The incredibly high valuation multiples at which many EV (electric vehicle) companies are currently trading at has pushed numerous investors to the sidelines. BorgWarner Inc. (BWA), a leading auto parts and equipment solutions provider based in the U.S., might just bring back those investors. The company is still cheaply valued in the market, but it has been aggressively expanding into the EV industry.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Government authorities around the world are actively pushing for zero-emission goals, and EVs are expected to play a major role in helping to achieve this objective. For this reason, policymakers have introduced tax subsidies for electric vehicles. This favorable macroeconomic environment could suggest that the EV industry is primed for exponential growth in the next decade.

BorgWarner’s Strategy

At its core, BorgWarner is an original equipment manufacturer that has historically focused on selling clutches and turbochargers. The company is now transforming its business model to prioritize EV engines and equipment, in an attempt to tap into the massive growth opportunity this industry presents. Last year, revenue from EVs accounted for less than 3% of total revenue, but BorgWarner has guided for $10 billion in EV revenue by 2030, or approximately 45% of total revenue. (See BorgWarner stock analysis on TipRanks)

The strategy of the company focuses on an M&A model. The company has spent billions of dollars to acquire third-party equipment manufacturing companies to gain market share in the EV industry, with it snapping up four names since 2015.

In addition to these investments, BorgWarner’s strong ties with Ford (F) and Volkswagen (VWAGY) will help earnings growth in the future, as both legacy automakers have pledged to invest billions of dollars through 2025 to launch EVs.

U.S. EV Market Is Undergoing A Transformation

In Europe, EVs accounted for 14% of the total passenger vehicles sold in December 2020, which was a fresh high. Inclusive of plug-in hybrids that use fossil fuel as a secondary option, the penetration of EVs was as high as 23% last December.

BorgWarner has a strong presence in Europe because of its relationship with Volkswagen, and Europe accounted for 35% of its 2020 revenue. Going by the increasing adoption of EVs in Europe and the progress Volkswagen has made in penetrating this all-important market, BorgWarner seems well-positioned to grow its earnings in Europe.

The U.S., in contrast, has been slower to embrace EVs than Europe and China. In 2020, EVs accounted for just 1.8% of new light vehicle registrations in the country, which was a record high.

A deep dive into consumer preferences in the country shows that a lack of available options for EV trucks and SUVs is behind this slow adoption. According to data from Forbes, the Ford F-Series was the top-selling vehicle in the U.S. in 2020, followed by Chevrolet Silverado and Ram Pickup. In fact, 8 out of 10 top-selling vehicles last year were SUVs or pickup trucks, which confirms Americans’ affinity for this vehicle category.

2021 is bound to be a transformational year for the U.S. automobile industry, as many automakers have pledged to introduce EV trucks and SUVs later this year. That is likely to trigger a multi-year growth phase in EV adoption in the country. Some noteworthy trucks to look out for in 2021 and 2022 include the Tesla Cybertruck and the Rivian R1T.

Many EV trucks are expected to be available in the market by the fourth quarter of this year, presenting new opportunities for BorgWarner.

Wall Street’s Take

BorgWarner stock collapsed in March 2020 along with the broader market sell-off, but the stock has recovered sharply in the last 12 months by appreciating 81%.

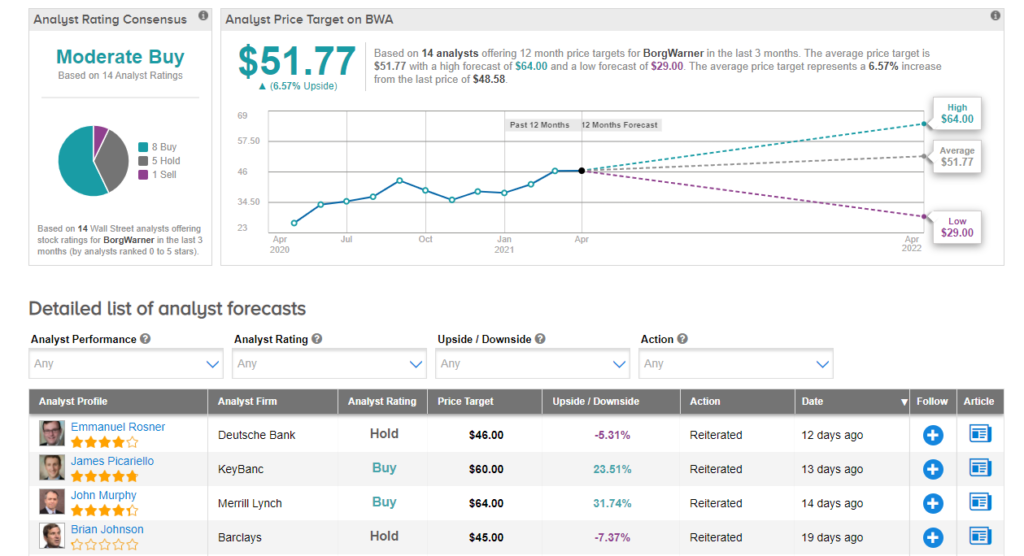

With an average analyst target price of $51.77, the upside potential lands at 7%. According to TipRanks’ consensus breakdown, BWA is a Moderate Buy, with 8 Buy ratings, 5 Hold ratings, and 1 Sell rating.

Takeaway

The company’s push to expand into the EV industry is likely to aid not only earnings growth, but also valuation multiples. Investor sentiment towards this industry is positive, so once the company announces new business partnerships with EV manufacturers to supply equipment, the stock is likely to attract premium valuation multiples. Considering this possibility, it would be reasonable to conclude that BorgWarner stock is well-positioned to reach new highs in the coming years.

Disclosure: Dilantha De Silva did not own any shares mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.