Founded in 1966, Minnesota-based Best Buy (BBY) is a consumer electronics company that provides consumer technology products and services in the U.S., Canada, and Mexico.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It operates in two business segments: Domestic and International. We are bullish on the stock.

Measuring Efficiency

Best Buy’s business model requires it to hold a lot of inventory. Therefore, the speed at which BBY can move its inventory and convert it into cash is very important in predicting its success.

To measure its efficiency, we calculated its cash conversion cycle, which shows how many days it takes to convert inventory into cash. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Best Buy’s cash conversion cycle is -3, meaning the company converts inventory into cash before having to pay suppliers. Basically, Best Buy doesn’t have to put up any money to finance inventory purchases because it can move its inventory and collect the payments while still on credit. Consequently, Best Buy’s suppliers are essentially financing its operations.

We can also take a look at Best Buy’s gross margin trends. Ideally, a consistently expanding gross margin is what you’d want to see unless the gross margin is already very high, in which case it is acceptable for it to remain flat.

In Best Buy’s case, gross margins have seen a very slight decline in the past few years, dropping from 24% in Fiscal Year 2017 to 22.5% in Fiscal Year 2022.

This is not ideal because it does not allow the company the opportunity to easily increase free cash flow margins or reinvest a larger percentage of revenue into growth initiatives.

Nonetheless, the decline is fairly minimal. BBY’s free cash flow should still increase as revenue increases, and the company can reinvest more money on an absolute basis.

Best Buy Creates Value for Shareholders

Great companies often have great management teams that efficiently allocate capital. To get a good picture of management’s effectiveness, we simply need to look at some numbers. A metric we like to look at is the economic spread, which is defined as follows:

Economic Spread = Return on Invested Capital – Weighted Average Cost of Capital

Here’s how you need to think of it: If the return on invested capital is greater than the cost of that same capital, then the company is creating value for its shareholders through its operations. Otherwise, the company is considered to be a value destroyer, and it would be better off simply investing money into risk-free bonds.

For Best Buy, the economic spread is as follows:

Economic Spread = 28.1% – 6%

Economic Spread = 22.1%

Such a high return on invested capital is very impressive, and well above the industry average of 8.9%. As a result, the company is creating tremendous value for its shareholders, implying that management is efficiently allocating capital.

BBY has been creating value for a long time. As you can see in the chart below going back 10 years, its ROIC has been consistently high and has been above 20% for the past six fiscal years.

Image created by Author

Best Buy’s Low Valuation, Share Buybacks

Best Buy appears to be undervalued at the moment based on forward estimates. For Fiscal 2023 and 2024, ending January 31 of their respective years, GAAP EPS estimates for BBY are $9.01 and $10.40 per share, respectively. This implies forward price/earnings multiples of around 11x and 9.6x, respectively.

Free cash flow is expected to be $1.7 billion for Fiscal 2023 and $2.27 billion for Fiscal 2024. This implies forward price-to-free-cash-flow ratios of 14.1x and 10.5x, respectively, not including the potential for future buybacks to bring that multiple lower.

BBY has done lots of buybacks in the past, resulting in its shares outstanding dropping from 350.8 million in Fiscal 2015 to 240.6 million currently. Therefore, if the share count keeps trending down, its per-share results have a chance of surprising to the upside.

Overall, the valuation seems low. This is especially true when you consider that Best Buy is a growing company that consistently has high returns on capital.

Wall Street’s Take

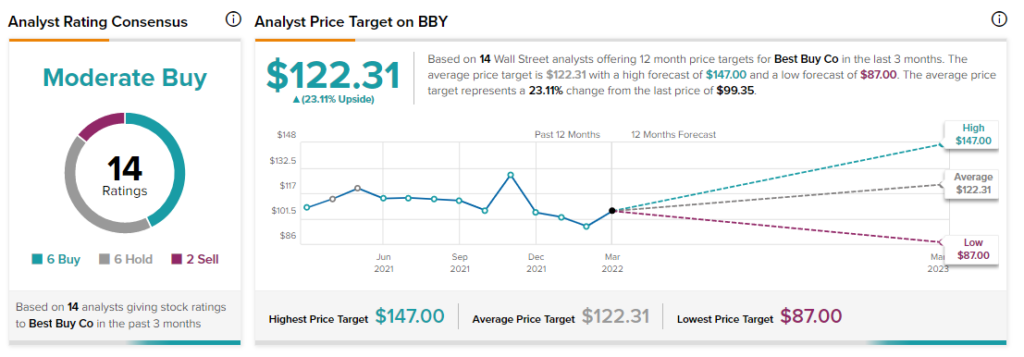

Turning to Wall Street, Best Buy has a Moderate Buy consensus rating, based on six Buys, six Holds, and two Sells assigned in the past three months. The average Best Buy price target of $122.31 implies 23.1% upside potential.

Final Thoughts

Operating in an industry that has been seriously disrupted by companies such as Amazon (AMZN), Best Buy has been able to stay competitive. It has become much more efficient, as demonstrated by its down-trending cash conversion cycle that has actually turned negative.

In addition, it has a management team that can point to high returns on invested capital as a way to prove that it is creating significant value for shareholders.

Lastly, it seems undervalued based on forward estimates, and it also has the backing of analysts who currently see 23.1% upside potential going forward. For these reasons, we are bullish on Best Buy.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure