Some people are destined to always be known for one significant act, and whenever the name Michael Burry comes up, it’s obligatory to mention the Big Short, the book, and subsequent movie that detailed Burry’s exploits during the 2008 financial crisis. Betting against the housing market, Burry foresaw its collapse and pocketed huge profits.

With the global economy once again appearing fragile, in recent times, Burry, who runs hedge fund Scion Asset Management, has periodically waded with forecasts of doom – warning of looming financial disaster on account of a mix of still overvalued stocks, uncontrollable inflation and the prospect of a multi-year recession.

However, despite his pessimistic outlook, Burry has not ceased his stock picking activities. The recent quarter saw him loading up on several equities, and we decided to get the lowdown on a pair of his latest picks.

We ran these tickers through the TipRanks database to get a bird’s eye view of their prospects and see whether there’s widespread agreement these stocks might be worth buying right now. Here are the results.

Signet Jewelers (SIG)

Even during economic downturns, fingers will still need to be slot into rings and that in essence is the defensive value proposition of Signet Jewelers.

Touting its status as the world’s largest diamond jewelry retailer, Signet operates a diverse portfolio of retail brands, including Zales, Kay Jewelers, and Jared, amongst others. In business since 1949, Signet Jewelers has built a reputation for offering a wide range of high-quality jewelry pieces, from engagement rings to fashion accessories. The company has a strong presence in North America and the United Kingdom, with approximately 2,800 store locations across these regions. In addition to their brick-and-mortar stores, Signet Jewelers has expanded its online presence, allowing customers to conveniently shop for jewelry through their e-commerce platforms.

Despite falling revenues, the company exceeded Q4 estimates and provided an upbeat outlook in the most recently reported statement for the fourth quarter of fiscal 2023 (January quarter). Revenue saw a 5.3% year-over-year decline to $2.66 billion, yet just edged ahead of the consensus estimate. At the other end of the scale, EPS of $5.52 came in ahead of the $5.43 forecast. Looking ahead, for FY24, Signet sees adjusted EPS hitting the range between $11.07 – $11.59, above consensus at $10.68.

It’s clear that Burry saw something worthwhile in Signet; during Q1, he opened a new position by loading up on 125,000 SIG shares, which now command a value over $9.27 million.

He’s not the only one showing confidence. Following the company’s recent investor day, Wells Fargo analyst Ike Boruchow lays out the reasons to back the jewelry giant.

“With numerous structural rev/margin tailwinds in place, SIG’s 3-5 Yr targets appear achievable,” the analyst said. “While the macro backdrop will remain difficult through most of FY24, mgmt has provided visibility into a rev inflection in 4Q and into FY25. We believe investor confidence in mgmt’s operational prowess is growing and DD (double digit) OM (targeting 11-12%), appears sustainable.”

These comments underpin Boruchow’s Overweight (i.e., Buy) rating while his $100 price target suggests the shares will post gains of 35% over the next 12 months. (To watch Boruchow’s track record, click here)

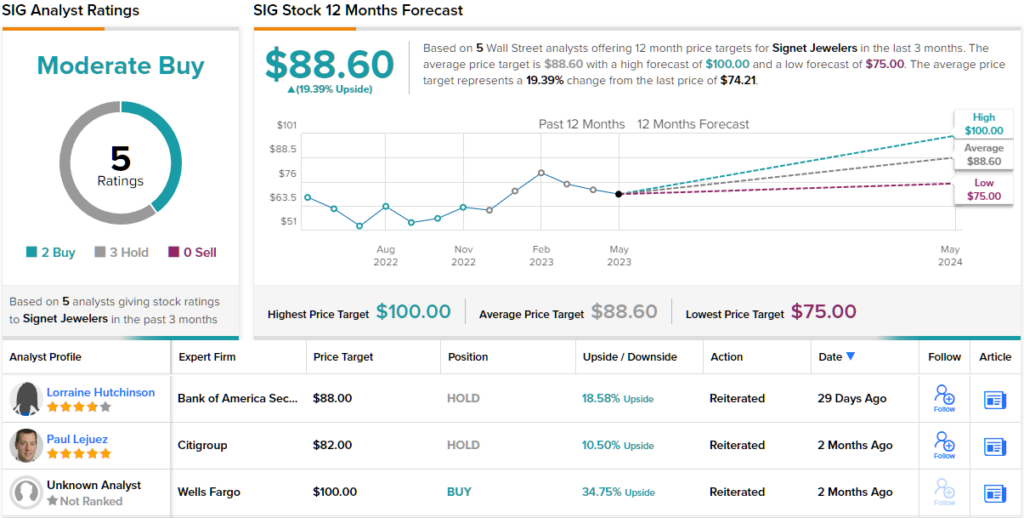

Overall, of the 5 recent analyst reviews on file here, 2 are to Buy against 3 to Hold, for a Moderate Buy consensus. The stock is currently trading at $74.21 and its $88.60 average price target suggests it will rise ~19% over the next 12 months. The company also provides a small bonus in the form of regular dividends, which currently yield an annual rate of 1.16%. (See SIG stock forecast)

JD.com (JD)

Judging by the next stock endorsed by Burry, he must be betting on the ongoing recovery of the Chinese economy. Burry has been making lots of room in his portfolio for JD.com, a leading Chinese e-commerce company. During Q1 he increased his JD holdings by 234% with the purchase of 250,000 shares. These are currently worth $9.33 million.

Founded in 1998, JD.com, also known as Jingdong, has emerged as one of the largest e-commerce platforms in China, offering a wide range of products including electronics, apparel, home goods, and fresh food. The company’s success can be put down to its strong logistics network, efficient delivery system, and commitment to providing authentic and high-quality products. JD has also been actively leveraging emerging technologies, such as artificial intelligence (AI) and big data, to enhance its operational efficiency and personalize customer recommendations.

It’s a model that worked in the e-commerce giant’s favor in the recently reported Q1 results. Revenue climbed by just 1.4% year-over-year to $35.4 billion, yet the figure came in $560 million above the forecast. The company’s non-GAAP net margin increased by 140 bps from 1.7% in the same period a year ago to 3.1%. This helped JD deliver non-GAAP EPADS of $0.69, some distance above the $0.5 predicted by the analysts. There was also an announcement of a new CEO which investors appeared to respond positively to.

The latest print and changes at the firm also gets the thumbs up from Barclays analyst Jiong Shao.

“What’s significant here in our view is that despite the concerns around price war since JD started its own 10bn RMB subsidy program a few months ago, the company delivered better-than-expected margins and raised its margin outlook. This may reflect a relatively healthier competitive environment than feared,” Shao opined.

“Only weeks after its announcement of re-organization, JD has announced new senior management and heads of business units. It is a transition year for JD and we do consider JD’s in-house logistics capabilities set it apart from all its e-commerce competitors, and the company is likely to come out of the transition year as a stronger and more nimble company,” the analyst went on to add.

To support this perspective, Shao maintains an Overweight (i.e. Buy) rating on JD shares, accompanied by a $52 price target. This forecast suggests the potential for a 39% increase in value over the next 12 months. (To watch Shao’s track record, click here)

Elsewhere on the Street, the stock garners an additional 12 Buys and 4 Holds, making the consensus view here a Strong Buy. The analysts see shares climbing 66.5% higher over the next year, considering the average target stands at $62.18. (See JD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.