The travel industry is recovering from COVID-19, benefiting top airplane manufacturers like Boeing (NYSE:BA) and Airbus (OTC:EADSF). But which stock is better? While similarities exist, I compared BA and EADSF and found that EADSF is the better stock due to one critical difference that should be pointed out — profitability.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing (BA)

The biggest difference is that Boeing is unprofitable, while Airbus is turning a healthy profit. Boeing is struggling under heavy losses in its Defense division, and it doesn’t look like those problems will be going away anytime soon. Thus, a neutral view may be appropriate for Boeing — with the caveat that a review is likely in order if or when the company gets its act together.

As the world’s oldest aircraft manufacturer, Boeing enjoyed a monopoly for over 50 years — until Airbus was founded in 1970. With Boeing’s status as a blue-chip stock, it might come as a surprise to some investors that the last time the company turned an annual profit was in 2018.

Even with $61.4 billion in revenue for the last 12 months, the company has lost over $8.4 billion. In the third quarter of 2022, Boeing reported a surprise loss due to hits from its Air Force One and Starliner programs, which resulted in a $2.8 billion charge.

Boeing had returned to profitability in the second quarter of 2022, and analysts expected another profit in the third. Part of the issue for Boeing’s Defense and Space divisions is the fact that the company can’t pass along cost increases (fixed contracts) to its government clients, making 2022’s runaway inflation an enormous problem.

Boeing’s core commercial jet division also continued to rack up losses during the third quarter despite the growing number of deliveries boosting its revenue. The company delivered 112 commercial jets during the third quarter, up from 85 in the year-ago quarter.

Boeing also looks expensive on a price-to-sales (P/S) basis, with a trailing multiple of 2.0 times versus the three-year average of 1.8 for the aerospace and defense industry. Finally, its balance sheet is quite troubling, as summarized by its debt/equity ratio of -323%. In other words, BA has a negative net worth and lots of debt.

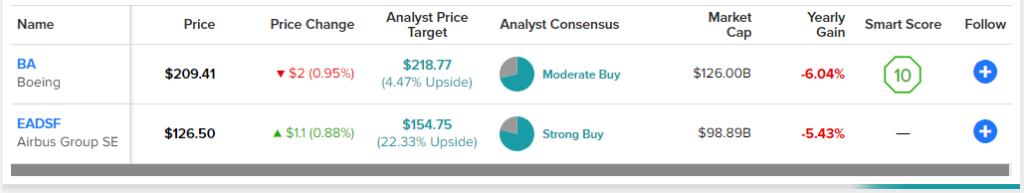

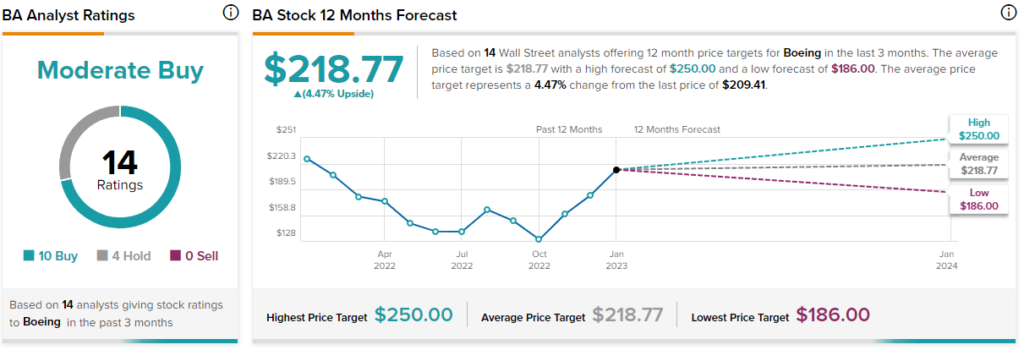

What is the Price Target for BA Stock?

Boeing has a Moderate Buy consensus rating based on 10 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $218.77, the average price target for Boeing stock implies upside potential of 4.5%.

Airbus (EADSF)

Last year marked the fourth straight year for Airbus as the number one airplane manufacturer. The company’s fundamentals and larger number of orders and deliveries put it clearly ahead of Boeing. In fact, Airbus’ P/E and P/S multiples also make it look cheap, so a bullish view appears appropriate.

Airbus generated €4.15 billion in net income on €55.1 billion in sales for the last 12 months. Although both Boeing and Airbus struggled to deliver airplanes due to issues like component and labor shortages, Airbus managed more deliveries and received more orders.

For all of 2022, Airbus delivered 661 planes and received orders for 1,078 planes, while Boeing delivered 479 jets and received orders for 774. The company’s balance sheet also looks far better than Boeing’s, having much less debt, although the bar was set extremely low.

Airbus also looks cheap based on its P/E of and P/S ratios of 21.9 and 1.6 times, respectively, versus the three-year industry averages of 28 times and 1.8 times, respectively. As a bonus, the company even has a 1.35% dividend yield.

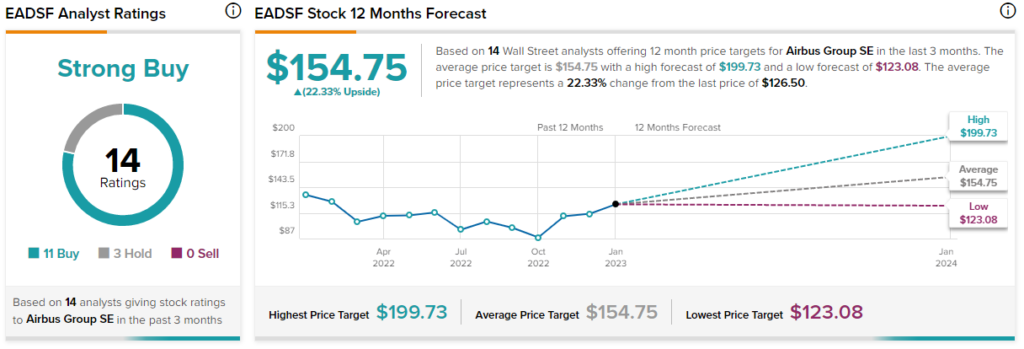

What is the Price Target for EADSF Stock?

Airbus has a Strong Buy consensus rating based on 11 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $154.75, the average price target for Airbus stock implies upside potential of 22.3%.

Conclusion: Neutral on BA, Bullish on EADSF

The large jet airliner market has been considered a duopoly between Boeing and Airbus since the 1990s, but decades into the fight, Airbus is the clear victor. Boeing lost billions of dollars and years of sales when the 737 MAX airplanes were grounded due to a pair of crashes, putting it far behind Airbus.

Today, Boeing is still in recovery mode, and it keeps facing challenges. It’s unclear if or when Boeing will recover, making Airbus the clear victor.