In the wake of the very encouraging latest inflation report, there’s a sense of renewed optimism on Wall Street. There is growing confidence that the series of interest rate hikes taken by the Fed since March 2022 in its effort to tame inflation is about to come to an end.

While that positive development has been hogging the headlines, BlackRock CEO Larry Fink thinks the economy is facing a big issue elsewhere: the US debt is spiraling out of control. In June, for the first time ever, national debt exceeded $32 trillion, with it jumping by $1 trillion in the past month alone. And that brings with it the potential for a debt crisis.

However, there is a solution to the problem, according to Fink, and it lies with economic growth. Fortunately, Fink believes that economic growth is imminent due to fiscal stimulus actions such as the CHIPS Act and the Biden administration’s $1 trillion infrastructure bill. “That’s all starting to come to the economy,” Fink recently said. “So actually, I think our economy is going to accelerate.”

Meanwhile, the world’s largest asset manager is not just sitting idle waiting for events to take shape. Against this backdrop, Blackrock has been busy loading up on a pair of equities, and if they are good for the asset manager, chances are they might be good for other investors, too. According to the TipRanks database, Wall Street analysts certainly think they are worth a punt – both are rated as Strong Buys by the analyst consensus. So, let’s see why you might want to follow in BlackRock’s footsteps.

California Resources Corp (CRC)

The first name we’ll look at is California Resources, an independent oil and natural gas exploration and production (E&P) firm. With a primary focus on California’s vast hydrocarbon resources, CRC is a major player in the state’s energy sector. In fact, it boasts the biggest privately held mineral acreage position in the Golden State.

CRC promotes its eco-friendly production processes with low carbon intensity. The company’s objective is to unlock the full potential of its land, mineral, and technical assets by prioritizing decarbonization efforts. To achieve this, CRC is actively engaged in the development of carbon capture and storage (CCS) and other initiatives aimed at substantial emissions reduction. However, the company’s history is not without blemishes. With $5 billion in debt, the company filed for bankruptcy in July 2020, but emerged from it in October 2020.

That is in the past, and in recent times, the financial performance has been robust. In Q1, the company generated adjusted net income of $193 million, amounting to $2.63 per diluted share, handily beating the $1.96 expected by the analysts. Net cash provided by operating activities reached $310 million in the quarter, adjusted EBITDAX came in at $358 million and the company generated free cash flow of $263 million. CRC saw out Q1 with $477 million of cash and cash equivalents and during the period repurchased 1,423,764 common shares for $59 million.

BlackRock has also been busy purchasing CRC stock. Since the end of the quarter, it has bought 5,840,098 shares. It now holds 11,731,390 shares, worth over $542 million and reflecting a 16.6% ownership stake in the company.

CRC also gets the support of RBC analyst Scott Hanold, who highlights how a recent big acquisition in the energy sector can be beneficial to this E&P firm.

The 5-star analyst writes, “XOM’s acquisition of DEN has positive implications for E&Ps with CCS opportunities given the scarcity factor on premium located pore space in areas of higher emissions and/or greater incentives for carbon capture. CRC is uniquely positioned in California and a first mover to recognizing CCS potential and value in the state.”

“We think CRC can close its valuation disconnect over time as hedges roll off, investors get more comfortable with the operating climate in California, and as the market starts to value its developing carbon management business,” Hanold went on to add.

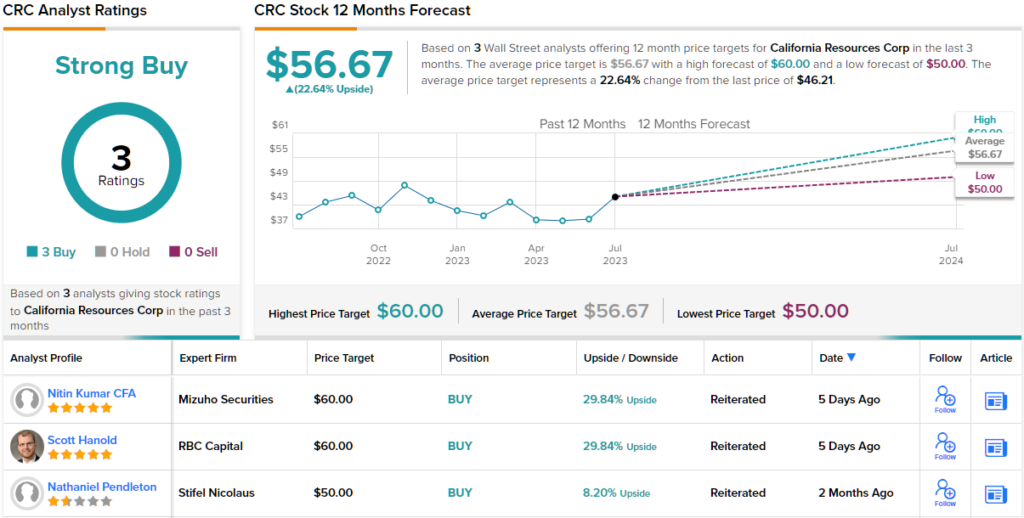

These comments underpin Hanold’s Outperform (i.e., Buy) rating while his $60 price target makes room for 12-month returns of 30%. (To watch Hanold’s track record, click here)

