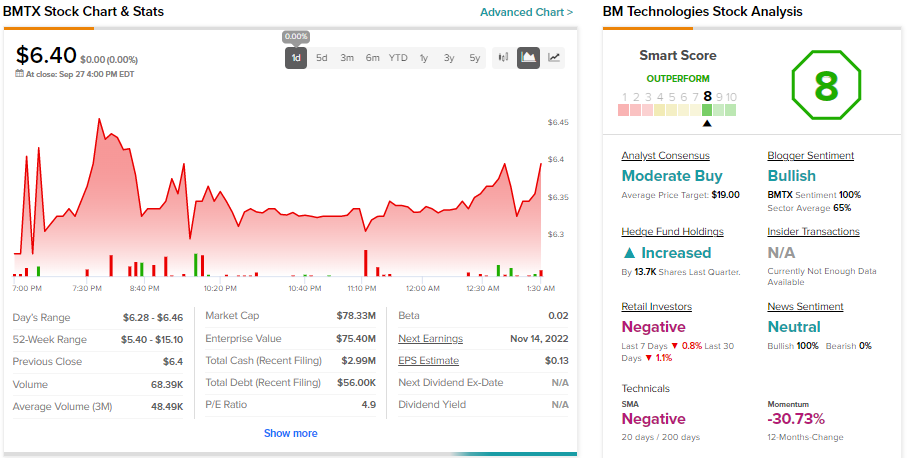

Investors willing to bet on high-risk penny stocks can make good use of TipRanks’ penny stock screener to find future winners. Using the tool, we zeroed in on BM Technologies (NYSE AMERICAN:BMTX) stock, which offers a digital banking platform. This penny stock sports an Outperform Smart Score rating on TipRanks and has considerable upside potential (based on an analyst’s price target), making BMTX an attractive bet for investors.

What Does BM Technologies Do?

BM Technologies is a leading digital banking platform in the U.S. Through its multi-partner distribution model, BMTX provides Banking-as-a-Service (BaaS) to offer low-cost products like checking and savings accounts, personal loans, and credit cards.

It connects consumers with FDIC (Federal Deposit Insurance Corporation) supervised banks and operates in three verticals, including higher education and student banking, Banking-as-a-Service, and Direct to Consumer.

Here’s Why BM Technologies Could be a Great Pick

Though BMTX facilitates deposits and banking services, it cannot hold these deposits as it is still not a bank and does not hold a bank charter. Instead, its partner banks hold the deposits it sources and issue BMTX’s debit cards. In return, BMTX earns a deposit servicing fee.

However, last year, it signed a merger agreement with First Sound Bank, which will boost its financials and allow it to hold deposits. The First Sound Bank deal is expected to close in the fourth quarter of 2022.

Maxim Group analyst Michael Diana sees this as a positive catalyst. Diana stated, “Now that BMTX will be a bank, it can keep some or all of the deposits in-house and deploy the cash into loans and securities, thereby generating net interest income. This should make the transaction accretive.”

It’s worth mentioning that BMTX serviced deposits worth $2 billion in the second quarter of 2022. Meanwhile, it opened about 215,000 accounts in the first half of 2022. Further, the analyst highlighted BMTX’s positive operating cash and no debt balance sheet.

Diana sees BMTX stock as undervalued and has a price target of $19, implying 196.9% upside potential.

Bottom Line

BMTX acquires customers in large volumes and at a lower cost than traditional banks, which is a positive. Further, the merger with First Sound Bank will boost its financials and generate net interest income. However, rising interest rates and a weaker macroeconomic environment could hurt its prospects.

Nevertheless, hedge fund managers bought 13.7K BMTX shares last quarter. Overall, it sports an Outperform Smart Score of eight out of 10 on TipRanks.

But before taking a call on BMTX, we recommend that investors learn more about Penny stocks, here: Are Penny Stocks a Good Investment?

Read full Disclosure