Is it time to go shopping and buy Best Buy (NYSE:BBY) stock yet? I believe prudent investors should wait until a crucial date has come and gone. It’s only a few days away, but you’ll have more data that can help you make a fully informed decision. Therefore, I am neutral on BBY stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Minnesota-headquartered Best Buy operates a popular chain of electronics stores. Inflation might be easing in some areas now, but 2023 has still been a challenging year for companies that sell discretionary items, including Best Buy.

In some ways, Best Buy should appeal to investors who are focused on bargains and passive income. Nevertheless, timing is everything, and you definitely don’t want to load up on Best Buy at the wrong time.

Is Best Buy Stock a Perfect Value-and-Yield Combo?

With the holiday season upon us, it’s time to hunt for great deals in the financial markets. So, is Best Buy a prime bargain right now? It might seem that way, based on the company’s GAAP price-to-earnings (P/E) ratio, which is better than the sector median P/E ratio of approximately 16x.

Furthermore, Best Buy offers an annual dividend yield of 5.3% versus the consumer cyclical sector’s average dividend yield of around 1%. So far, it looks like Best Buy stock is a prime candidate due to its value-and-yield combination.

Hold on a minute, though. Best Buy stock hasn’t been a great performer this year, down 12.7% YTD. Even a 5.3% annual dividend won’t be much of a consolation prize if the stock keeps going down. Could it be a value-and-dividend trap?

We can look to Best Buy’s third-quarter Fiscal Year 2024 results to determine whether the company is demonstrating growth. In the “Good News” column, we can say that Best Buy has a good track record of quarterly EPS beats. Plus, the company just posted another beat, posting Fiscal Q3-2024 earnings of $1.29 per share versus Wall Street’s expectation of $1.19 per share.

The quarter wasn’t all positive for Best Buy, however. Notably, the company’s revenue of $9.76 billion fell short of the analyst consensus estimate of $9.9 billion in quarterly revenue.

Moreover, investors might be concerned about Best Buy’s FY2024 guidance. For the full year, Best Buy’s management now expects the company to generate $43.1 billion to $43.7 billion in revenue, compared to the prior guidance of $43.8 billion-$44.5 billion. Also, Best Buy adjusted its FY2024 EPS outlook slightly lower, to $6.00-$6.30 from the company’s previous guidance of $6.00-$6.40.

Best Buy CEO Corie Barry provided an explanation for the company’s lowered guidance. “In the more recent macro environment, consumer demand has been even more uneven and difficult to predict.”

In other words, the American consumer might not be as resilient as some optimists might have hoped. In addition, Barry stated, “Based on the sales trends in Q3 and so far in November, we believe it is prudent to lower our annual revenue outlook.”

A Huge Day is Coming for Best Buy

Finally, I believe it’s wise to wait until after this Friday before making any decisions about Best Buy stock. That’s because Black Friday, typically the biggest U.S. shopping day of the year, is coming up, and Best Buy really needs to knock it out of the park with blockbuster sales. Hence, it makes sense to just wait until the Black Friday sales data comes in.

Is Best Buy Stock a Buy, According to Analysts?

On TipRanks, BBY comes in as a Hold based on four Buys, 11 Holds, and two Sell ratings assigned by analysts in the past three months. The average Best Buy stock price target is $78.27, implying 15.8% upside potential.

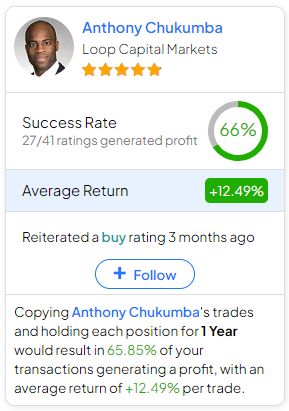

If you’re wondering which analyst you should follow if you want to buy and sell BBY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Anthony Chukumba of Loop Capital Markets, with an average return of 12.49% per rating and a 66% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Best Buy Stock?

Value seekers and dividend collectors may be tempted to just load up on Best Buy shares right now. After all, Best Buy posted another quarterly earnings beat.

Unfortunately, not all of the pertinent data is available yet. Best Buy just lowered its full-year sales outlook, and the company needs to generate outstanding sales figures for Black Friday. Consequently, I am neutral on BBY stock for now and am not considering buying any shares today.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue