Beyond Meat (BYND) has been one of 2020’s star performers. A sparkling recent earnings report, and several promising international deals have acted as catalysts for the stock’s outstanding performance. To wit, shares have increased by 100% since the turn of the year.

The company’s CEO Ethan Brown recently presented at William Blair’s 40th Annual Growth Stock Conference and firm analyst Jon Andersen was there to get the lowdown.

In a challenging macro environment, Beyond’s products appear to be holding up well.

For the four-week period leading up to May 17, the company’s sales grew by 134%, compared to the overall plant-based category’s also rather impressive 64% uptick.

In the same period, BYND held the top four best-selling SKUs (stock keeping units) in all of plant-based meat, while market share increased to 19% (or 560 basis points).

In the summer, the company will expand its product line, when it will introduce value packs with 10 plant-based patties costing half the price of its current offerings.

Additionally, along with the introduction of the value packs, Beyond will release new products such as Beyond Beef and Beyond Breakfast Sandwiches, and initiate a marketing campaign designed to “educate consumers regarding the health and sustainability benefits of plant-based meat and the quality taste and nutrition found in Beyond Meat’s products.” With less than 4% penetration of US households and positioned at the forefront of the secular health and sustainable lifestyle trend, Beyond is well positioned to capitalize.

Andersen thinks so, too, and believes Beyond Meat represents “a unique growth opportunity due to its vast addressable market and rapidly developing brand and scale.” However, various risks such as “the impact of the COVID-19 pandemic on foodservice sales, competition from emerging brands and legacy protein providers,” in addition to “execution complexity with multiple growth vectors,” keep him on the sidelines for now.

Therefore, Andersen keeps a Market Perform (i.e. Hold) rating without suggesting a price target. (To watch Andersen’s track record, click here)

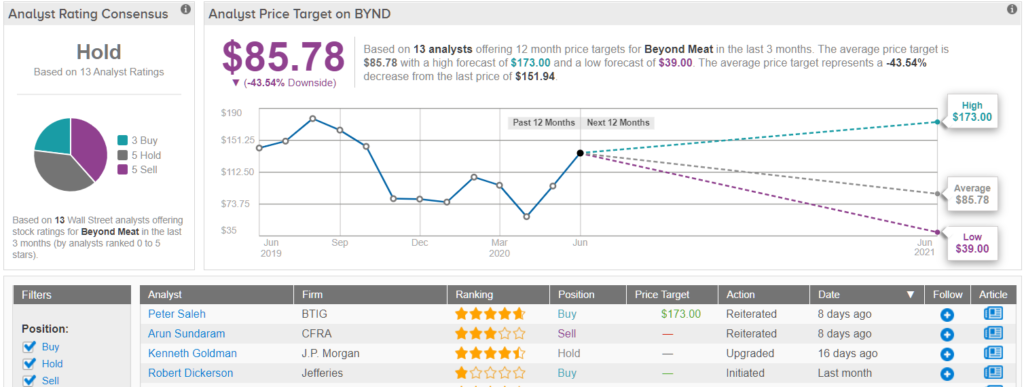

It appears the William Blair analyst is in sync with the rest of the Street. Based on 3 Buys, and 5 Holds and Sells each, the consensus rates BYND a Hold. The Bears are giving out orders in this kitchen, as the $85.78 price target represents considerable downside of 43.5% over the next 12 months. (See BYND’s stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.