This week, America’s top wireless companies avoided stiff fines from the Federal Communications Commission for sharing their customers’ locations with various third parties. Undoubtedly, data privacy has been of growing concern to many in recent years. With the FCC in a deadlock, the wireless heavyweights AT&T (NYSE:T), Verizon (NYSE:VZ), and T-Mobile (NASDAQ:TMUS) seem to have gotten away with less than a slap on the wrist.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

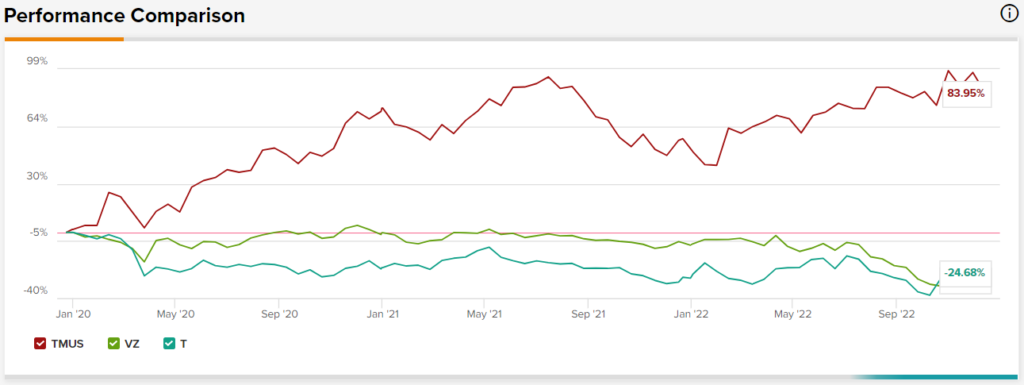

Indeed, the news was a big win for the national wireless carriers as we wrap up a year of some varying results, with T-Mobile stock not too far from highs while its two rivals (AT&T and Verizon) sink.

FCC Deadlock: The Aftermath for the Wireless Heavyweights

The reaction to the FCC deadlock wasn’t met with much of a positive reaction from Wall Street. The magnitude of such fines didn’t seem to have made too much of a difference through the eyes of investors. However, had federal regulators been as harsh as the Chinese government, the Big Three telecoms probably would have rallied on the avoidance of fines.

In any case, investors shouldn’t make too much of the recent avoidance of privacy fines. Even if the penalties were relatively modest, given the size of the major wireless players, the FCC’s message was loud and clear. Privacy matters – and firms found guilty of sharing user data could run the risk of being made an example of.

Now, I don’t expect the FCC to follow in the Chinese government’s footsteps by beginning to dole out $1 billion (or more) worth of fines if customer data finds its way into the wrong hands. However, I do think firms dealing with sensitive data are now fully aware of the potential costs of mishandling private data.

Further, there’s some degree of reputational damage that could accompany the sharing of user data with third parties. Firms that go behind the back of customers could be met with harsher and harsher penalties over time.

Companies like Apple (NASDAQ:AAPL) are viewed as “the good guys” as they set new standards regarding how user data is handled. In a way, Apple is a pioneer when it comes to privacy; and all firms, even those outside of the tech sector, may have to follow the new, high standards set in place by Apple regarding data collection and transparency.

Undoubtedly, few expected their telecoms to share their data with third parties. Now that customers know service providers can share their data, they’ll likely be more mindful of where they choose to take their business in the future. It isn’t just apps that one’s data can be sent to a third party without consent.

Are Top Wireless Stocks Still Buys, Following the FCC Deadlock?

Looking ahead, the top wireless plays are intriguing value options for capital gains-focused and dividend-oriented investors alike. The FCC deadlock is a positive piece of news for the telecoms.

More importantly, it’s an opportunity to make the appropriate changes to win back the trust of its users. Indeed, the Big Three telecoms dominate the wireless scene. As such, I don’t see any market loss or reputational damage from the prior invasion of user privacy.

If all big industry players were caught red-handed, customers don’t really have much of a choice when it comes to switching. Further, many users may not view the non-consensual sharing of their location data as too big a concern.

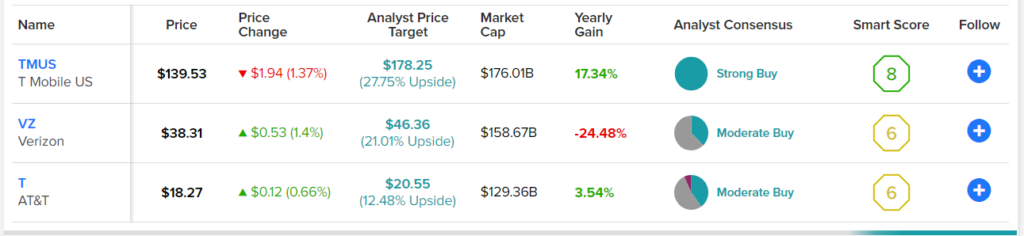

T-Mobile stock continues to eat up its rivals’ lunch, but with a stretched multiple, questions linger as to whether its premium price tag versus peers is warranted. AT&T and Verizon shares now trade at single-digit price-to-earnings (P/E) multiples, with dividend yields hovering in the towering 6% to 7% range. Still, TMUS stock has the highest upside potential, according to Wall Street.

There’s no denying the share-taking ability of T-Mobile. Regardless, paying up a premier multiple for a top performer comes with its own share of risks. Most notably, a reversal (or slow) in trend could bring forth considerable downside risk.

Even in the face of recession, there seem to be few, if any, signs that T-Mobile’s about to slow down anytime soon as its rivals attempt to up their game in a fiercely-competitive wireless industry. As such, I’d prefer going with the top dog in TMUS stock over the two underdogs (T and VZ) as they look to put up a better fight.