Finance and technology are two economic sectors that have always generated more than their share of innovation and headlines, and are seeing rapid growth in our modern world. The combination of them, fintech, is realizing the promise of digital networking to change the ways that we do business – and has created a slew of opportunities for investors.

The fintech industry finds its support in a variety of ways, from the industry’s impact on the B2B payment market, for example, as well as its general smoothing of our ongoing shift toward digitized payments in general. Without fintech, the digital world as we know it likely could not exist.

Scanning the industry’s prospects, and how that translates to investors, BMO analyst Rufus Hone is highly optimistic about the fintech sector as we head into 2024.

“While Fintech stocks have been rallying in recent weeks, we are still bullish on the setup for our coverage for the year ahead,” Hone said. “Valuations have reset meaningfully and (in most cases) are undemanding on an absolute basis, sentiment is negative (albeit we see early signs of improvement), and the rising cost of capital has forced disruptors to dial-back growth ambitions and customer acquisition, leaving a more rational competitive environment. We see benefits for the scaled incumbents, and while the macro remains challenging, the industry secular tailwinds around cash-to-cash conversion, the broader digital transformation (opening up B2B payments), and emerging revenue pools (e.g., embedded finance) remain compelling growth drivers.”

Now here are 3 stocks that Hone recommends specifically, all ‘top picks’ for the analyst. We’ve drawn their details from the TipRanks database and present them here with Hone’s comments.

Don’t miss

- Mobileye, Goodyear Among Top Picks as Deutsche Bank Assesses Auto Stocks

- Bank of America Says the S&P 500 Will Hit a New Record High in 2024 — Here Are 2 Stocks to Play That Bullish Sentiment

- These 3 stocks are Cowen’s best ideas for 2024 including AstraZeneca and Datadog

International Money Express, Inc. (IMXI)

We live in a strongly interconnected world. The advent of digital technology is only one aspect of this; the proliferation of relatively inexpensive long-distance travel is another, and has facilitated a dramatic movement of people around the globe, one that would have been unthinkable just a century ago. Many of these travelers are seeking economic opportunities, for themselves and their families, and are sending money remittances back to their home countries. That’s where International Money Express, our first BMO pick, comes in.

This company, from its Miami, Florida base, is a leader in the international money transfer business. The company has offices in Mexico and Guatemala, and has operations in 30 countries – 20 in Latin America, 8 in Africa, and 2 in Asia. International Money Express, or Intermex, can boast more than 100,000 payout locations, serving more than 4.5 million customers. The company specializes in money transfers from the US and Canada to addressees in the target countries.

International Money Express offers services online, through its website and its mobile app, as well as through retail locations. Senders can choose to wire funds via ACH, or through credit or debit cards, and addressees can receive funds in cash from ATM or a company location, or electronically through a bank account or digital wallet.

The international transfer market is big business, and Intermex’s most recent financial release, for 3Q23, shows that the company is working it successfully. The firm beat expectations at both the top and bottom lines. Revenue came in at $172.4 million, up more than 22% year-over-year and 2.3 million ahead of the estimates, while adj. earnings were reported as 51 cents per share, a penny better than expected.

When we turn to analyst Hone, writing for BMO, we find that he is appreciative of this company’s recent successes, and sees it capable of continuing to grow. Hone writes, “IMXI’s stock has bounced back since demonstrating improved momentum in 3Q, with stronger YoY growth in its core business that has carried over into 4Q (expecting ~8% growth YoY in transactions versus ~5% prior). Despite the recovery, we believe the stock is now priced for much lower future growth than we anticipate, despite IMXI’s long track record of double-digit revenue/earnings growth, and meaningful market share gains in key LACA corridors…”

All of this adds up to an Outperform (Buy) rating, and a $30 price target that implies a 47% increase in share value over the next 12 months. (To watch Hone’s track record, click here.)

