Some investors have been disappointed in the performance of Berkshire Hathaway (BRK.B) stock recently. They’ve expressed a preference for higher-growth companies. Few investments have safer returns than BRK.B if you are looking to invest.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Berkshire Hathaway did well financially last year. The market is doing very well, so the stocks and the cash balance follow.

The interest rates and corrections in the S&P 500 also aren’t affecting it at all. Despite the general market downturn, a sum-of-the-parts valuation suggests this stock is undervalued. If the market keeps going south, this company should outperform. I’m bullish.

Berkshire Finally Mounts a Comeback

Berkshire has had some bad investments. For example, Warren Buffett cashed out of airlines in 2020 after admitting it was a big mistake purchasing stakes in them. The sale made headlines.

However, what we must not forget is that Berkshire gets most things right very regularly. As an example, Berkshire has a massive holding in shares of one of the most successful companies in history, Apple (AAPL). Much like Apple, most of its investments are in strong, stable businesses that have a smooth recurring cash flow.

Despite this, investors think Berkshire is running out of ways to grow and are questioning the company’s decision to keep so much cash on hand. Even though Berkshire regularly repurchases billions worth of stock, it still has nearly $150 billion in cash on its books.

Some of the best investors started investing in Berkshire Hathaway because they recognized its business value. Many of Berkshire’s shareholders know how valuable their investments can be in the long run.

The portfolio is highly diversified and helps to supplement your growth-based investment strategy. While Buffett’s conservative style may remain in place, he is transitioning from CEO to non-executive chairman.

Built for Success

There are four basic sectors BRK.B includes in its investment portfolio. These can include but are not limited to stocks, bonds, and mutual funds. They vary in what they contain.

The importance of Apple in the IT sector has led to Berkshire building up a large holding in the company. American Express also features a prominent position among Buffett’s investments, including shares from Bank of America (BAC), Bank of New York Mellon (BK), Mastercard (MA), and more.

Interest Rates Rising

A lot of recent research has focused on the financial management industry, with many arguing that interest rates will rise rapidly during the year.

The stock market can benefit tremendously, so more intelligent companies are finding smart ways to manage their finances accordingly. When interest rates are increased, there are a lot of benefits that come along with it. In this case, the spread between profits and operating costs goes up. This helps banks stay more profitable, and have more money to invest.

Berkshire has many banks and related companies as investments. Many of them have a lot of exposure to interest rates, for better or worse. When interest rates are high, banks emphasize the difference between what they pay their customers and what they can deploy onto assets.

Risks to the Thesis

The concentration of the equity portfolio in Apple stock is a real concern for investors that highly value diversification. As mentioned before, Apple is the most popular business in Warren Buffett’s portfolio. Although there are detractors of this strategy, it’s still justified because Apple is a great company.

In addition, a large part of Berkshire’s business is insurance, so it is also constantly exposed to underwriting risk like other insurance companies.

It’s difficult to accurately measure such risks, and overall it can be beneficial to have them in your policy portfolio as a hedging strategy. This is why insurance companies have to set their premiums correctly to make up for any losses that might occur.

Succession Fears

You never know who will be the successor to Buffett if he leaves. It could be a risk for Berkshire Hathaway investors. The investment strategy of Buffett is one of the main reasons people get into Berkshire.

If you hire an “investing” as opposed to a “money management” agent, then your asset value may decrease over time. Therefore, this is the element weighing down the Berkshire Hathaway price target.

However, these succession fears might be overblown. Over the years, Buffett has entrusted his investment managers with tackling multi-billion dollar portfolios. Todd Combs and Ted Weschler have experienced money managers. They now manage $34 billion of investments, including what they manage within pension plans at BRK-owned businesses.

Combs and Weschler made a lot of money over the past decade, while Buffett added capital from their large investments.

Wall Street’s Take

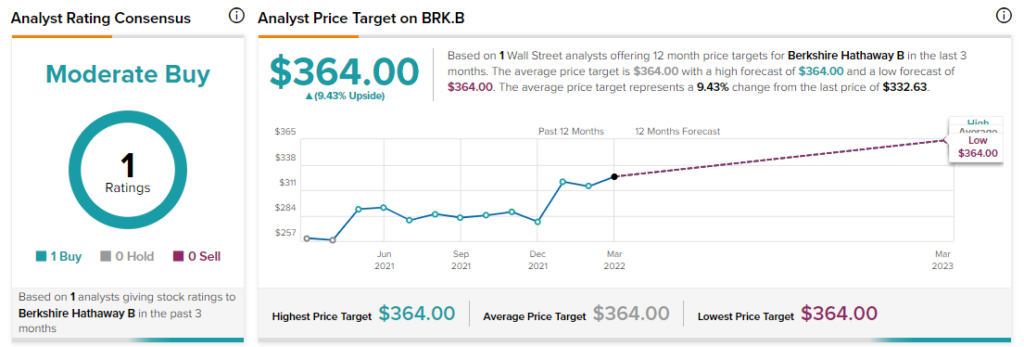

Since Buffett took the reins of Berkshire Hathaway, the company has been viewed as a safe and conservative investment on Wall Street. The company’s price target reflects this reality. BRK.B has a Moderate Buy consensus rating based on one analyst offering a Buy rating.

Berkshire Hathaway’s price target is $364, representing an upside of 9.4% from the current price.

Bottom Line

Buffett focuses on the shares of undervalued companies that still have good potential for growth.

At this point, most investors treat BRK.B stock as a conservative investment, almost like a mutual fund. However, Berkshire Hathaway doesn’t pay dividends.

So, investors are really looking forward to share price appreciation more than anything else. During the last three months, BRK.B has built up solid momentum. Therefore, if you are looking for a low-risk investment, look no further.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.