The S&P 500 currently sits 14% below the all-time high of 4,793, which was reached at the end of 2021. However, if a Bank of America prediction is about to play out, new highs will be attained early next year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

BofA’s technical research strategist, Stephen Suttmeier, points to specific bullish indicators indicating that the S&P 500 could climb to 4,900 by next March. This represents a potential uptick of ~19% from current levels.

The signals Suttmeier is referring to revolve around breadth, or the level of involvement in upward swings among the underlying stocks that make up the markets.

“Upside breakouts for the weekly global advance-decline line of 73 country indices tend to provide a bullish trend continuation signal for US and global equity markets,” Suttmeier explained, pointing to some recent examples that back his case.

Meanwhile the analysts at BofA have an idea about which stocks are well positioned to take advantage of the anticipated rally. We ran a pair of their recent recommendations through the TipRanks platform to get a fuller picture. Here is what we found.

Cogent Communications (CCOI)

We’ll start with Cogent Communications, a US-based internet service provider operating on the international scene. Founded in 1999, Cogent quickly developed a reputation for growth through acquisition – more than a dozen such moves in just its first 5 years of operation – as well as for turning out the financially troubled internet carriers it bought.

The company has, in the last few months, gotten back to those roots by the purchase of the Sprint Wireline business from T-Mobile. The transaction – which included both a purchase price of $1 (you read that correctly) and mutual transfers of working capital between the companies – brings Sprint’s legacy network of US long-haul fiberoptics and an associated customer base into Cogent’s stable.

Today, Cogent mainly offers internet access and data transport across a high-end fiber optic network that reaches across North and South America, Europe and Asia, Africa, and Australia. The company operates over 61,200 miles of intercity fiber and another 42,400+ miles of metro fiber; this network serves more than 219 markets, and connects with thousands of other networks worldwide.

Cogent’s business has been generally profitable. In the first quarter of this year, the company reported a top line of $153.6 million in service revenue, up 1% quarter-over-quarter and 3% year-over-year – although it did just miss the analyst forecast by some $200K. On earnings, Cogent reported EPS of 13 cents, 1 cent below the estimates.

Even though the revenue and earnings missed expectations for Q1, Cogent still had the confidence to bump up its quarterly dividend in the declaration for Q2. The company boasts that this marked 43 consecutive increases to the div payment. At the current declared rate of 93.5 cents per common share, the dividend annualizes to $3.74 and gives a high yield of 5.7%.

Analyst David Barden, covering this stock for Bank of America, approves of the Sprint acquisition due to the following reasons: first, the new free cash flow (FCF) generation resulting from the Sprint Wireline acquisition; second, the related increase in earnings before interest, taxes, depreciation, and amortization (EBITDA); and third, the emergence of new sales growth vectors. These factors collectively represent a new and under-represented opportunity for the stock

Covering this stock for Bank of America, analyst David Barden favors the Sprint acquisition for several reasons. First, it brings new free cash flow (FCF). Second, it contributes to EBITDA accretion. And third, it introduces new sales growth vectors that are currently underrepresented in the stock.

Barden goes on to outline Cogent’s path forward, noting: “We expect CCOI mgmt to swiftly leverage its existing platform and sales force to realize synergies and transition the acquired business from losses to profit. In all, we forecast the combined business will eclipse the current annual run-rate $50-60mn FCF at >$150mn in 2024.”

Summing it up, Barden gives CCOI shares a Buy rating, with an $85 price target that suggests a potential one-year gain of ~33%. (To watch Barden’s track record, click here)

Zooming out a bit, we find that Cogent’s stock gets a Moderate Buy consensus rating from the Wall Street analysts, based on 9 reviews that include 5 Buys and 4 Holds. The shares are trading for $64.03 and have an average price target of $73.75, implying a 15% upside in the next 12 months. (See CCOI stock forecast)

InterDigital (IDCC)

Next up is InterDigital, another tech company tied to networks and connectivity. Specifically, InterDigital focuses on research and development of new technology for wireless and video connected technologies. The company aims to solve the network industry’s pressing technical challenges, with solutions to increase broadband efficiency, deliver better video, and improve the multimedia user experience.