Overall, 2 other analysts have offered their take on this name recently, and both are also positive, making the consensus view here a Strong Buy. Going by the $56.67 average target, a year from now, the shares will be changing hands for a 23% premium. (See CRC stock forecast)

Schrödinger, Inc. (SDGR)

Now, let’s shift our focus from energy to the intersection where tech and healthcare meet. Schrödinger is a leading scientific company specializing in chemical simulation software. Its computational platform supports research efforts for biopharmaceutical and industrial enterprises, academic institutions, and government laboratories worldwide.

The company’s core focus lies in the development of advanced molecular simulation software and machine learning tools, which revolutionize the drug discovery process and facilitate the design of new therapeutic compounds. Schrodinger’s drug discovery initiatives are done both independently and through collaborations, covering diverse therapeutic areas.

Fueled by AI buzz, this healthcare disruptor has been on a bit of a tear this year, with the shares up by 192% so far. The company is also seeing some healthy real-world growth. In Q1, revenue rose by 33% compared to the same period a year ago, to $64.8 million. Although software revenue dropped a bit, drug discovery revenue compensated by climbing 108% to $32.6 million. For this year, Schrodinger sees drug discovery revenue reaching between $70 and $90 million vs. last year’s $45.4 million. While the losses narrowed compared to last year, the company delivered adj. EPS of -$0.38, missing the analysts’ forecast of -$0.19.

Investors were not all that pleased with the report, with the shares falling consequently. However, looking at the year-to-date gains, that was a temporary blip.

Meanwhile, BlackRock appears satisfied with the performance, as evidenced by its recent actions. Since the end of the quarter, the asset manager has acquired 4,574,800 shares, bringing its total holdings to 8,438,927 shares. These shares are currently valued at over $460 million, representing a 13.5% ownership stake in the firm.

Gaurav Goparaju, an analyst at Berenberg, is also optimistic about the company’s prospects. He highlights the strength of the software business while acknowledging the impressive performance of the drug discovery segment.

“While current market conditions have reduced new customer growth, SDGR’s software segment is being driven by increased consumption of software from active customers,” Goparaju explained. “Given the seasonality of contract renewals (e.g., expect large multi-year renewals in Q4), management is confident in meeting FY23 software guidance, with segment revenues weighted to H2. Also driving confidence in software guidance are SDGR’s active discussions with 12+ global biopharma customers regarding new multimillion-dollar, multi-year software contracts.”

“On the back of rapidly increasing drug discovery revenues, internal pipeline progression into the clinic, and greater consumption of software by existing customers, we maintain our Buy rating,” the analyst went on to add.

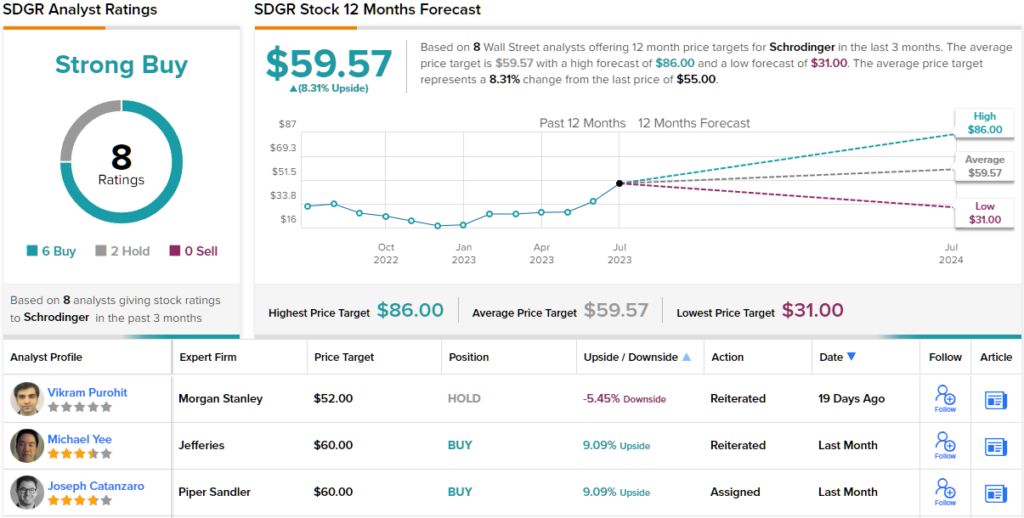

That Buy rating goes alongside a price target of $86, representing potential upside of 57% from current levels. (To watch Goparaju’s track record, click here)

Most agree with Goparaju’s take. The stock claims a Strong Buy consensus rating, based on 6 Buys vs. 2 Holds. The shares are expected to deliver additional returns of ~8%, considering the average target stands at $59.57. (See SDGR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.