Plant-based meat innovator Beyond Meat (BYND) has been one of Wall Street’s biggest standouts of 2020, with shares skyrocketing over 100%, thanks to strong retail figures.

Beyond’s increasing presence on consumers’ shopping lists has caught the eye of Credit Suisse analyst Robert Moskow, who is singing a different tune after new data was published.

“Contrary to our initial view, Beyond may emerge as a net beneficiary of the pandemic in the near-term due to strong demand in retail channel (48% of sales) and in the long-term due to rising consumer interest in healthier foods,” Moskow said.

According to a Hunter consumer survey, since the pandemic’s onset, the percentage of people tucking into healthier food has grown by 20%. Evidently, more people are becoming aware of the benefits of a healthy lifestyle, particularly as it pertains to the body’s ability to combat illness.

Moskow believes that after the pandemic’s demise, the trend will have a direct impact on Beyond’s long-term success. “We think the spike in at-home consumption will lead to stronger sales at restaurant chains as social restrictions ease off,” he commented.

What’s more, with a new Beyond product about to hit the shelves, the veggie patty maker has another catalyst to propel it forward. This summer’s launch of value packs with 10 plant-based patties at half the price of its current offerings will ensure Beyond’s “growth rate in retail will remain high.”

Beyond is slowly making inroads with consumers who are also returning for more. “Household penetration has more than doubled year-to-date to 3.7% and repeat rates have accelerated to 37% (from 32%),” the analyst added.

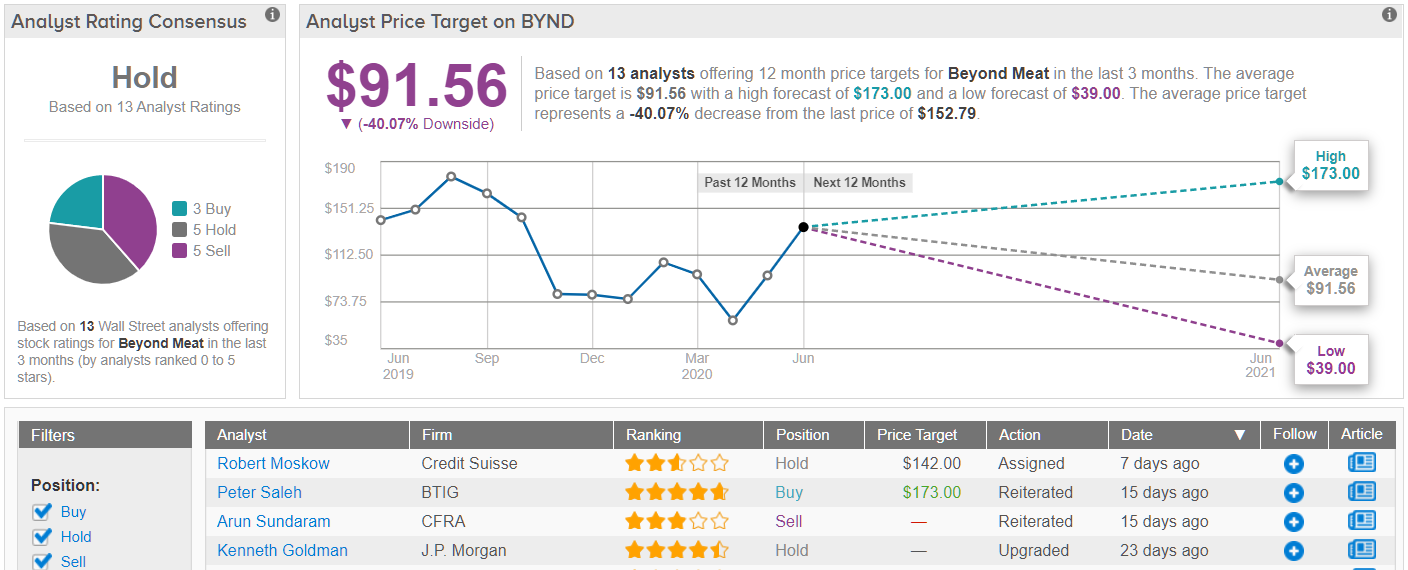

Accordingly, Moskow raises his price target for Beyond from $90 to $142. However, following its latest rally, the new figure implies shares could drop 7%. For now, though, the analyst maintains his Neutral (i.e. Hold) rating. (To watch Moskow’s track record, click here)

Street consensus rates Beyond a Hold, too, based on 3 Buys, 5 Holds and 5 Sells. The plant-based meat pioneer’s shares have been on a roll this year, and have left the analysts’ forecasts eating (veggie) mincemeat. Therefore, the current average price target of $91.56 indicates possible downside of 40%. (See Beyond Meat price targets and analyst ratings on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.