to protect their portfolios against a potential recession. Alphabet’s EBITDA (earnings before interest tax depreciation and amortization) margin of 33.2% is accommodated by a return on common equity of 26.89% (higher than the sector median of 5.9%), meaning investors are reaping the benefits of shareholder value creation. And, into the bargain, Alphabet’s stock is relatively undervalued, with its price-to-earnings ratio of 18.3x at a ~33% discount to its five-year average of 27.1x.

Is GOOGL Stock a Buy, According to Analysts?

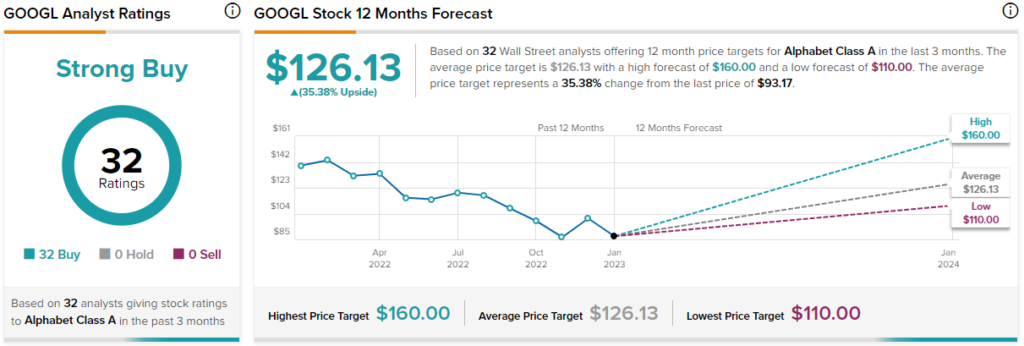

Turning to Wall Street, Alphabet earns a Strong Buy consensus rating based on nine Buys assigned in the past three months. The average GOOGL stock price target of $126.13 suggests 35.4% upside potential.

The Takeaway

Although Piper Sandler’s bullish call on Boeing aligns with key metrics, its bearish outlook on Alphabet holds little substance when fundamental aspects are considered. Both stocks look undervalued and could perform admirably in 2023.

Join our Webinar to learn how TipRanks promotes Wall Street transparency