The AI revolution is still in its early stages, with significant growth potential ahead. As the world becomes increasingly reliant on artificial intelligence, machine learning, and data analytics, companies that can harness these technologies (like BBY and SNOW) are poised for explosive growth.

Despite recent profit-taking, forecasts show that the U.S. AI market could reach $299.64 billion by 2026. The global AI market is expected to grow at an impressive 37.3% CAGR from 2024 to 2033. Samantha McLemore, CIO of Patient Capital, shares this optimism, stating, “The bull market continues, and the path of least resistance is higher.” This optimism isn’t just for tech giants but also for companies like retailer Best Buy (BBY) and software firm Snowflake (SNOW)

I am bullish on both Best Buy and Snowflake. Best Buy will benefit from the surge in demand for AI-capable electronics, while Snowflake’s innovative data cloud platform and strong partnerships give it an edge in enterprise AI. Both companies are well-positioned to capitalize on the ongoing AI revolution, offering promising growth and shareholder value.

Best Buy (NYSE:BBY)

Best Buy, a well-known brand in consumer electronics, is strategically positioning itself to capitalize on the AI trend. One of the key drivers behind Best Buy’s optimistic outlook is the anticipated replacement cycle for consumer electronics. The last major cycle occurred during the pandemic, about four years ago, and analysts are now expecting a significant uptick in demand for new, AI-enabled devices.

According to Canalys, 19% of PCs shipped this year will be AI-capable, escalating to 60% by 2027, with a strong inclination toward commercial adoption. Best Buy’s recent sales data supports this trend, with a notable increase in laptop sales over the last two quarters compared to the same periods last year.

Nonetheless, in its Q1 FY25 report, the company reported Enterprise revenue of $8.85 billion, a 6.1% decline in comparable sales from the previous year.

This marks the 10th straight quarter of sales decreases, highlighting ongoing challenges in the consumer electronics market. However, the company beat earnings expectations, reporting adjusted earnings per share of $1.20, surpassing the anticipated $1.07, showing its ability to manage costs effectively in tough times.

Despite facing sales challenges, Best Buy’s stock has shown resilience and has even gained this year. Currently, BBY stock is up roughly 14% year-to-date, indicating investor confidence in the company’s strategies and prospects.

To capitalize on this coming trend, Best Buy is investing in strategic initiatives to enhance customer engagement and drive sales growth. These include adding trained sales teams, creating interactive displays, producing over 500 product showcase videos, and deploying generative AI technology to improve customer support and personalized experiences through partnerships with Google (GOOGL) Cloud and Accenture (ACN).

Best Buy’s forward-looking guidance, while cautious, reflects a stabilizing market environment. The company projects full-year revenue between $41.3 billion and $42.6 billion, with comparable sales ranging from a 3% decline to flat. Despite these conservative figures, management remains optimistic due to the positive trends in specific product categories and an anticipated recovery in tech demand.