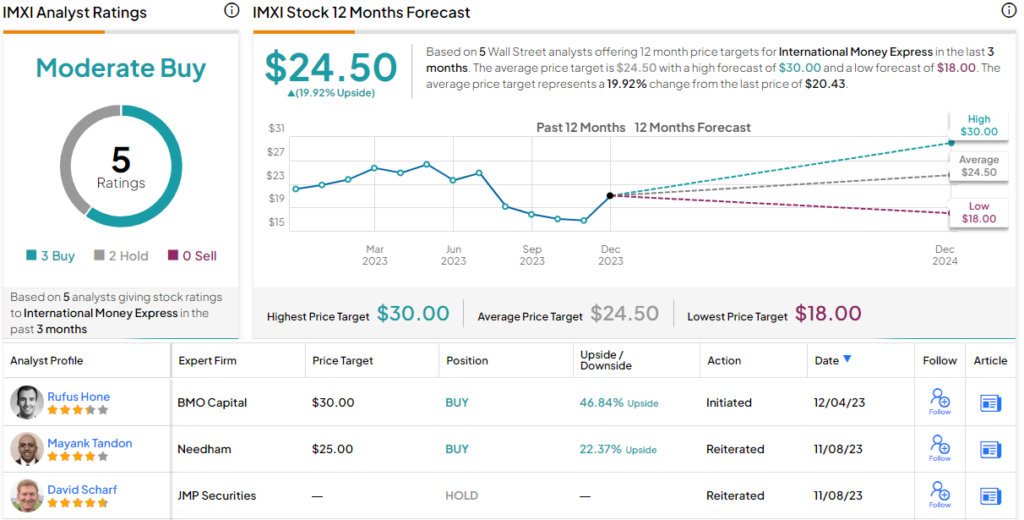

This stock has earned a Moderate Buy rating from the consensus of the Street’s analysts, based on 5 reviews that include 3 Buys and 2 Holds. The shares are trading for $20.43 and their $24.50 average target price points toward a one-year upside potential of 20%. (See Intermex’s stock forecast.)

Block, Inc. (SQ)

Next up is Block, Inc., a parent company and owner of some major names in the expansion of the world of digital finance. Block owns both Square and Cash App, among other applications, and its various services have altered the payment environment for both buyers and sellers. The company makes mobile payment easy, allowing sellers to conduct business anytime, anywhere, and allowing buyers to make electronic payments as easily as handing over cash. The company also has its hands in the crypto world, through the cryptocurrency platform Spiral.

Flexibility is the key here, and Block excels at that. The company’s Square application includes hardware that can turn smartphones into card readers and tablet computers into cash registers, while the Cash App boasts that it is universally accessible. Block’s tools and apps, together, have become a go-to place for online customers looking to network and streamline their financial transactions.

It’s not just smoothing out financial transactions that makes Block interesting. The company is expanding the applicability of its apps and tools, to make them more adaptable to our busy lives. Square’s interface can be optimized for particular businesses – restaurants, or package delivery, for example – while the Cash App can offer users some of the same advantages as bank accounts – options to save money, access to debit and credit cards, even options to invest in stocks.

The stock has been charging ahead over the past month, propelled by a better-than-expected Q3 report. Total revenue grew 24% y/y, to reach $5.6 billion, and beat the forecasts by $190 million. At the bottom line, Block reported adj. earnings of 55 cents per share, outpacing the estimates by 9 cents per share. The company also guided for adjusted EBITDA of $2.40 billion in 2024, way above consensus at $1.94 billion.

These solid results caught Hone’s attention as he looked at the fintech landscape, and the analyst wrote of Block’s ability to continue generating returns, “We expect SQ’s cash EPS to double by 2025E, with meaningful growth again in 2026 — relative to its scaled peer group, this is easily best-in-class. Newly introduced 2024E and longer-term guidance (e.g., achieving Rule of 40 by 2026E) were material positive surprises. This provided investors with much-needed visibility towards a significant increase in adjusted operating margins and EPS growth.”

Hone went on to explain why he believes that this stock is likely to keep on its upward trajectory, especially on profit growth: “We believe 3Q23 was a turning point for SQ, with earnings/operating income growth at a material positive inflection, and we foresee durable gross profit growth across both Cash App and Square Seller over the medium term, in tandem with much greater operating efficiency.”

Once again, we’re looking at a stock that Hone rates as Outperform (a Buy). His price target of $84 suggests a one-year gain of 23.5% for the shares.

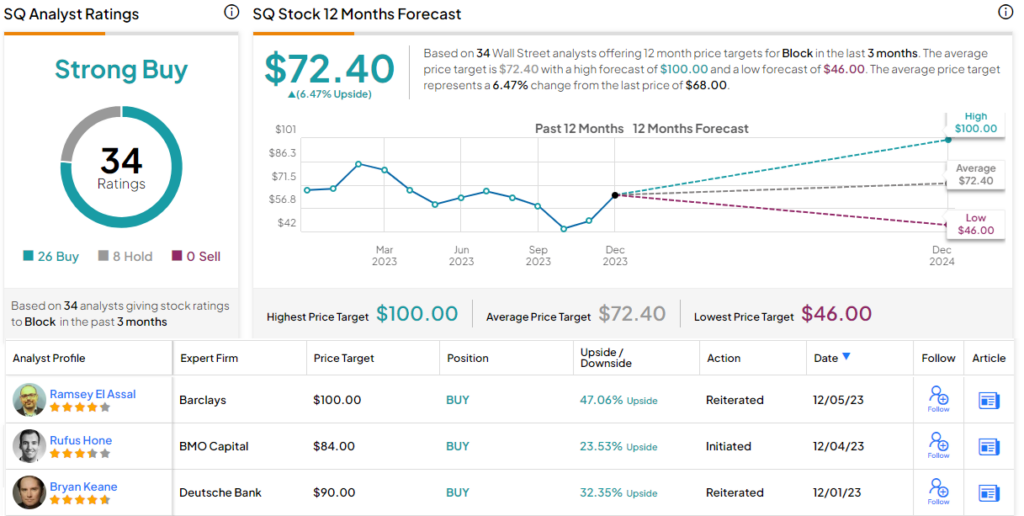

This stock’s 34 recent analyst reviews, with their 26 to 8 breakdown favoring Buy over Hold, add up to a Strong Buy consensus rating. Shares in SQ are selling for $68, and the $72.4 average target price implies a 6.5% upside on the one-year horizon. (See Block’s stock forecast.)

