British American Tobacco Stock (NYSE:BTI) is currently trading at a near-record-low valuation. The London-based tobacco and nicotine products leader, known for brands like Newport, Velo, Natural American Spirit, Camel, and Vuze, has experienced elevated pressure on its shares in recent months. The stock’s continuous decline has pushed its dividend yield to nearly 10%, reaching unprecedented levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Anticipating potential interest rate cuts this year, investors may reprice the stock in light of these compelling metrics. Consequently, I am bullish on BTI stock.

BTI Stock Reached a Record-Low Valuation

BTI stock has been hammered in recent months, which pushed its valuation to a record low (before bouncing back slightly in recent sessions). In particular, the stock reached 6.2x forward earnings (now 6.5x), its cheapest ever. It is quite bizarre to see BTI stock undergo such a steep valuation compression in recent years, which has carried its forward P/E from the mid-teens to the mid-single digits. This is especially true given that the company has continued to post growing revenues and profits.

Nonetheless, there is a rationale behind this pressure. In my view, the market attributes this stress to various factors, including the overall unattractiveness of tobacco stocks to investors, heightened competition in non-combustibles, and escalating regulatory constraints.

The aversion of investors to tobacco stocks due to their anti-ESG characteristics has been an enduring reality. The “news” here, however, is that regulators have recently shown a higher determination to combat big tobacco.

As combustibles face growing scrutiny, the big players in the industry must swiftly pivot towards heated tobacco and oral products, among other alternatives. Yet, the landscape there is fiercely competitive, intensifying the challenges within BTI’s investment scenario. Add to these challenges the fact that interest rates have been elevated in recent months, meaning investors now require a higher rate of return from a stock, and you can see why BTI stock has suffocated in recent months (and years).

Why “Mr. Market” May Reprice the Stock

Despite the persistent downward trajectory of BTI stock, suggesting a lack of immediate reversal catalysts, I am optimistic that investors may reassess the stock’s value, especially in light of potential rate cuts. The market expects that the Fed will cut rates three times this year. This will be the first time the Fed has cut rates since the QE that took place in the early days of the COVID-19 pandemic. I believe that rate cuts are likely to reverse the current sentiment on the stock for several reasons.

To begin with, as interest rates decline, investors actively seek alternative high-yield opportunities. While offering a risk-free 4.5%-5% return on cash, it makes prudent sense to opt for government-backed fixed-income securities from a risk/reward standpoint. However, as soon as interest rates start falling, equities presenting robust yields are poised to deliver a more favorable risk/reward dynamic.

With British American Tobacco yielding 9.7% at its current levels, it’s almost certain that investors will have to rethink its investment case. The stock’s yield will be too attractive to ignore relative to, say, bonds, which is likely to result in investors chasing the yield, driving the stock higher.

The magnetism lies not solely in the high yield but also in the sustainability of BTI’s 9.7% yield. The company has consistently hiked its dividend for an impressive 27 consecutive years, a testament to its relentless reliability. This upward trajectory is set to persist, given the company’s robust payout ratio and the imminent attainment of record earnings per share this year.

To back this argument, based on the company’s guidance and consensus estimates, a projected adjusted EPS of £3.76, up from last year’s £3.71, points to another annual record figure. With a solid payout ratio of 61% against the current annual dividend per share of £2.31 (£2.3088 precisely), BTI certainly remains on firm ground.

Last year’s 6% dividend increase serves as a powerful endorsement of management’s confidence in dividend coverage, too. Lastly, having already disbursed four £0.5772 quarterly dividends, the prospect of another hike looms large, further improving the attraction of BTI’s dividend.

Considering these factors, I’m confident in the potential for significant value appreciation in BTI stock. While acknowledging the presence of competitive pressures and regulatory risks, it seems evident that the market may be overly reactive. The proposed UK legislation, aiming to criminalize the sale of tobacco products to individuals born on or after January 1, 2009, is unlikely to significantly impact the company for several compelling reasons.

First, the enforceability of such legislation appears challenging. Second, the UK market itself represents a relatively modest portion of BTI’s overall operations. Thirdly, the company demonstrates adaptability by actively capturing market share with its non-smoking products.

Last, it’s crucial to highlight that the $31.5 billion write-off in the U.S. business, recently disclosed by the company, is a non-cash occurrence that has not altered management’s optimistic outlook on achieving record revenues and adjusted EPS this year. As the market comprehensively reevaluates these aspects, there is a strong possibility that BTI shares will be revalued at higher levels.

Is BTI Stock a Buy, According to Analysts?

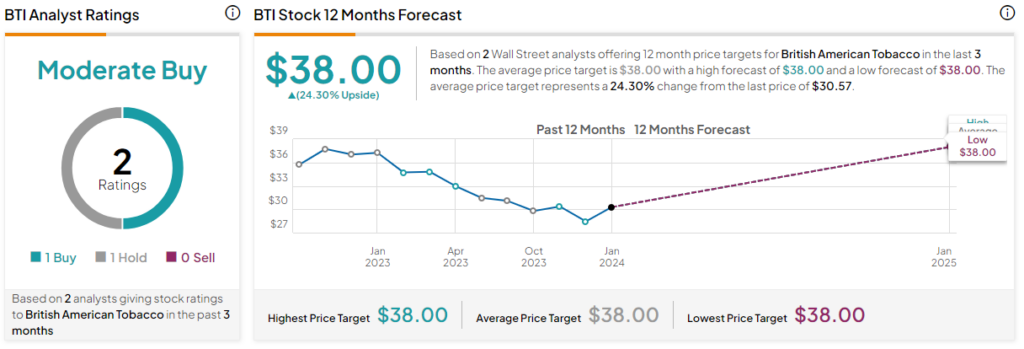

Checking Wall Street’s sentiment on the stock, BTI currently boasts a Moderate Buy consensus rating based on one Buy and one Hold assigned in the past three months. At $38, the average BTI stock forecast implies 24.3% upside potential.

The Takeaway

British American Tobacco stock is trading at unprecedentedly low valuation levels, driven by industry challenges and regulatory pressures. Despite the stock’s prolonged decline, potential interest rate cuts could be a game-changer. With a remarkable 9.7% dividend yield and a history of consistent increases, BTI remains an attractive option, especially in the face of falling potentially declining rates.

While acknowledging the competitive landscape and risks, the potential for value appreciation becomes apparent. As investors seek high-yield opportunities, BTI’s sustainable high-yielding dividend, promising earnings outlook, and a wide margin of safety at current valuation levels form a compelling investment case.