Investors have had little to cheer about recently as the markets have struggled to shake off the grip of various factors pulling them down. These factors include the prospect of interest rates remaining elevated, concerns related to high yield bonds, an uptick in oil prices, and the ongoing conflict between Israel and the terrorist organization Hamas, all of which have played a role in dampening market activity.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, for investors seeking signs that the mood is about to change, Bank of America strategists have some good news. The bank has drawn attention to its Bull and Bear Indicator, which recently entered the “extreme bearish” zone, signaling a contrarian buying opportunity for stocks.

Over the years, this contrarian indicator has consistently proven itself reliable. Since 2002, it has provided 20 buy signals, with a median three-month return of 5.4% for US stocks following the signal.

Furthermore, the most recent signal coincided with another contrarian buying opportunity, as investors increased their cash allocation levels.

With these signals offering the prospect of a rebound, the BofA stock experts are pointing investors toward the stocks they like right now, ones they see making good use of the bull market’s resumption. We used the TipRanks database to also find out whether other Street analysts are showing confidence in these names too. Let’s check the details.

Don’t miss

- Morgan Stanley Predicts at Least 70% Upside for These 2 High-Conviction Stocks — They Have Upcoming Catalysts and Strong Growth Prospects

- ‘Stay Cautious,’ Says Billionaire Leon Cooperman About the Stock Market — Here Are 2 High-Yield Dividend Stocks He’s Using for Protection

- 2 ‘Strong Buy’ Chip Stocks From Wall Street’s Top Tech Analyst – 2 ‘Strong Buy’ Chip Stocks From Wall Street’s Top Tech Analyst

Syndax Pharmaceuticals (SNDX)

We’ll first head to the biotech space to get the lowdown on Syndax Pharmaceuticals, a company focused on finding treatments for cancer, specifically leukemias with high unmet need.

The goal of any biotech company is to get a product approved, and Syndax is getting closer to that aim, thereby offering investors an upcoming catalyst.

Syndax is developing revumenib, a highly selective oral menin inhibitor indicated to treat relapsed/refractory leukemia patients. On the back of recent positive topline data from the AUGMENT-101 pivotal trial in R/R KMT2Ar acute leukemia, under the FDA’s Real-Time Oncology Review (RTOR) program – which offers a faster and more streamlined review process for oncology drugs – the company plans to submit a New Drug Application (NDA) for revumenib in relapsed or refractory (R/R) KMT2Ar acute leukemia, including acute myeloid leukemia (AML) and acute lymphoid leukemia (ALL). Syndax intends to begin the NDA submission shortly and anticipates finalizing it by the end of the year.

Elsewhere in the pipeline, the company is also developing axatilimab, a monoclonal antibody that impedes the colony stimulating factor 1 (CSF-1) receptor, indicated to treat chronic graft-versus-host disease (GVHD). Before the end of 2023, the company expects to file a Biologics Licensing Application (BLA) for axatilimab as a treatment of patients with cGvHD.

While all this is to come, in the meantime, the stock has performed poorly in 2023, showing year-to-date losses of 50%. However, Bank of America analyst Jason Zemansky pinpoints the reason for the decline and thinks that it is not indicative of the drug’s chances of success. On the contrary, there’s plenty to be upbeat about.

“While menin inhibitor revumenib is poised for approval as early as 2024, SNDX shares been under pressure likely given safety/efficacy concerns, particularly as it relates to its competitive profile vs. rival ziftomenib,” Zemansky explained. “Rather than a ‘winner-take-all’ outcome, we think commercial dynamics will be more nuanced, which the Street has misjudged. Given first mover advantage, we forecast robust initial uptake, with each asset eventually carving out a distinct niche. With downside protection from cGVHD asset axatilimab (with Incyte), we see compelling upside for shares at current levels.”