FleetCor Technologies (FLT)

Last on our list of BMO recommendations, is FleetCor Technologies, a niche company in the digital payment realm. FleetCor specializes in business payment and spend management, offering tools that make it easier for enterprise clients to track and control their outflow. The company started out as a major provider of spending programs for corporate vehicle fleets and workforces, providing fuel cards and lodging payments when clients’ employees were on the road.

Today, FleetCor still does that – and more. It also provides access to smart business cards that can manage spending for easier control, avoid reimbursement hassles, and generate simplified reports; FleetCor can even manage employee use of controlled access transportation arteries, such as toll roads and bridges, through the use of RFID chips.

Branching out, FleetCor can also facilitate cross-border payments, always a hassle for businesses, especially if they are located near to an international border; provide small businesses with an all-in-one platform for managing vendor payment and bookkeeping; and consolidate commercial card programs, for easier reporting, data management, and credit invoicing.

The company last reported quarterly earnings, for 3Q23, in early November. The top-line showed a quarterly revenue total of $970.9 million, a total that was up almost 9% y/y – but that missed the forecast by $7.9 million. The firm’s adj. earnings came to $4.49 per share, 6% higher than the year-ago result but 1 penny less than had been anticipated.

Nevertheless, checking in one last time with BMO analyst Rufus Hone, we find him upbeat on FleetCor, citing the company’s leading position in its niche and its prospect for further growth. Hone says of this stock, “As a leader in several B2B payment verticals, FLT is poised to benefit from the secular digitization of B2B payments and several vertical-specific tailwinds while executing on its successful M&A strategy. Consensus estimates appear to only reflect organic growth (our model incorporates 14%/13% revenue growth in 2024E/2025E respectively, versus consensus at 9%/10%)… FLT’s revenue model is highly recurring (retention >90%) and highly profitable (EBITDA margins >50%), with a long runway of grow ahead across multiple business lines (notably in its Corporate Payments business).”

Tracking this stance forward, Hone gives FLT an Outperform (Buy) rating, with a $300 price target that shows his confidence in a 19% gain in the year ahead.

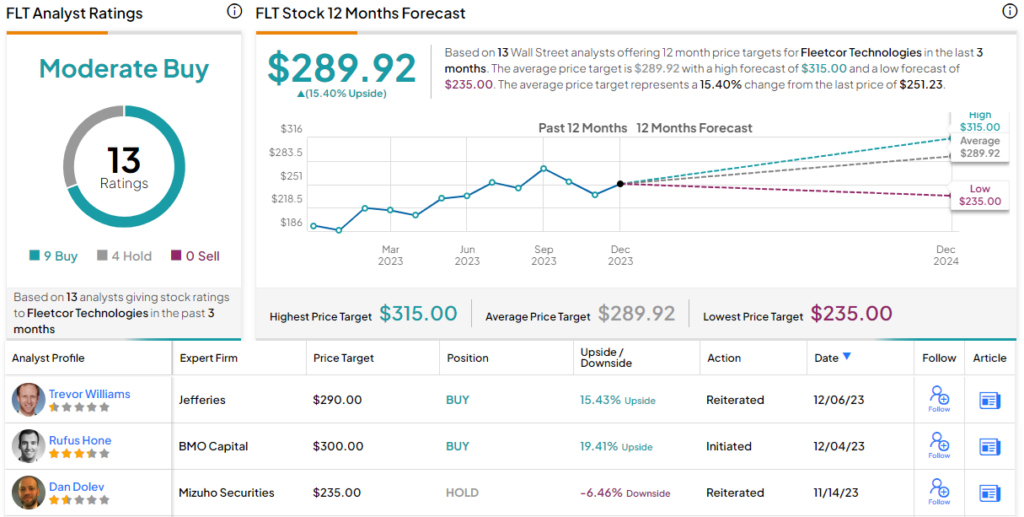

The analyst consensus on FLT is a Moderate Buy, based on 13 recent reviews that include 9 Buys to 4 Holds. FLT shares are trading for $251.23 and have an average price target of $289.92; this combination suggests a one-year upside potential for 15%. (See FleetCor’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.