Ken Fisher is bullish about stocks, and it is going to take a lot of convincing to change his mind.

In fact, the Fisher Investments founder has been doing most of the convincing recently. The billionaire has been fielding calls from clients asking various concerns about market conditions, the most common being: why should investors take a risk and stay in the stock market when Treasury bills have been yielding 5%?

Yet, Fisher points out that after factoring in inflation (currently at 3.24%) and taxes, there’s not much left from such a return. Meanwhile, despite the shaky macro backdrop, the S&P 500 is up by 20% year-to-date.

Fisher, whose investing adventures have earned him a personal fortune of ~7.5 billion, also notes that history is on his side of the argument. “Inflation has averaged 3.0% annually since 1926,” Fisher says. “Meanwhile, stocks annualized 10.1%. Most folks need stocks to finance long-term goals — to outpace inflation and taxes.”

So, Fisher is staying in stocks. But not just any stocks – he’s heavily invested in the crown jewels and counts Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) as his two biggest holdings. The two market colossuses have both outperformed the broader markets this year, forming part of the ‘Magnificent Seven’ club, and evidently Fisher thinks they will continue to do so.

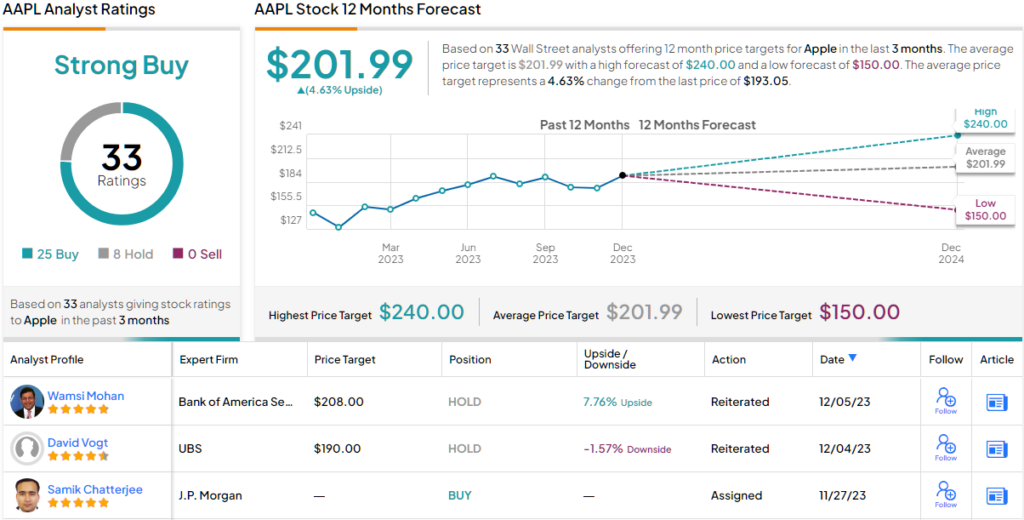

Most on the Street appear to agree; checking in with the TipRanks database for some additional color, we find both are rated as Strong Buys by the analyst consensus. Let’s dig a little deeper and find out why so many think they are set to continue delivering the goods.

Apple

Apple is the world’s most valuable company, and Fisher’s investment in the company reflects that status. It accounts for his biggest position, representing 5.2% of his portfolio. He currently owns 53,634,713 AAPL shares, worth over $10.33 billion.

So, Fisher is a fan, but then so are hundreds of millions across the globe who have been drawn into the ever-expanding Apple ecosystem by the promise of its sleek and best-in-class products, with the center of gravity being the ubiquitous iPhone.

It’s hard to imagine what the world would be like without Apple’s flagship product, which ushered in the era of the smartphone and represents about half of Apple’s total revenue haul. But Apple, of course, is far more than just the iPhone, offering everything from hardware (Macbook, iPad) to wearables (Apple Watch) and to the increasingly relevant Services business.

In fact, even against a difficult economic backdrop that saw Apple’s revenue slide year-over-year, the Services segment shone in the company’s latest quarterly readout.

In its fiscal fourth-quarter report (September quarter), Services revenue reached a record $22.3 billion, beating the $21.35 billion the Street anticipated and showing year-over-year growth of 16%.

