Aircraft mainstay Boeing (BA) has not had what you’d call a great year. Most of Boeing’s problems can be traced back to one two-word phrase: “737 MAX.” The plane has given Boeing plenty of problems over the last three years. Throw in an environment not well suited to air travel and things only get worse.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, many of Boeing’s problems seem to be fading into the distance, so I’m bullish on the stock, thanks to an improving macro environment and healthier conditions at Boeing.

Beaten Down, Time for Entry?

Boeing’s year in terms of share price has been turbulent to say the least. The company kicked off the year with a steep drop followed by an equally steep recovery that happened in the space of about two weeks. Boeing’s February saw a climb, and March, meanwhile, witnessed explosive gains. In just a little over a week, Boeing went from around $223 to nearly $270 per share off bullish hopes of an airline recovery.

Those gains didn’t last, however, and by mid-May, they were lost altogether once investors priced in the Delta variant. A series of up and down movements followed, before one serious downward trend in November took the company from around $233 to under $190 by mid-December. Another recovery closed out the year.

The latest news giving the aircraft builder a tailwind is that the Chinese market is poised to recertify the 737 MAX. Reports noted that the plane could potentially be flying once more by the end of this month. An earlier “operational readiness flight” that took place on January 9 seems to have been one of the last major hurdles.

Wall Street’s Take

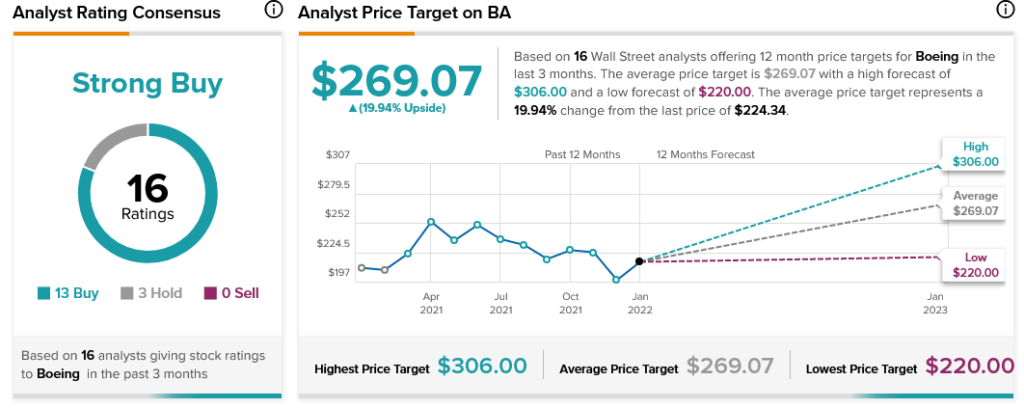

Turning to Wall Street, Boeing has a Strong Buy analyst rating consensus. That’s based on 13 Buys and three Holds assigned in the past three months. The average Boeing price target of $269.07 implies a 19.94% 12-month upside potential.

Things are Looking Up for Boeing

The last several months have not been good ones for Boeing. Not many companies wish to buy up aircraft and passenger jets during an uncertain time when air travel was hampered for several months, and just may never return to its 2019 glory. Mixing in persisting issues with the 737 MAX plane, Boeing’s credibility as a manufacturer came into question.

However, we can see a turnaround given the recovery in air travel. Delta (DAL) announced its quarterly results recently, and actually managed to beat estimates. That alone is good news for Boeing. It signifies that there’s a market that will likely be looking to buy Boeing aircraft once more.

That’s not the only good news for Boeing, though. The company has been working to diversify its revenue streams, a move that’s likely to pay off. For instance, Boeing recently promised the expansion of its German supply network if Germany agrees to buy F-18s to replace some of its Tornado craft. Those deals would amount to around $4 billion in extra business.

Moreover, Boeing has also been working the air cargo side of things. With a massive pileup of ocean shipping at California ports, air cargo has proven particularly valuable to businesses looking to still receive product. With over 300 777 Freighters sold so far, Boeing has an excellent chance to make further inroads in this segment as well.

BA will need improved free cash flow to restart its dismal dividend picture. Boeing’s dividend history shows a company that routinely paid and raised dividends for years. At least, until February 2020, when the COVID-19 pandemic hit and the company was hamstrung along with it.

Concluding Views

Boeing is coming back. It was perhaps a bit of misplaced optimism to look at Boeing as part of the “recovery narrative” that dominated 2021. Now, however, there’s objective reasoning to consider a comeback at Boeing. The company is trading much closer to its lowest targets, and there’s clear room for upside here.

Moreover, there’s a means to get that upside going. With air cargo, military applications, and a recovering domestic travel industry contributing, it’s more likely than ever.

Several factors are working in Boeing’s favor here. Suggesting a comeback is in play isn’t out of line at all. With all this positive support, there’s every reason to be bullish on Boeing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure