Markets are wildly volatile currently, with stock prices swinging to the extremes at every opportunity. When times are tense, assurance of experts is the only solace for investors. Wall Street’s top pros are the ones whose deep stock research and insights have the power to even sway stock prices. Thus, when it gets tough to predict the next swing of the pendulum, taking stock of what investors think makes sense. To make it easier, the TipRanks Analysts’ Top Stocks tool offers a comprehensive list of the most recommended stocks by analysts with the best track record. To that end, Boston Scientific (NYSE:BSX) and Jacobs Solutions (NYSE:J) are two of the most recommended stocks over the past two days.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Boston Scientific (BSX)

Medical device manufacturer Boston Scientific had suffered from a decline in demand for devices used in non-deferrable procedures in the areas of Urology and Pelvic Health and Endoscopy in the initial months of the pandemic. However, in the second quarter of this year, the company rebounded promisingly in this legacy business and recorded meaningful organic revenue growth across each of its core businesses.

Speaking of inorganic growth, too, Boston Scientific is showing promise. Several acquisitions, including those of energy-based medical solutions provider Lumenis, new-generation detection algorithm provider Preventice, Baylis Medical Company, and others, are expected to contribute about 250 basis points of growth to 2022 operational revenues.

Financially, the company seems to be in good health as well. Its debt-to-asset ratio has progressively reduced over the past four years, indicating growth in assets. This gives strong upside potential to BSX stock.

Is BSX Stock a Buy, According to Analysts?

Ahead of its Q3 earnings release, which is slated for Wednesday, analyst Jayson Bedford reiterated his Buy rating and $48 price target for BSX stock. The analyst also placed Boston Scientific on ratings firm Raymond James’ Analyst Current Favorites list. He expects to see business momentum to have continued in Q3.

Turning to the rest of Wall Street, Boston Scientific stock has a Strong Buy consensus rating based on 14 Buys and one Hold. The average price target for the BSX stock is $48.40, reflecting around 17.2% upside potential from current price levels.

Jacobs Solutions (NYSE:J)

Jacobs solutions, formerly known as Jacobs Engineering, provides engineering solutions, including technical, professional, and construction services, to industrial, commercial, and governmental clients. Jacobs has been pulling significant recurring revenues driven by a solid uphill trek in demand in the areas of Climate Response, Consulting & Advisory, and Data Solutions.

Having government agencies as its customers come with many benefits, which include consistency and timely payments. Notably, Jacobs’ Critical Missions Solutions (CMS) unit boasts of well-funded projects from cyber, the U.S. Department of Defense, mission-IT, space, nuclear, and 5G-related contracts.

Financial health is another strong point. Despite net debt of $3.28 billion (as of the third quarter of Fiscal 2022), short-term obligations (current maturities of long-term debt) are only $51.6 million. Thus, with cash of $1.1 billion, Jacobs is well-stashed to meet current obligations.

Is Jacobs Solutions Stock a Buy, According to Analysts?

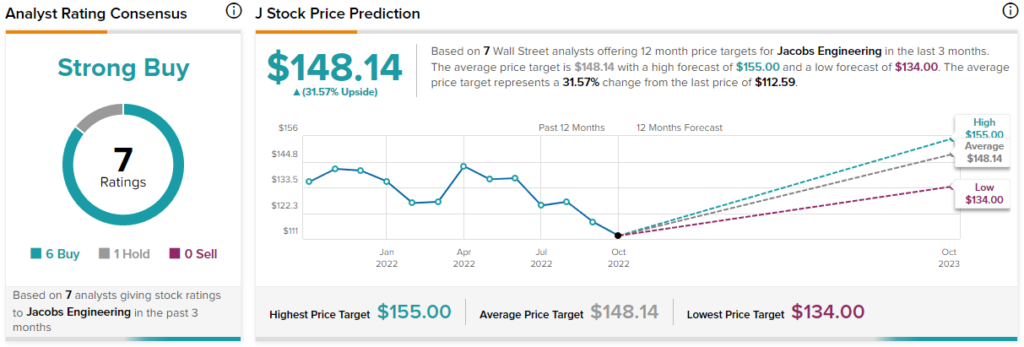

Earlier this week, Citi analyst Andrew Kaplowitz lowered his price target on Jacobs to $144 from $151 but maintained a Buy rating on the stock. Also, Jacobs stock has a Strong Buy consensus rating on Wall Street based on six Buys and one Hold. The average price target on J stock is $148.14, indicating 32% upside potential over the next 12 months.

Conclusion: BSX and J Shares Look Solid

Based on the positive conviction of Wall Street analysts about their longer-term outlook, both BSX and J look well-equipped to tide over short-term recessionary and inflationary challenges.