For the retail investor, the only certainty of our current market environment is uncertainty. Volatility is up, and the main indexes are showing deepening losses in the wake of Russia’s invasion of Ukraine.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

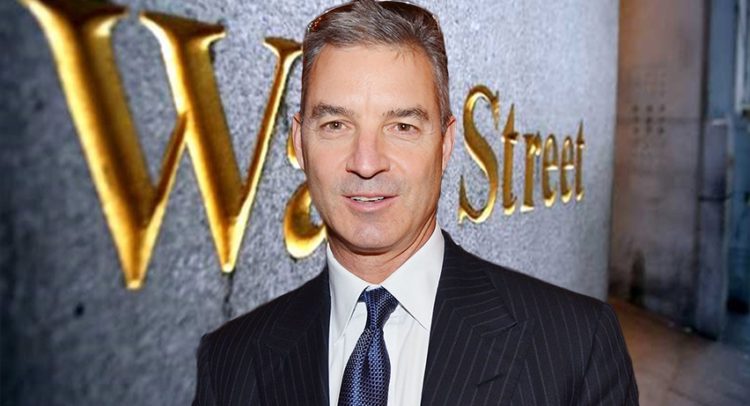

In a time like this, it’s good to find a guide, a market expert whose trading can stand as an example. Daniel Loeb, founder and CEO of the hedge fund Third Point, fits that bill. Loeb has long focused on buying into troubled companies at bargain prices, cracking the whip on management, and pushing a return to profitability. It’s a strategy that has built his fund to into a multi-billion dollar giant, with over $17 billion in total assets under management. For our purposes, the most important of those assets are the $14.3 billion in 13F securities – stocks.

Explaining his positions, the hedge guru wrote, “We are focused currently on catalyst-driven opportunities including: 1) M&A that is revealing hidden value in previously overlooked stocks; 2) value-oriented, ‘old’ tech stocks… that deserve a second look; and 3) opportunities in merger arbitrage.”

Taking this into consideration, we wanted to get all the details on three stocks the billionaire’s fund snapped up recently. Running the tickers through TipRanks’ database, we found out that the analysts are also fans, with each name scoring a “Strong Buy” consensus rating. Not to mention each ticker offers solid upside potential. Let’s take a closer look.

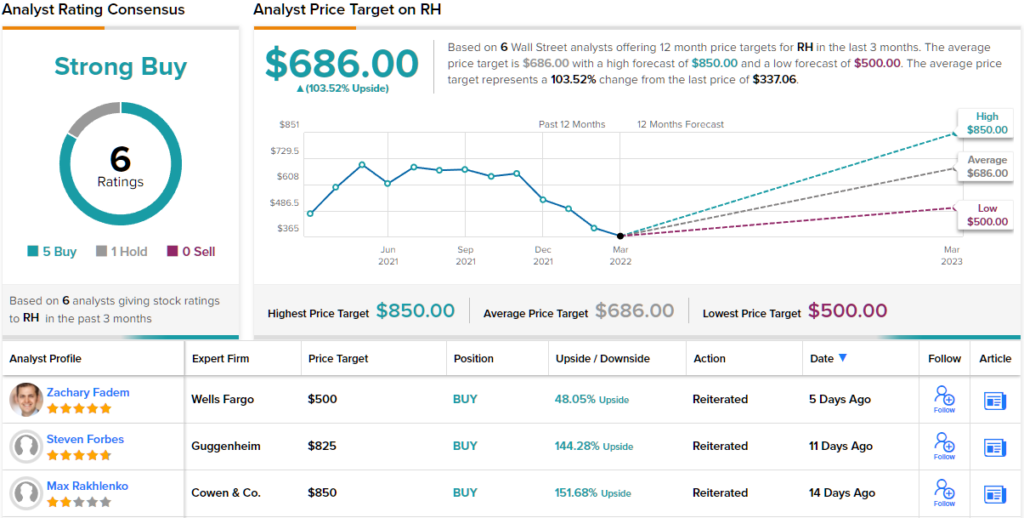

RH (RH)

We’ll start with RH, a company that has reinvented itself in recent years, making a switch from run-of-the-mill cash-and-carry home goods retailer to a luxury brand for home furnishings, selling on a direct-to-consumer membership model and featuring showplace galleries for its high-end product lines.

