General Grant understood that in life, momentum counts. He probably would not have phrased it that way, but his campaigns showed it – he always pushed forward, and turned any event toward meeting his long-term goals. He created momentum, and put it to his army’s service.

Market investors can make use of that same pugilistic attachment to momentum. Find a stock that has been on a roll, whose fundamentals are strong, and keep with it – that’s the essence of momentum investing. It runs in the face of the old cautionary adage that past performance does not guarantee future returns, but as Grant could tell you, you won’t succeed if you keep turning aside.

With this in mind, we used TipRanks’ database to look up two stocks that saw their share price surge to recent record highs. And best of all, some analysts believe the stock has a way to go yet, while both have received overwhelmingly bullish praise from the Street, enough to earn a “Strong Buy” analyst consensus. Let’s take a closer look.

Jones Lang Lasalle, Inc. (JLL)

Based in Chicago, Jones Lang Lasalle is a globe-spanning real estate and investment management company, offering a range of services to high-net-worth customers. Services include agency leasing, finance, project and property management, tenant representation, valuations, and more. The customer base includes institutional and retail investors, corporate clients, and the very wealthy. This is a high-end company, tailoring real estate services to a well-heeled clientele.

JLL benefits from a clientele that has both wealth to spend and need for professional management of it, no matter what the overarching economic conditions. This basic fact underlies the company’s revenue performance over the past two years, including the COVID crisis and recession. JLL’s quarterly revenue for the last 9 quarters has stayed between $3.7 billion and $5.4 billion, with a pattern of relative lows in Q1 gradually rising to relative highs in Q4. EPS has shown a similar pattern, albeit with greater ‘noise’ in the data.

The company’s business generates substantial cash, and in 2020 JLL saw a record level of $1.11 billion in cash from operations. This was a 131% increase from 2019, and made more impressive by coming during the COVID year. The company registered strong cash collections on its receivables during the year. 2020 also saw substantial reductions in company debt, from $670 million at the end of 2019 to $192 million at the end of December 2020.

With such a firm financial foundation, it’s not surprising that JLL has also seen strong share price momentum. The stock is up 124% in the last 12 months and 50% since the turn of the year – far above the 17% returns notched by the S&P 500.

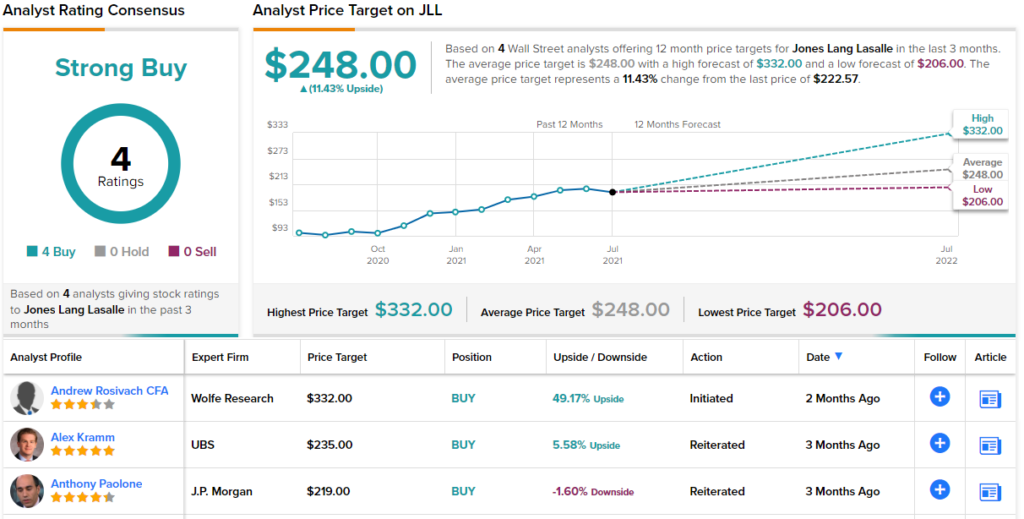

Covering JLL for Wolfe Research, Andrew Rosivach is impressed by its recent growth and likely prospects. He initiates his coverage with an Outperform (i.e., Buy) rating, and his $332 price target implies a one-year upside of 49%.

Backing his stance, Rosivach writes, “We assume cyclical growth from transaction-based business lines (i.e. leasing and capital markets) will lead to outsized earnings growth in the near term. If volumes do not recover at the pace that we expect, earnings growth may not be as substantial. However, given tight credit markets, current conditions are constructive for growth particularly in capital markets. (To watch Rosivach’s track record, click here.)

Wall Street is clearly bullish here, and the Strong Buy consensus rating is based on 4 positive reviews. The shares are priced at $222.57; their average price target of $248 suggests room for 11% upside in the next 12 months. (See JLL’s stock analysis at TipRanks.)

Arvinas Holding Company (ARVN)

The second stock we’ll look at, Arvinas, is a clinical-stage biopharma company engaged in the development of protein degradation therapeutics. This is a fascinating field, and a new class of drugs tailor-made to target specific disease-related proteins. Proteins are present in all biological reactions at the cellular level, and the human body has natural processes for disposing of denatured proteins; Arvinas’ technique is to harness those protein disposal systems to cause degradation and breakdown of disease-causing protein molecules. The company has a proprietary development platform, PROTAC, to engineer proteolysis targeting chimeras.

Over the past year, Arvinas has seen its shares spike twice, once in December and once in July. The December spike coincided with news that ARV-110 and ARV-471, the company’s most advanced drug candidates, had both shown positive results in early testing, the former as a treatment for prostate cancer and the latter as a breast cancer therapy. Both drugs showed acceptable safety and tolerability profiles, along with evidence of efficacy in anti-tumor activity. Both candidates are now undergoing Phase 2 studies.

In July, the company announced additional upbeat news about ARV-417. Arvinas disclosed that it will be working with Pfizer in a global collaboration to commercialize ARV-417. The agreement stipulates that Pfizer will make an up-front payment of $650 million in cash to Arvinas, with an additional $350 million separate equity investment in the company.

These positive developments have helped shares climb by an impressive 212% over the past 12 months. They have not just sparked investor interest in ARVN – they have also prompted Wall Street’s analysts to take notice. From H.C. Wainwright, 5-star analyst Andrew Fein writes, “The major takeaway from the [Pfizer] deal, according to us, is the potential of ARV-471 in combination therapy with Pfizer’s CDK4/6 inhibitor…. not only does the collaboration validate ARV471 but it also boosts other degrader programs in the TPD (targeted protein degradation) landscape. Therefore, considering ER degraders as still a brand-new approach in the oncology space, we remain cautiously optimistic regarding the prospect of ARV-471 and ARV-110, as we head towards 2H21.”

Unsurprisingly, Fein reiterated a Buy rating on this stock, and raised his price target from $100 to $135, implying a 12-month upside of 33% for the shares. (To watch Fein’s track record, click here.)

This company’s headline grabbers grabbed the attention of 9 analysts. Their collected reviews are unanimous, to Buy the stock, giving ARVN shares a Strong Buy consensus rating. The stock is selling for $101.1, and its $126.44 average price target suggests it has room for an extra 25% of share appreciation in the year ahead. (See Arvinas’ stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.