Other metrics were down, however, and total revenue declined by 1% compared to the same period a year ago, to clock in at $89.5 billion, although that figure met analyst expectations. Still, despite the top-line drop, at the other end of the equation, EPS of $1.46 came in $0.07 above consensus.

That earnings beat is noted by J.P. Morgan analyst Samik Chatterjee, who commends Apple’s “resilience in a tough macro.” He writes, “Apple continued to deliver earnings upsides through levers that investors amply appreciate, including gross margin expansion from a higher mix of hardware products as well as a higher mix of Services revenue, tight discipline on operating expenses, and robust buybacks (including an accelerated repurchase in the quarter), which supported the earnings beat in F4Q23 and will in our estimate enable Apple to deliver to sell-side consensus EPS expectations for F1Q24 despite a softer revenue outlook.”

“We expect the resilience of revenues and the levers to drive earnings growth will continue to be appreciated by investors through a premium valuation multiple, even as estimates moderate on concerns around the impact of a subdued macro,” the 5-star analyst went on to add.

These comments underpin Chatterjee’s Overweight (i.e., Buy) rating while his $225 price target represents upside of ~17% from current levels. (To watch Chatterjee’s track record, click here)

The majority of Chatterjee’s colleagues agree. Apple receives a Strong Buy consensus rating, based on 25 Buys vs. 8 Holds. However, going by the $201.99 average target, the shares only have room for modest upside of 5% from current levels. (See Apple stock forecast)

Microsoft

Fittingly, Fisher’s second biggest investment is in Microsoft, the tech rival constantly vying with Apple for market dominance. Fisher is the owner of 24,978,283 MSFT shares, a position that commands a market value of $9.23 billion and makes up almost 4.5% of his total holdings.

Like Apple, Microsoft regularly features in our everyday lives, and its Windows operating system is the most widely used operating system in the world, with an estimated 1.3 billion active users. Then there is its Microsoft 365 product suite, used by businesses across the globe, Microsoft Teams, the Edge web browser and the Xbox video game consoles, to name just a few of its myriad products.

There’s also cloud service Azure, whose excellent growth helped the tech giant’s fiscal first-quarter results (September quarter) beat Street expectations.

In the quarter, cloud services revenue, which is mostly made up of Azure, increased by 29% YoY (28% in constant currency), and helped Intelligent Cloud revenue reach $24.3 billion.

In total, revenue climbed by 12.8% from the same period last year to reach $56.5 billion, in turn beating the Street’s forecast by $1.95 billion. Likewise, at the bottom-line, EPS of $2.99 outpaced the prognosticators’ expectations by $0.34.

Here might also be the place to mention, that Microsoft is in the early innings of a huge opportunity. The company is heavily invested in ChatGPT maker, OpenAI, positioning it at the forefront of the AI revolution and recently celebrated the general availability release of the Copilot AI assistant tool in Microsoft 365.

This is a point picked up by Evercore analyst Kirk Materne, who brings investors’ attention to its excellent positioning in the AI space.

“We view Microsoft as perhaps the single-best positioned vendor in the AI revolution given the broad-based nature of its business (e.g., GPU consumption, Azure OpenAI Service) as well as application-specific use cases for Copilot,” the 5-star analyst explained. “We believe that the AI narrative should only get stronger in CY24.”

“Microsoft has a massive opportunity to capture market share and expand revenue across AI – and we see a large opportunity for Azure to capture mindshare across AI in terms of additional consumption and PaaS revenue – though we view M365 Copilot as one of the more quantifiable opportunities for investors,” Materne further added.

Quantifying his stance, Materne rates the shares as Outperform (i.e., Buy), backed by a $432 price target. If the target is achieved, MSFT shares could provide ~12% returns over the next 12 months. (To watch Materne’s track record, click here)

Overall, Microsoft generates plenty of analyst coverage and almost all of it positive. Barring one skeptic, all 33 other recent reviews are Buys, naturally making the consensus view here a Strong Buy. The forecast calls for one-year returns of ~12%, considering the average target stands at $413.55. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.