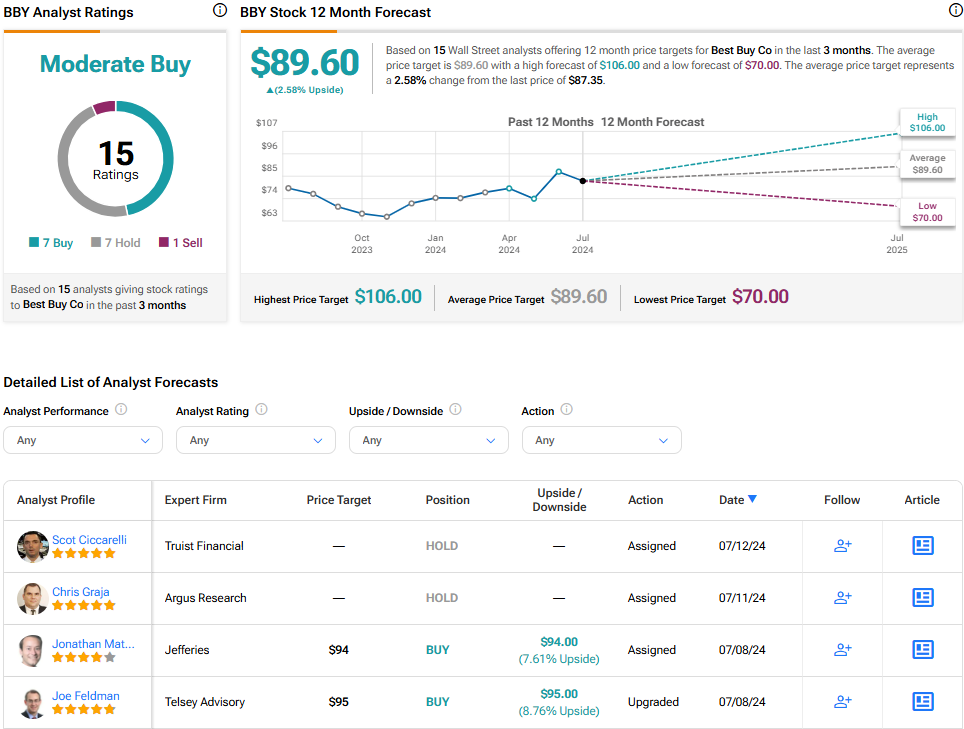

Is Best Buy Stock a Buy, According to Analysts?

Based on the latest analyst ratings, Best Buy has a Moderate Buy consensus rating. Out of 16 analysts covering the stock, eight rate it a Buy, seven a Hold, and one a Sell. The average BBY stock price target of $90.55 implies upside potential of 2.6%.

Snowflake (NYSE:SNOW)

Snowflake (SNOW) is a prominent player in the cloud-based data warehousing and analytics market, with a market capitalization of $43 billion. It is positioning itself as a key player in the enterprise AI market.

CEO Sridhar Ramaswamy, who took the helm in February 2024, has given the company a “blank check” to achieve this end, including hiring top AI talent from other industry players like TruEra. This aggressive push into AI could open up new revenue streams and solidify Snowflake’s position.

At its 2024 Summit, Snowflake unveiled AI-focused innovations, including enhancements to Snowflake Cortex and new capabilities for streaming data and open table formats like Apache Iceberg. It also partnered with Nvidia (NVDA) to enable custom AI applications and launched a Data Security Posture Management platform with Normalyze.

In its most recent quarterly report (Q1 FY25 ended April 30, 2024), Snowflake reported revenue of $828.7 million, representing a solid 33% year-over-year increase. Product revenue, which is the company’s bread and butter, came in at $789.6 million, up 34% from the previous year. These figures show that the company is maintaining strong growth, even as it scales up.

The company’s net revenue retention rate stood at a remarkable 128%, underscoring strong customer loyalty and the expanding use of Snowflake’s platform among existing clients. While customer spending growth has slowed a bit, Snowflake has gained 30% more big-ticket clients, each bringing in over $1 million annually.

Despite these robust figures, Snowflake’s stock has taken a hit this year and is currently trading at $129.59, down over 34% since January.

Given Snowflake’s strong market position and AI capabilities, some analysts see the current stock dip as a buying opportunity.

Looking ahead, Snowflake’s financial guidance for the second quarter and full-year fiscal 2025 remains optimistic. The company projects Q2 product revenue between $805 million and $810 million, representing 26-27% year-over-year growth. For the full year, Snowflake anticipates product revenue of approximately $3.3 billion, with a gross profit margin of 75% and an operating income margin of 3%.

Is Snowflake Stock a Buy, According to Analysts?

According to the latest analyst ratings, Snowflake stock has a Strong Buy consensus rating. Out of 33 analysts covering the stock, 25 rate it a Buy, and eight rate it a Hold. The average SNOW stock price target of $200.97 implies upside potential of around 55%.

The Bottom Line

Best Buy and Snowflake are strong opportunities in the AI-driven market. Best Buy will benefit from surging demand for AI-capable electronics, while Snowflake excels in data warehousing and enterprise AI. Despite inherent risks, I’m bullish on both companies; their growth potential is significant. For anyone looking to invest in AI’s future, Best Buy and Snowflake should definitely be on your radar.