The potential acquisition of VMware by Broadcom has created ripples in the technology industry. It is likely to be the “biggest-ever acquisitions of a technology company,” according to Bloomberg. Data compiled by Bloomberg indicates that “takeovers of technology companies globally are up 46% this year to $263 billion.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the Wall Street Journal, the bid for VMware could be worth $60 billion, or $140 a share. It is expected that this potential deal is likely to boost Broadcom’s software business.

Let us look at each of these two companies in detail and how this potential acquisition is likely to affect one of its competitors, CrowdStrike Holdings.

Broadcom (NASDAQ: AVGO)

Broadcom is a semiconductor company that develops, designs, and supplies semiconductors and a wide range of infrastructure software solutions. The company’s end markets include data center, networking, broadband, wireless, storage, enterprise software, and industrial.

The company has always been open about its strategy to pursue acquisitions that complement its businesses. As a part of its acquisition strategy and with a focus on the software market in recent years, Broadcom purchased CA Technologies for about $18 billion in 2018 and Symantec Corp.’s enterprise security unit for $11 billion in 2019. The company has generated strong free cash flows to fund its acquisitions as was evident in Q1 with free cash flows of $3.4 billion.

Broadcom expects its free cash flows to remain strong in Q2. The company’s management elaborated more on its acquisition strategy during its Q1 earnings call.

Hock Tan, Broadcom’s President, and CEO commented, “Well, really, in last quarter, we are very clear about our capital-allocation plan, at least for 2022, and which is, frankly, at — we’re still looking for acquisitions. We’ve just been very, very — as we usually do, being very thoughtful and selective about the assets we would acquire.”

Tan pointed out that for the past two years, while AVGO has not gone ahead with acquisitions, it had decided to buy back shares worth $10 billion in FY22. But he added that the company still had the “capacity to do a good-sized acquisition.”

AVGO’s potential acquisition of VMware could be a part of this strategy. Mizuho Securities analyst Vijay Rakesh expects that this deal could drive up AVGO’s software revenues by a factor of three, resulting in the company’s software revenues comprising 45% to 48% of its total revenues, almost double the current revenue share of 23%.

Moreover, from the analyst’s viewpoint, the potential acquisition could result in VMW adding “Infrastructure software and a multi-cloud strategy consisting of a cloud-native application platform, cloud-based infrastructure, Secure Edge & Anywhere Workspace, all bound by a common layer for management, security, and networking capabilities.”

However, Rakesh’s only concern is that the deal may require regulatory approval from “the U.S., Europe, and China, among others.”

Overall, the analyst is optimistic that AVGO could be on track to generate more than $16 billion in free cash flows in FY22 and has a Buy rating on the stock. The analyst has a price target of $700 on the stock, short of the highest price target of $775 on the Street. Rakesh’s price target implies an upside potential of around 33.9% at current levels.

Overall, other Wall Street analysts echo Rakesh and are bullish with a Strong Buy consensus rating based on a unanimous 13 Buys. The average AVGO price target is $702.69, which implies 34.1% upside potential to current levels.

VMware (NYSE: VMW)

Shares of VMW have shot up by 15.9% in the past five days, more likely fuelled by the news of its potential acquisition by Broadcom. Michael Dell-backed VMware is a cloud software company and its cloud portfolio spans cloud management, cloud infrastructure, application modernization, networking, and security.

According to analyst Rakesh, Michael Dell currently owns approximately 40% of VMW while Silver Lake, a private equity firm has a 10% ownership stake. Both remain the top investors in VMW.

VMware is expected to announce its Q1 FY23 results on May 26.

The acquisition news caught Evercore analyst Kirk Materne by surprise considering that the spin-off of VMW from Dell Technologies (DELL) was just completed last year. However, the analyst believes that “the attraction for Broadcom is that VMware remains one of the best hybrid-cloud stories in software, with a blue-chip customer base that likely has material overlap with CA, and combined, could create a broader story around hybrid cloud management.”

Materne thought the Broadcom offer was “fairly opportunistic” and “would be a bit surprised if there was not some upside to it as 15x EV/FCF [enterprise value-to-free cash flow] seems pretty low for a steady growth story.”

The analyst thinks that currently, VMW is in the early stages of a change in business model spanning over multiple years and as such, Materne is sidelined on the stock with a Hold rating. The analyst’s price target of $125 implies an upside potential of 7.8% at current levels.

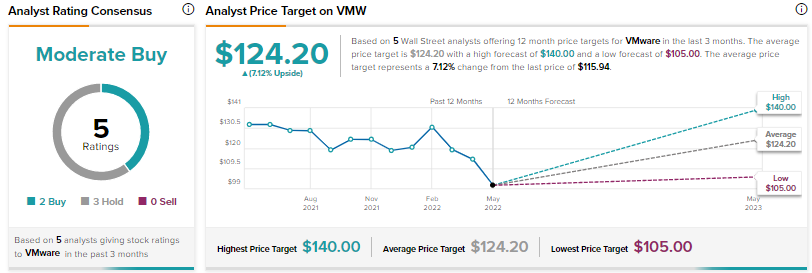

However, other Wall Street analysts are cautiously optimistic with a Moderate Buy consensus rating based on two Buys and three Holds. The average VMW price target is $124.20, which implies 7.1% upside potential to current levels.

CrowdStrike Holdings (NASDAQ: CRWD)

CrowdStrike Holdings, founded in 2011, provides cybersecurity solutions through its Falcon platform including endpoint security through the cloud and managing cloud identity, data, and workloads.

So, how would a potential acquisition of VMW affect a cybersecurity firm? Well, VMware competes with CrowdStrike through its endpoint security platform, Carbon Black.

However, according to Cowen analyst Shaul Eyal, VMW has been gradually losing its market share when it comes to cybersecurity to CRWD. By Eyal’s estimate, CRWD’s market share in the end-point security market has gone up from 7.9% in 2019 to 14.2% in the middle of 2021.

Even in the Software-defined Wide Area Network (SD-WAN) which could be worth $3.2 billion, according to Eyal, VMW is placed in the third position when it comes to market share with approximately 7% market share.

The analyst is of the opinion that a potential merger could have “positive implications” for cybersecurity companies. Elaborating further, the analyst pointed out that over the near term it is the “potential business disruption that big behemoths are seeing during an integration process (typically for a period of 18-24 months)” while over the long term, “it is the product quality and former DNA of merged assets which could pave the way for emerging and category leaders to benefit from meaningful displacement opportunities.”

Eyal is upbeat about CRWD with a Buy rating and a price target of $305 on the stock, implying an upside potential of 118.1% at current levels.

The rest of the analysts on the Street also agree with Eyal and are optimistic with a Strong Buy consensus rating based on 19 Buys and one Hold. The average CRWD price target of $259.30, which implies 85.4% upside potential to current levels.

Bottom Line

From Eyal’s viewpoint, such a deal may benefit other companies in the cybersecurity space. However, there is another possibility. That is, the deal has the potential to enhance Broadcom’s cybersecurity products and establish it as a long-term participant in this space.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.