Learn all about two REIT-focused mutual funds with the potential to earn over 10% appreciation in the next twelve months.

Investing in Real Estate Investment Trusts (REITs) companies is a great way to earn passive income. As a rule, REIT stocks are supposed to distribute 90% of their taxable income as dividends to shareholders. This makes REITs an attractive sector to consider in your portfolio. Amid the ongoing stock market volatility, investing in REIT-focused mutual funds can ensure you earn at least some regular returns on your investments.

Even so, there are innumerable REIT companies listed in the U.S. stock market, making it difficult for investors to cherry-pick stocks. Hence, investing in REIT-focused mutual funds will enable you to get diversified exposure to the sector. Let’s dive right into the two mutual funds that we are exploring today.

PGIM US Real Estate Fund Class A (PJEAX)

The PGIM US Real Estate Fund Class A seeks to earn both capital appreciation and income by investing 100% of its investors’ money in American REIT stocks. The PJEAX has a Smart Score of seven, meaning it has the potential to perform in line with market expectations. As of today’s date, PJEAX has 36 holdings with total assets of $69.53 million.

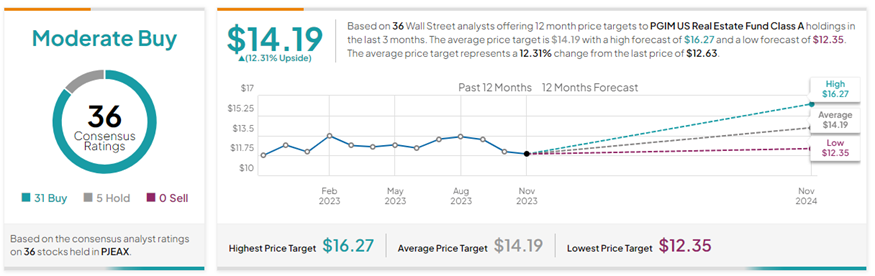

On TipRanks, PJEAX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 36 stocks held, 31 have Buys, while five stocks have a Hold rating. The average PGIM US Real Estate Fund Class A price target of $14.19 implies 12.3% upside potential from the current levels.

Year-to-date, PJEAX has gained 4.7%. Its top five major holdings include Prologis (PLD), Welltower (WLT), Equinix (EQIX), Digital Realty (DLR), and Equity Residential (EQR).

Baron Real Estate Fund Insti Shs (BREIX)

The Baron Real Estate Fund Insti Shs is a diversified fund with a major focus on real estate businesses with significant growth potential. Notably, the fund has exposure to different industries and all market cap ranges. The BREIX also has a Smart Score of seven, meaning it has the potential to perform in line with market expectations.

As of today’s date, BREIX has 39 holdings with total assets of $1.57 billion. Currently, 38.72% of the BREIX funds are invested in real estate stocks, while consumer cyclicals take the lead with 43.65%.

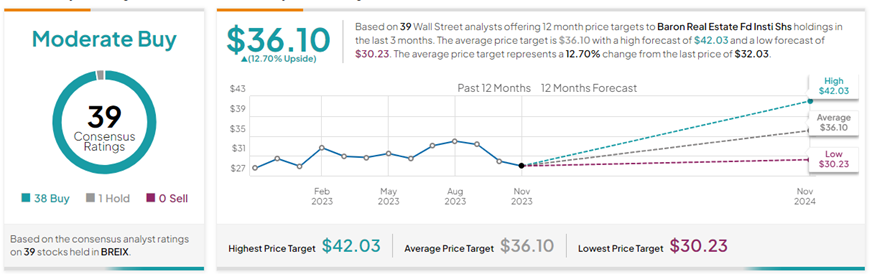

On TipRanks, BREIX has a Moderate Buy consensus rating. This is based on its holdings of 38 stocks with a Buy rating and only one stock with a Hold rating. The average Baron Real Estate Fund Insti Shs price target of $36.10 implies 12.7% upside potential from the current levels.

BREIX has gained 10.8% so far this year. Its top five holdings are Toll Brothers (TOL), Brookfield Corporation (BN), Prologis, CoStar Group (CSGP), and Lennar Corp. (LEN).

Ending Thoughts

Both PJEAX and BREIX focus on the Real estate sector, with BREIX having exposure to other sectors as well. Investors can choose from the wide variety of REIT-focused mutual funds available in the market with the help of TipRanks tools to earn regular passive income. Importantly, investing in mutual funds that are focused on the REITs sector could help you gain exposure to this well-established sector during the current tough macroeconomic environment.