In times of uncertainty, investors may find themselves confused about which stock to purchase; this is where the TipRanks Top Smart Score Stocks tool can be useful. The tool helps identify stocks with the potential to generate returns higher than market averages.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Using this tool, we’ve looked up two stocks sporting a Perfect Score – Medtronic (NYSE:MDT) and Dover (NYSE:DOV). It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Let’s take a close look at each stock.

Medtronic Plc

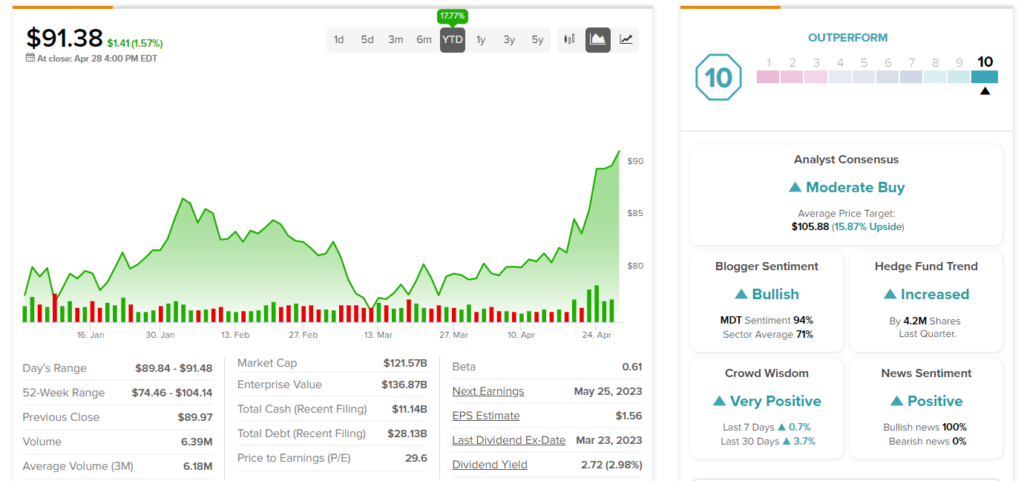

MDT stock was added to the Perfect 10 list yesterday. The stock has a Positive signal from retail investors and hedge funds. Our data shows that hedge funds bought about 4.2M shares of the company in the last quarter. The stock also enjoys bullish Blogger sentiment and Positive News Sentiment on TipRanks.

The company’s efforts to reduce costs and make investments in high-growth areas are expected to drive long-term growth. Also, it has an attractive dividend yield of 3.03%.

It is worth highlighting that MDT stock received Buy ratings from three analysts last week. This was due to the FDA’s approval of the company’s MiniMed 780G system with the Guardian 4 sensor. The system helps to automatically adjust insulin delivery as needed.

Is Medtronic a Buy or Sell?

MDT stock has a Moderate Buy consensus rating on TipRanks. This is based on seven Buy, 10 Hold, and one Sell recommendations. The average price target of $105.88 implies 15.9% upside potential from current levels. The stock has gained 17.8% so far in 2023.

Dover Corp.

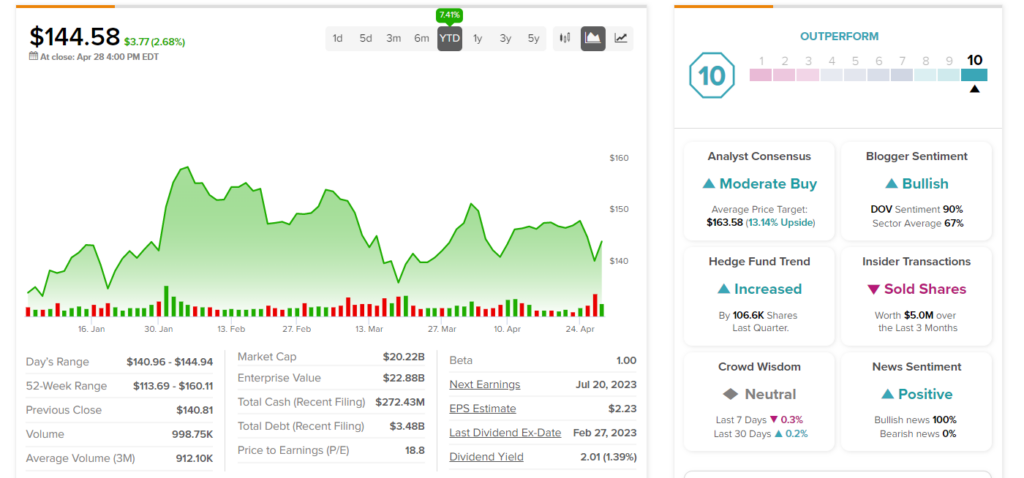

Dover was also added to the Perfect 10 list yesterday. Our data shows that hedge funds are currently bullish on the stock, as they bought 106.6K shares of the company last quarter. The stock also exhibits Bullish bloggers and Positive news sentiment. The efficiency of Dover is further demonstrated by its ROE of 24.29%.

The company’s balance sheet is healthy, and free cash flow is rising. Additionally, its cost-control efforts should help the bottom line grow. It is anticipated that Dover’s performance will improve in the near future due to the order backlog returning to normal and the possibility of increased demand.

Following the better-than-expected first-quarter earnings release last week, five analysts on TipRanks rated DOV stock a Buy. Among these, Oppenheimer analyst Bryan Blair believes that the company is well positioned to meet 2023 expectations. Further, Blair is optimistic about Dover’s “backlog strength/visibility” and expects it to maintain its strong earnings performance.

Is DOV a Good Stock?

Dover has a Moderate Buy consensus rating on TipRanks, based on eight Buy and five Hold recommendations. The average DOV stock’s price target of $163.58 implies 13.1% upside potential from current levels.

Ending Thoughts

Investors looking for growth-oriented stocks might want to consider Medtronic and Dover, which have outstanding Smart Scores on TipRanks. Additionally, the companies’ initiatives to expand their bottom line by reducing costs are encouraging.