When it comes to the broader semiconductor industry, it’s difficult not to be skeptical about Intel (NASDAQ:INTC). Once holding the benchmark to which all other companies aspired, Intel has become almost an afterthought. However, the company did, to its credit, fight back hard last year. Still, skepticism reigns supreme. Nevertheless, bearish options traders who actively short its shares may be tempting fate. I am bullish on INTC stock due to its potential to surprise the market.

Understanding the Framework of INTC Stock

As you might guess from the title of this article, the subject focuses on options. We’ll touch on some of the key industry factors affecting INTC stock. However, the main idea here is speculation regarding how activity in the derivatives market (where the smart money congregates) may influence the price action in the open market, largely the domain of the retail investor.

Fundamentally, an options contract (whether a call or put) offers no intrinsic value, in the same way that a contract to purchase a car has no directive value. Rather, contracts derive value from the underlying asset; hence, options are often called derivatives. Essentially, holding the contract represents the right (but not the obligation) to buy (call) or sell (put) the underlying security. Typically, each option contract carries the leverage of 100 shares of the target security.

Generally, the process of buying calls or puts is straightforward. If the derivative contract goes in the money (ITM) relative to the strike price, you have the option (no pun intended) to exercise the contract or sell it. If the derivative falls (or rises) away from the strike price, the option may expire worthless. Therefore, the most money at risk when buying calls or puts is the principal.

However, for every option that is bought, someone else must sell it. Essentially, option sellers underwrite the risk that the derivative will not go ITM (become profitable). That’s why option sellers are also known as option writers because they underwrite the risk in exchange for the premium (the price paid for the contract).

Option writing offers income-generating opportunities. However, writing uncovered calls presents an extraordinary risk. If, for instance, INTC stock skyrockets well past a given strike price, the call writer must fulfill the terms of the call option upon exercise (i.e. sell 100 shares per contract to the call buyer).

If the position is uncovered (the call writer doesn’t own enough INTC stock), the bearish trader must buy shares at the open market price only to sell them at the lower strike price. Since a security can theoretically rise indefinitely, uncovered call writers expose themselves to uncapped losses.

The Pressure is on for Intel Bears

As it relates to INTC stock, shares have recently exploded higher. Just in the trailing month, the much-scrutinized security has gained 13%. Understandably, then, many bearish traders wrote call options. Indeed, options flow data – which exclusively screens for big block transactions likely made by institutions – shows several high-volume sold calls.

Regarding near-term speculation, on January 3, a major entity (or entities) sold 828 contracts of the Jan 19 ’24 37.50 call. At the time of the order, INTC stock traded hands at approximately $47.10. You’ll notice that at said price, the call is deep ITM relative to the $37.50 strike price. One of the reasons why speculators sell deep ITM calls is to pick up a hefty premium, and this transaction resulted in a premium collection of $772,800.

However, the risk here is that the expiration date of January 19 is coming up soon. So, it doesn’t take much (given the stock’s recent mobility) for INTC to shoot higher. Contrarian bullish speculators may also view the options flow screener in a bid to squeeze out bearish traders. To cover calls, one can simply buy back the obligatory number of shares. Of course, doing that will likely lift the security’s open-market pricing.

Regarding longer-term speculation, on January 4, bearish traders sold 1,175 contracts of the Jan 17 ’25 50.00 Call. Here, the pessimists collected premiums worth $636,000. Still, that’s a long time to assume that INTC stock won’t rise to $50 (share price is currently $48.35) by January 2025.

Yes, Intel incurred many missteps and troubles. However, these wagers seem overly pessimistic, and those who underwrote the risks might pay.

Now Isn’t the Time to Short INTC Stock

It’s not just the possibility that the bears can get blown up that may drive INTC stock higher. Rather, the fundamentals just might support the proposition. As TipRanks reporter Marty Shtrubel mentioned, Intel suffered huge setbacks. However, its fundamentals have been improving, leading to a significant rise in its share price.

Consider Intel’s market share loss in the CPU market. At the peak in the third quarter of 2016, Intel commanded an 82.5% share of the CPU market relative to Advanced Micro Devices (NASDAQ:AMD). However, by Q3 2021, Intel’s share slipped to 60.2%. Fast forward to Q4 2023, the metric comes in at 61.1%.

Very little improvement materialized. At the same time, it’s possible that the acceleration of market share losses has been halted. It may be (relatively speaking) blue skies ahead. If so, now’s not the time to short INTC stock.

Is INTC Stock a Buy, According to Analysts?

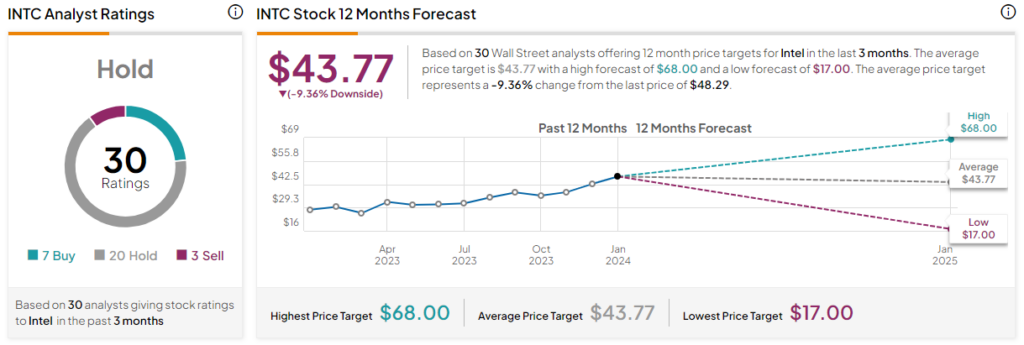

Turning to Wall Street, INTC stock has a Hold consensus rating based on seven Buys, 20 Holds, and three Sell ratings assigned in the past three months. The average INTC stock price target is $43.77, implying 9.4% downside risk.

The Takeaway: INTC Stock Might Trip Up the Bears

At first glance, investors might be tempted to short INTC stock based on the volume of sold call options. The problem is that Intel represents a hot ticket, and contrarian bulls may attempt to force the pessimists to cover their short positions, which can send the stock higher. As well, fundamental data suggests that now might not be the ideal time to be bearish on the chipmaker.