Sentiment in the stock markets is positive, but is it positive enough? The S&P 500 is up nearly 5% so far this year, and 21% from the low point it hit this past October. That puts the index into official bull-market territory, but bull markets usually produce a sense of euphoria among investors, and according to one market strategist, we’re just not quite there yet.

Savita Subramanian, chief strategist from Bank of America, has been watching market conditions carefully, and tracking the general mood among investors. “Sentiment has warmed vs. last year,” Subramanian says, “but we don’t see levels of euphoria that bull markets typically end with.” She goes on to note that Bank of America’s proprietary market gauge, the Sell Side Indicator, remains firmly in Neutral territory – and that stocks tend to bring solid returns when the indicator is Neutral.

Given this, it would seem that there is still room for this bull to run – and Subramanian’s colleagues at Bank of America have been picking out the stocks that they believe will rally in the coming months. These are shares with solid upside potential, per the BofA analysts; as much as 150% in one case. In fact, the banking giant is not the only one singing these stocks’ praises. According to TipRanks, they are both rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look and find out what the optimism is all about.

Ocular Therapeutix (OCUL)

Up first is a biopharmaceutical company focused on the development of new treatments for conditions that affect the eyes and vision. The company is working to create transformational therapies designed to take advantage of advances in drug delivery system consistency and sustainability. Ocular’s new treatments are based on Elutyx, the company’s proprietary bioresorbable hydrogel-based formulation. The gel formulation is designed specifically to allow the introduction of therapeutic agents directly to the eye without the use of injections or drops, which are current delivery systems that many patients find difficult to tolerate.

Ocular has the good fortune – not always common among cutting-edge biotherapeutic companies – of having both approved products available on the market and a high-potential medication in the late stages of the clinical trial pipeline.

Regarding marketable medications, Ocular has two products currently available. The first is ReSure, an incision sealant for use after cataract surgery. The second, Dextenza, is a drug used post-surgery to treat pain and inflammation in the eyes. Dextenza has been on the market since 2018 and is the company’s main revenue driver, generating $15 million in sales during 3Q23, the last period reported.

Regarding the pipeline, Ocular’s leading candidate is Axpaxli, formerly known as OTX-TKI. This drug candidate is under investigation for two indications, wet age-related macular degeneration (wet AMD), and diabetic retinopathy. The more advanced of these is the wet AMD study; Axpaxli is the subject of the Phase 3 SOL trial, scheduled to start screening subjects during 1Q24. In an announcement last month, it was revealed that the FDA had agreed to a modification of the Special Protocol Assessment (SPA) Agreement for the SOL trial.

Ocular’s Axpaxli program has caught the attention of industry analysts, including Bank of America’s Tazeen Ahmad, who lauds the drug candidate’s potential to redefine treatment paradigms for wet AMD.

“We think that Axpaxli, the company’s lead asset, has the potential to provide a highly differentiated profile in the treatment of wet age-related macular degeneration (wAMD) offering infrequent dosing (~9 months) vs current SoC (6-8wks), which is a key area of unmet need. In our view, the wAMD market is well-established and large enough to support multiple players. wAMD could represent an attractive commercial opportunity for OCUL,” Ahmad opined.

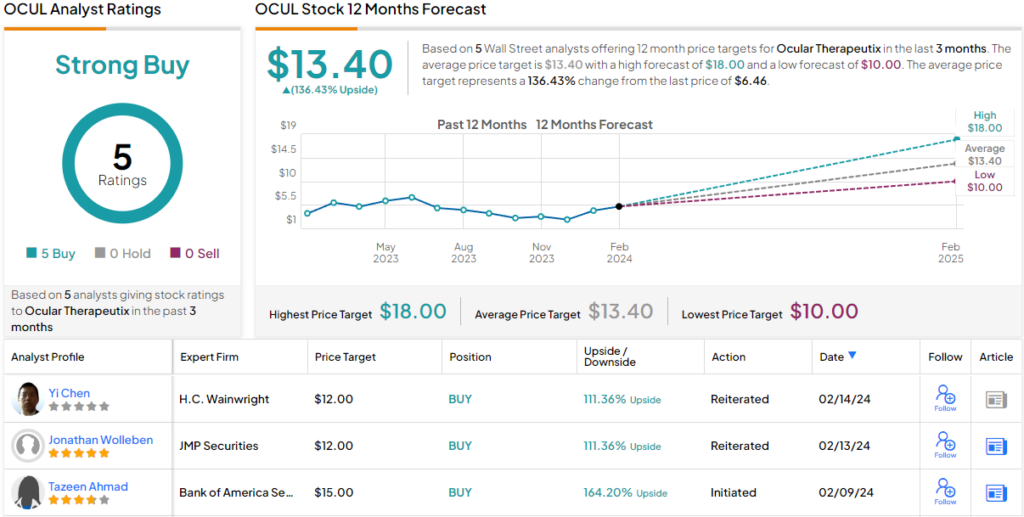

Looking ahead, Ahmad sees fit to rate OCUL shares a Buy – and her $15 price target points toward a high 164% upside potential for the next 12 months. (To watch Ahmad’s track record, click here)

The Strong Buy consensus here is unanimous, based on 5 positive reviews, showing that the Street is clearly upbeat on the stock. The average price target, at $13.40, suggests a 136% one-year gain from the current trading price of $5.68. (See Ocular’s stock forecast)

Triumph Group (TGI)

For the second stock today, we’ll shift to the aerospace industry. Triumph Group is an engineering company, offering services, structures, systems, and support to both civilian and military aircraft operators. The company provides support for maintenance and upkeep, aircraft modifications, and overhauls, and works with aircraft of all types, from airline passenger jets to Army transport helicopters. Triumph is a standout in the aviation world, as there are few companies anywhere capable of providing these necessary services.

