Fears of a recession causing havoc to the markets are not reserved solely to the average investor. Even some of Wall Street’s most lauded stock pickers are worried about the implications.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Citing an unnerving disconnect between the current positioning of stocks and bonds – essentially, the bond market pricing in a recession while stocks appear to factor in a more optimistic outlook – billionaire Cliff Asness thinks things could get hairy if a recession comes into play.

“If inflation stays sticky or it comes down because we enter a nontrivial recession – it’s equities that I think are in a scary place,” Asness recently opined. “They’re not priced very consistently with bonds.”

That’s not to say the co-founder and CIO of AQR Capital Management – a firm with $100 billion in assets under management – is turning away from stocks. In fact, the quant investing sage has been loading up on the equities he must believe are able to fend off any unwanted economic developments.

We ran a pair of his choices through the TipRanks database to see what the rest of the Street has to say about them. Here are the results.

The Cigna Group (CI)

If a recession is about to mess things up, a safe harbor is often provided by healthcare stocks, a segment seen as one able to withstand an economic downturn. Cigna might be a good example of their value. The global health services organization is a huge industry player, boasting a market cap over $72 billion, and specializing in providing a wide range of healthcare solutions to individuals, employers, and government entities.

The company operates via two primary divisions – Evernorth and Cigna Healthcare. Evernorth offers a comprehensive set of services and capabilities that include benefits management, care management, intelligence, and pharmacy solutions. Cigna Healthcare division brings together the former U.S. Medical segment (U.S. Commercial, U.S. Government) and the remaining International Health business. This division offers medical solutions across various markets with a focus on local needs.

The size and span of the business is easy to gauge from the company’s revenue haul. In the most recently reported quarter – for 1Q23 – the top-line reached $46.5 billion, amounting to a 5.7% year-over-year increase and beating the forecast by $1.07 billion. There was a beat on the bottom-line too, as adj. EPS of $5.41 came in above the $5.24 consensus estimate. For the outlook, the company raised expectations for both the sales and the profit profile.

Nevertheless, despite the market’s positive reaction to the print, with the shift in 2023 from value names to tech – and after outperforming last year – CI shares have taken a beating in 2023.

Evidently, Asness felt the time was right to increase his CI stake. During Q1, he loaded up on 560,014 shares, increasing his holdings by 95% to a total of 1,152,991 shares. These currently command a market value of over $316 million.

Mirroring that confident stance, Truist analyst David S. MacDonald saw plenty to like in the Q1 report. The 5-star analyst wrote, “We remain bullish on CI following a solid start to ’23 marked by balanced growth across segments, top and bottom-line beats, better MCR and raised guidance. Importantly, the call and enhanced 10-Q disclosures provided additional detail/comfort around rebate retention exposure/retail spread, PBM affordability and transparency and we think should help allay concerns about potential regulatory risk. Finally, the capital light business model continues to churn out attractive FCF, providing ample flexibility for ongoing investment/expansion.”

These comments underpin MacDonald’s Buy rating while his $375 price target makes room for 12-month returns of ~52%. (To watch MacDonald’s track record, click here)

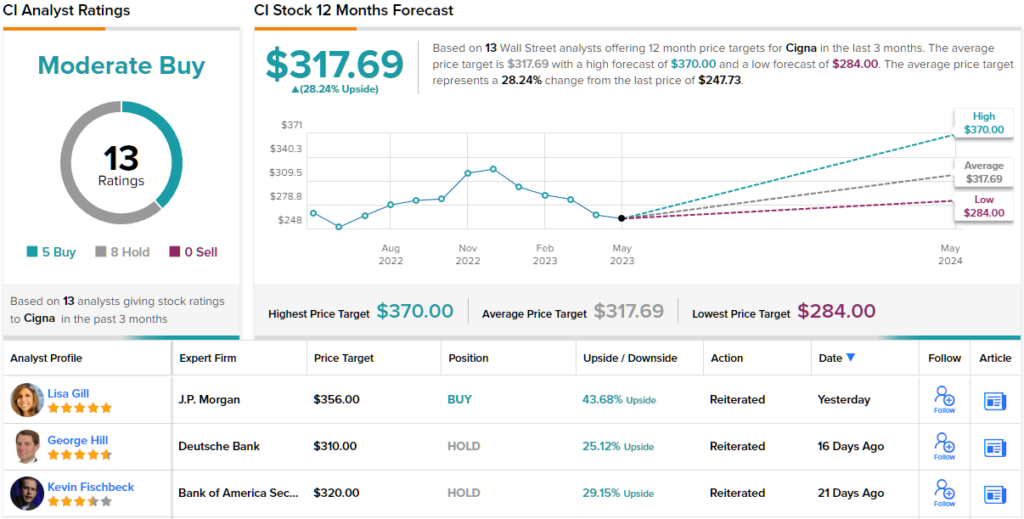

Elsewhere on the Street, the stock garners an additional 4 Buys and 8 Holds, for a Moderate Buy consensus rating. The average target stands at $317.69, suggesting ~28% from current levels. As an added bonus, CI also pays a dividend. The current quarterly payout stands at $1.23, yielding 1.88%. (See Cigna stock forecast)