The company’s most recent reported earnings, for 3Q21, showed a record $1.01 billion at the top line, growing over 19% year-over-year. Earnings in the quarter were also strong; adjusted EPS hit $7.03 per share. This was up 13% y/y, and well above the $6.68 EPS estimate. The company also increased its operating margin to just over 27%, a strong performance by any standard. For the first nine months of 2021, RH reported a free cash flow of $380 million.

RH managed this performance despite the supply chain snarls and pandemic headwinds, and its luxury branding, which makes it captive to fickle tastes. The company will release its Q4 and full-year 2021 results at the end of this month; those results will clarify then picture on this company’s forward prospects.

For now, we can look at the recent activity by major investors like Loeb. His firm reported, in its latest 4Q disclosure, buying 235,000 shares of RH, expanding its existing holding by 79%. Investors of Loeb’s stature don’t make such buys lightly. Third Point’s total holding in RH, of 535,000 shares, is currently valued at $173.9 million.

A look at the comments from Cowen analyst Max Rakhlenko adds some explication. He writes of RH’s near-term, “We view FY22 guidance as a key first catalyst which we think will help turn the tide. Catalysts will soon come fast as RH introduces record newness including a highly anticipated new collection (RH Contemporary) with its own 500-page source book, other major brand refreshes, open its first gallery in Europe, launch a new website (all late spring/early summer), and other brand enhancing introductions. Despite recent pressure, we view RH as a leading high-quality, long-term compounder with pricing power and an expanding moat dominating a fragmented peer set.”

To this end, Rakhlenko puts an Outperform (i.e. Buy) rating on the stock, with an $850 price target that suggests a 141% upside for the year ahead. (To watch Rahlenko’s track record, click here)

Wall Street is mostly in agreement that this stock is a Strong Buy, as the 6 recent reviews break down 5 to 1 in favor of Buy over Hold. The shares are selling for $325.08 and their $686 average price target indicates potential for 111% upside by year’s end. (See RH stock analysis on TipRanks)

Crown Holdings (CCK)

The second stock on our list, Crown Holdings, is one whose products you’ve probably used, even if you don’t know it. Crown is a leader in the metal packaging sector, and offers solutions in metal cans for the food and beverage industry and the aerosol container niche, as well as specialty packing and metal closures. Think a soda can, or a tuna can, or the twist cap on a glass bottle – all this, and more, is in the province of Crown Holdings.

It’s big business, too. Crown saw $9.4 billion total revenues in 2020, followed by $11.4 billion in 2021. The company’s 4Q21 top line came in at over $3 billion, up 22% year-over-year. The Adjusted EPS of $1.66 was more than 10% higher y/y, and the company reported over $530 million in cash assets at the end of 2021, even after a $1.5 billion settlement charge with its UK pension fund in the final quarter of the year.

Crown’s performance gave management confidence to raise the dividend, the first increase since implementing the payments last year. The current common share dividend is set at 22 cents per share, annualizing to 88 cents and giving a modest yield of 0.7%. The yield here is less important than the macro-scale of the company’s commitment to return profits to shareholders – Crown returned $1 billion to shareholders in 2021.

A solid business niche will attract investors large and small, and Dan Loeb’s firm bought 1 million shares in CCK in Q4, taking a big stake worth $121.4 million.

Baird analyst Ghansham Panjabi is also bullish on this stock, writing: “A combination of strong internal execution, earnings momentum from incremental CapEx, and disproportionate allocation of cash flow (and balance sheet capacity) toward buybacks sums to our view that execution toward 2022 guidance should be the catalyst to drive valuation multiple expansion in permanence for CCK shares. As such we remain bullish on the investment outlook…”

In line with these bullish comments, Panjabi gives CCK an Outperform (i.e. Buy) rating, with a $165 price target indicative of ~32% share appreciation in the offing. (To watch Panjabi’s track record, click here)