InterDigital has license agreements with leading wireless companies and tech firms around the world, and those agreements can sometimes end up in court. In recent months, the company has gotten favorable rulings on two major cases, involving Lenovo and Samsung.

In the Lenovo case, a licensing dispute, a UK court handed down a judgement ordering Lenovo to pay $138.7 million in license fees to InterDigital, and must pay ‘in full’ for past sales going all the way back to 2007. The Samsung case did not get to court, but the two sides did reach an agreement. The recent conclusion of that binding arbitration helped push InterDigital’s 1Q23 revenues to more than $200 million.

And that brings us to the company’s most recent quarterly financial results. The boosted top line came to $202.37 million, up almost 100% year-over-year and beating the forecast by over $101 million. The quarterly EPS was reported as $3.58, far ahead of last year’s 58 cents, and $2.99 ahead of the forecast. We do need to repeat that this performance was due, in large part, to the receipt of court and arbitration awards. The company’s recurring revenue in the quarter was $101.6 million, up 2% y/y.

InterDigital has used its Q1 windfall, in part, to accelerate its capital return/share repurchase program. The company increased its repurchase authorization during the quarter, to a total of $400 million, and bought back 2.7 million shares.

All of this caught the eye of Tal Liani, who covers IDCC for Bank of America. Liana laid out his stance on the stock, noting: “Bullish on medium-term outlook and strong management team, we flag likely upside on the Samsung and Lenovo revenue contributions as another key driver. InterDigital is currently in binding arbitration with Samsung and recently received a favorable ruling in the Lenovo case. The company already recognizes these revenues, though at a conservative level, and could see some upside once the cases finalize…. In addition, we see stock upside from continued growth beyond wireless into CE, IoT, and Autos, and note that strong share buybacks are adding to the stock’s attractiveness…”

Liani’s take on IDCC has changed dramatically. He recently made a double upgrade on the stock, from Underperform to Buy, and his $105 price target (up from $55) implies a 23% upside going out to the one-year time horizon. (To watch Liani’s track record, click here)

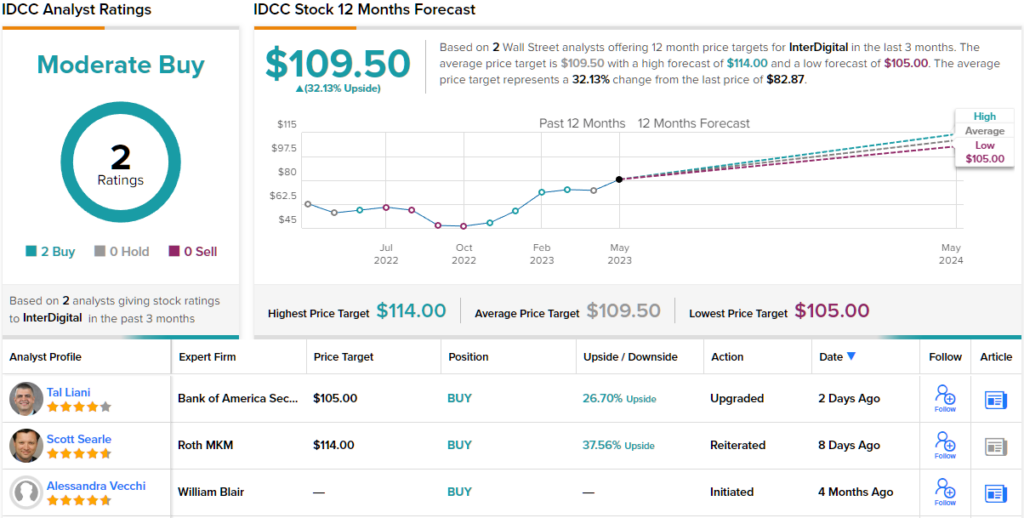

IDCC has slipped under most analysts’ radar; the stock’s Moderate Buy consensus is based on just two recent ratings – but both are Buys. With shares trading at $82.87, the $109.50 average price target suggests room for a 32% upside. (See IDCC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.