American International Group (AIG)

For our next Asness-endorsed name will turn to insurance giant AIG. The company is one of the world’s largest insurance and financial services organizations. Operating through various subsidiaries, AIG provides a wide range of insurance products and services to customers in over 80 countries. AIG’s offerings include property and casualty insurance, life insurance, retirement products, and mortgage insurance, among others.

Driven by robust underwriting gains, the global insurance powerhouse beat the profit estimates in its latest quarterly report – for 1Q23. Representing its strongest first quarter underwriting results, general insurance underwriting income climbed by 13% year-over-year to $502 million. That helped adj. EPS rise from $1.49 in the year-ago quarter to $1.63, while outpacing the $1.42 the analysts were looking for. And while partially negated by lower alternative investment income, total consolidated net investment income still climbed 9% to $3.5 billion.

Furthermore, the company gave a boost to its quarterly dividend, raising it from $0.32 to $0.36 per share, the first increase since 2016. The dividend currently yields 2.37%.

It’s safe to say Asness has confidence in AIG’s ongoing success. He increased his holdings by 79% in Q1 with the purchase of 2,557,149 shares. He now holds a total of 5,794,696 shares, worth ~$306 million.

AIG also gets the support of Goldman Sachs analyst Alex Scott. Scanning the latest financial statement, Scott explains why was impressed with the results. “We were very encouraged by the AIG earnings report this quarter as it showed favorable growth, further loss ratio improvement, favorable reserve development despite inflationary pressures, contained catastrophes despite elevated industry experience, net investment income benefiting to a greater degree than we expected from higher interest rates, and corporate expense discipline,” Scott said. “Further, we felt that the discussion around 1) the ultimate level of corporate expenses and 2) margin improvement in US personal lines was also a positive for the earnings power of the company.”

Accordingly, Scott rates AIG shares a Buy, backed by a $79 price target. The implication for investors? Potential upside of ~50% from current levels. (To watch Scott’s track record, click here)

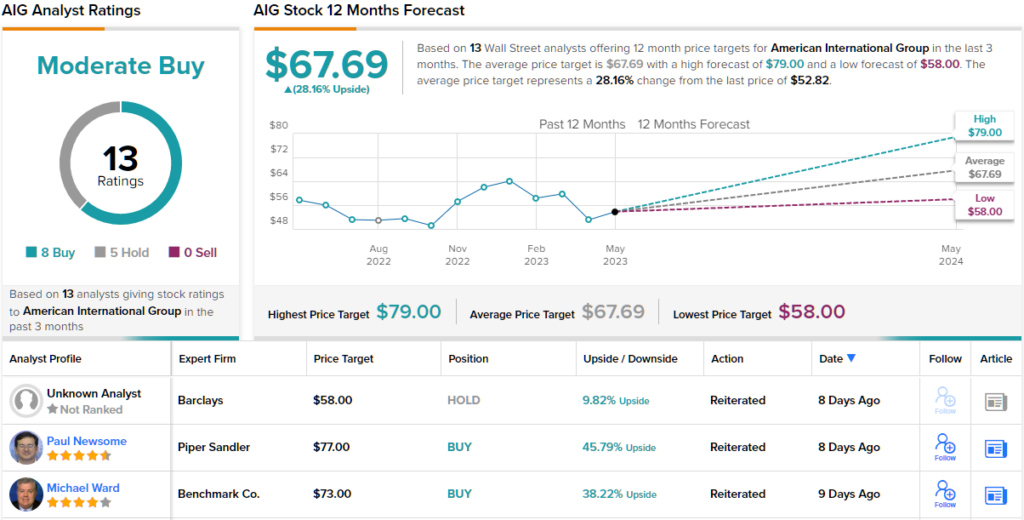

Overall, 13 analysts have chimed in with AIG reviews over the past 3 months, and these break down into 8 Buys and 5 Holds, adding up to a Moderate Buy consensus rating. Going by the $67.69 average target, a year from now, investors will be sitting on returns of 28%. (See AIG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.