Overall, the Strong Buy consensus rating shows that Wall Street generally agrees with the Baird take here. CCK has 12 analyst reviews on line, including 11 Buys and 1 Hold. (See CCK stock forecast on TipRanks)

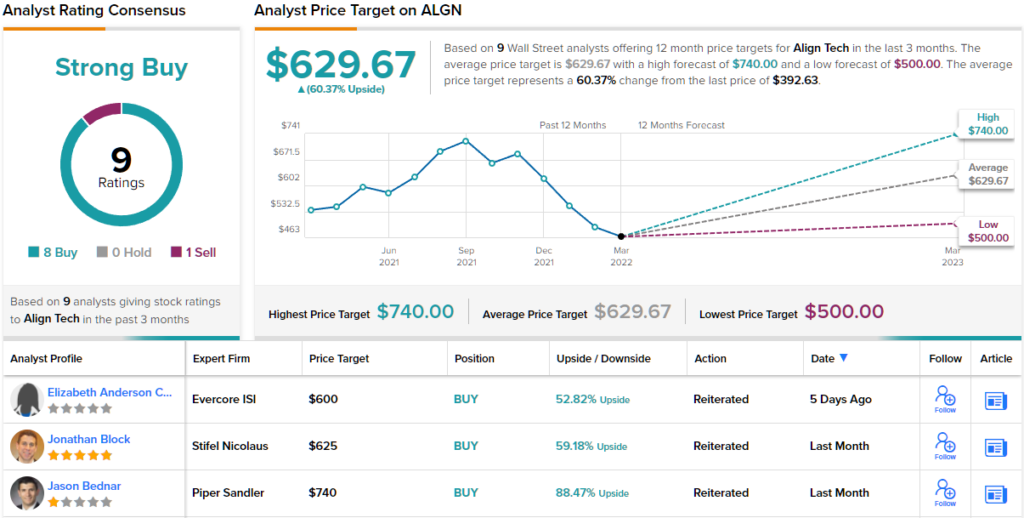

Align Tech (ALGN)

Let’s wrap up with Align Tech, a tech-related company with a unique niche. Align Tech develops and manufactures a line of 3D digital scanners along with its branded Invisalign product, a clear aligner for orthodontic use. The company’s Invisalign system was first developed in the 1990s, was approved for use in 1998, and began sales in 1999. Since then, Align Tech has grown to become a multi-billion company, holding over 1,200 patents and boasting of 10.9 million patients treated over the years.

Since bottoming out in 2Q20, Align’s top line revenues have shown growth in every quarter – albeit slower in the most recent reports. The 4Q21 financials showed $1.03 billion at the top line, a company record and up 23% year-over-year. For the full year 2021, revenues came in at $4 billion, also a record, and an even more impressive y/y gain of 59%. Non-GAAP quarterly EPS of $2.83 was up 8.4% from the year-ago quarter.

Align was another new position staked out by Loeb’s Third Point — and a big one. The firm bought up 300,000 shares, a substantial purchase that is currently worth over $120 million.

Also among the bulls is Piper Sandler analyst Jason Bednar, who lays out a strong case for buying into ALGN now, writing, “[We] remind investors that not only is this market significantly underpenetrated and is being resourced/supported by ALGN in a better fashion than any other competitor, but this management team has an established track record of executing well against its stated annual growth objectives.”

“Despite our confidence in management’s ability to deliver 20%+ growth this year and even though shares already offer one of the best risk-reward setups in med-tech, in our opinion, we also don’t expect this type of growth profile to be reflected in the stock until investors currently on the sidelines gain comfort through industry data points and channel checks that the clear aligner demand trend line is truly rebounding post-Omicron. In the interim, for those investors that can take a 6-12 month view, we recommend using current levels as an opportunity to accumulate positions,” the analyst added.

Bednar’s comments support his Overweight (i.e. Buy) rating here, and his $740 price target implies gains of ~88% in store for the stock over the coming year. (To watch Bednar’s track record, click here)

All in all, this company gets a Strong Buy from the analyst consensus, based on 9 reviews that include 8 Buys and a single Sell. The stock is selling for $392.85 and its $629.67 average price target suggests a 12-month upside potential of ~60%. (See ALGN stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.