Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities, such as stocks, bonds, and other assets. Today, we are focusing on two energy-focused mutual funds with the potential to earn over 20% appreciation in the next twelve months.

Let’s delve deeper.

Fidelity Select Portfolio Natural Resources Portfolio (FNARX)

The Fidelity Natural Resources Fund seeks to earn capital appreciation by investing 80% of its investors’ money in precious metals and in companies that own or develop natural resources. The FNARX has a Smart Score of six, meaning it has the potential to perform in line with market expectations. As of today’s date, FNARX has 39 holdings with total assets of $663.75 million.

On TipRanks, FNARX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 39 stocks held, 33 have Buys, while six stocks have a Hold rating. The average Fidelity Select Portfolio Natural Resources Portfolio price target of $52.61 implies 34.2% upside potential from the current levels.

Year-to-date, FNARX has gained 5.2%. Its top five major holdings include ExxonMobil (XOM), Hess Corp. (HES), Imperial Oil (IMO), Canadian Natural Resources (CNQ), and MEG Energy Corp. (MEG).

Vanguard Specialized Portfolios Energy Fund (VGENX)

The Vanguard Specialized Portfolios Energy Fund focuses on long-term capital appreciation. This actively managed fund offers investors low-cost exposure to U.S. and non-U.S. companies that are principally engaged in energy-related activities. The VGENX also has a Smart Score of seven, which indicates it has the potential to perform in line with market expectations. As of today’s date, VGENX has 44 holdings with total assets of $5.48 billion.

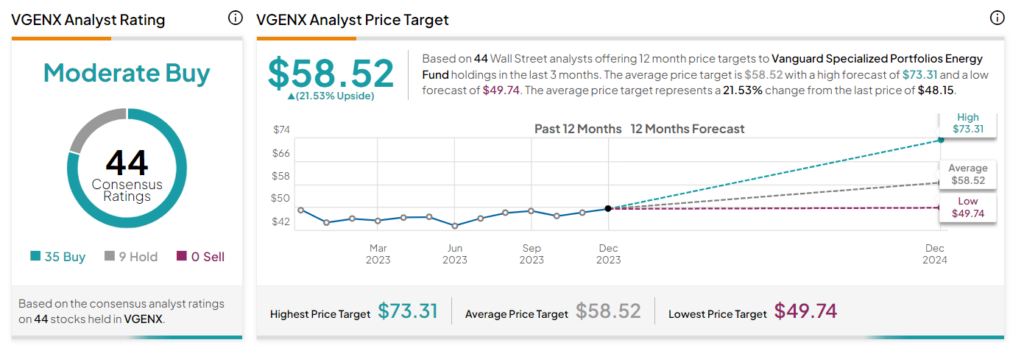

On TipRanks, VGENX has a Moderate Buy consensus rating. This is based on 35 stocks with a Buy rating and nine stocks with a Hold rating. The average VGENX Mutual Fund price target of $58.52 implies 21.5% upside potential from the current levels.

VGENX has gained 8% so far this year. Its top five holdings are ConocoPhillips (COP), Shell (SHEL), BP (BP), TotalEnergies (TTE), and Engie (ENGI).

Ending Thoughts

Investing in energy-focused mutual funds presents investors with a compelling opportunity to gain broad exposure to this crucial sector while simultaneously mitigating risk through diversification. Investors can consider both FNARX and VGENX, which offer significant upside potential.