These comments underpin Zemansky’s Buy rating on SNDX, while his $29 price target makes room for 12-month returns of a hefty 129%. (To watch Zemansky’s track record, click here)

Overall, SNDX has Wall Street’s unswerving support. A full house of 10 Buys results in a Strong Buy consensus rating. With an average price target of $35.10, the analysts expect shares to be changing hands at a 177% premium over the next 12 months. (See Syndax stock forecast)

Match Group (MTCH)

For our next BofA-endorsed stock, we’ll turn to something completely different. Match Group is a leading global online dating and relationship company that operates a portfolio of some of the most popular and widely recognized dating platforms in the world. The company has been at the forefront of the digital dating revolution, transforming the way people meet and connect with potential partners. Its impressive portfolio includes iconic brands such as Tinder, Match.com, OkCupid, and Hinge, among others.

The company’s success has been driven by its innovative approach to technology and user-centric design, making it a dominant player in the online dating industry. After implementing organizational improvements following some lackluster results, the most recently reported quarter, for 2Q23, showed the company was back on the right track. Revenue rose by 4.4% year-over-year to $829.55 million, beating the Street’s call by $18.08 million. There was similar success on the bottom line too, with EPS of $0.48, surpassing the analysts’ forecast by $0.03. Match will be reporting Q3 results next Tuesday, on October 31st.

Assessing the company’s prospects, BofA analyst Curtis Nagle thinks there’s a lot to like here and sees it as well-positioned to outperform its industry rivals.

“We expect new monetization efforts under CEO Bernard Kim, strong Hinge growth and an improvement in Tinder user trends to drive an acceleration in revenue and EBITDA expansion in 2024,” Nagle explained. “Shares are currently trading at the low-end of Match’s historic EV/EBTIDA range (~10x vs. 9x), and we see valuation as attractive relative to growth (we forecast 13% avg. EBTIDA growth in 2023-25). Despite slightly higher projected growth for rival Bumble (BMBL), we prefer MTCH for scale benefits incl. less brand concentration, the largest global dating database, AI utilization and track record for building multiple brands.”

To this end, Nagle rates MTCH shares a Buy with a price target of $52. Should the figure be met, a year from now, investors will be sitting on returns of 50%. (To watch Nagle’s track record, click here)

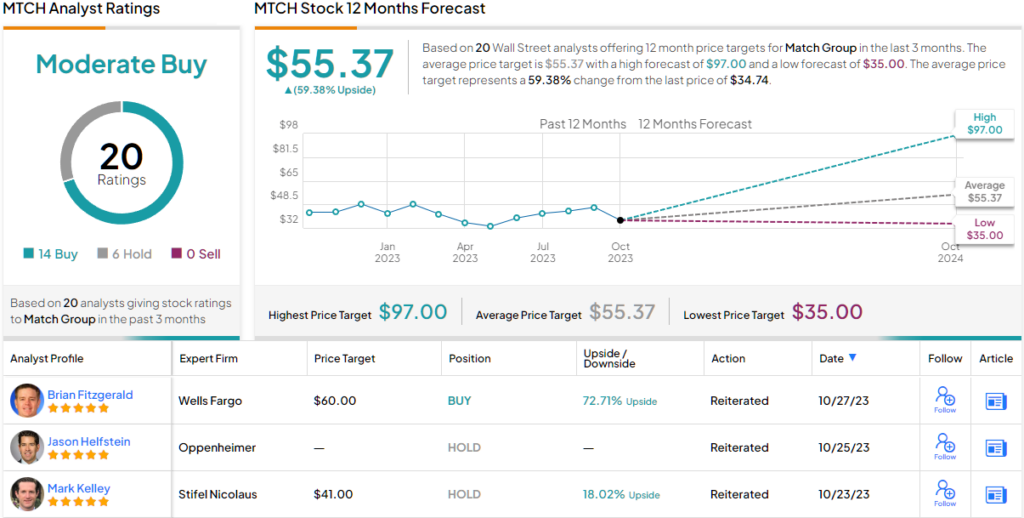

Elsewhere on the Street, the stock claims an additional 13 Buys and 6 Holds, for a Moderate Buy consensus rating. The average target stands at $55.37, suggesting shares will appreciate by 59% over the one-year timeframe. (See Match stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.