Triumph Group has over 4,800 employees working out of 28 locations in 8 countries. This network collaborates with militaries, large commercial airlines, smaller regional carriers, passenger and freight carriers, and original equipment manufacturers of both planes and components. Triumph has the knowledge and expertise to work with any system of an aircraft, from fuel systems to hydraulic pumps. The company generated well over $1.3 billion in annual revenue during its last complete fiscal year.

Several recent news items point toward continued success for Triumph Group. The first, in December, concerned the sale of the company’s Product Support business to AAR Corporation. The transaction, expected to close during 1Q24, is valued at $725 million and is expected to bring net after-tax proceeds of $700 million.

More recently, in February, Triumph announced two important contracts. One is for an airline operator in the Asia-Pacific area. This is a five-year contract for the provision of MRO services (maintenance, repair, overhaul) for CF6-80C2 engine nacelles across multiple Boeing airliner fleets.

The second recent contract announcement was with the US Army. This contract is for the upgrade of the EMC32T Hydraulic Metering Assembly (HMA) fuel control on the T55 engines on the Army’s fleet of CH-47 Chinook heavy-lift transport helicopters. The contract will run from 2024 through 2028, and under its terms, Triumph will upgrade over 100 of the engines. It’s important to note here that Triumph was the original designer and builder of the fuel control system, making the company uniquely qualified to carry out this upgrade program.

Also this month, Triumph released its financial results for fiscal 3Q24, which ended on December 31, 2023. The company’s top line came to $285 million. This was up 9% year-over-year, although it missed the forecast by $83 million. The non-GAAP EPS figure came to a net loss of 16 cents per share for the quarter. This loss was 30 cents per share deeper than had been expected.

For analyst Ronald Epstein, in his coverage of this stock for Bank of America, the key point is clearly the Product Support Group transaction, and its impact on the shares. Epstein writes of Triumph, “We think the recent sale of its Product Support Group for $725 million is a transformational event for the company. The divestiture should reduce TGI’s current Net Debt/ EBITDA from 7.6x to 4.9x and push net leverage levels to under 3x in the next 12-18 months. While the stock has surged more than 20% since the deal was announced, we see further upside to current higher valuation levels. A more focused portfolio and stronger balance sheet supports TGI trading in line with peers.”

Going forward from this, the BofA analyst rates TGI stock a Buy, and sets a $21 price target that implies a 40% one-year upside potential. (To watch Epstein’s track record, click here)

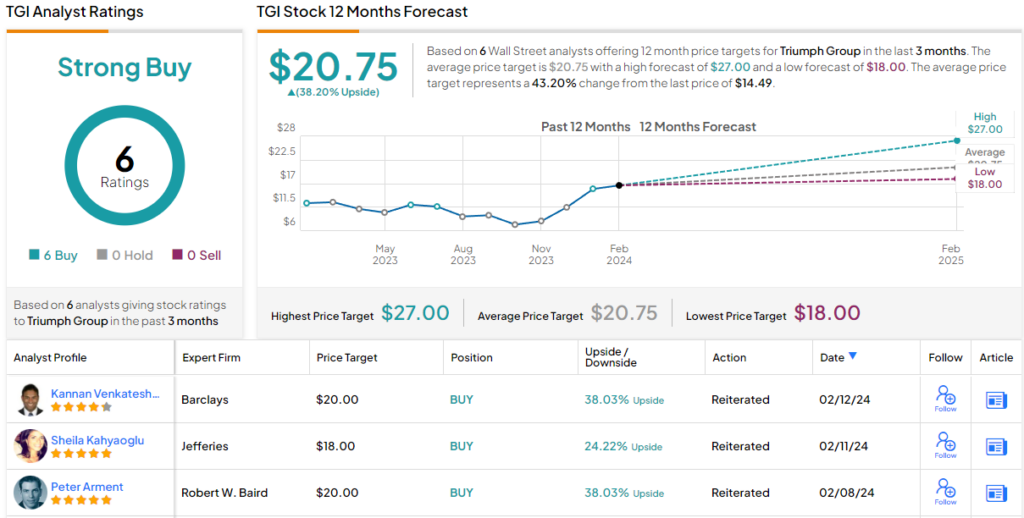

Overall, there are 6 recent analyst reviews of this stock, and they are all positive, making the Strong Buy consensus rating unanimous. The shares are trading for $15 and their $20.75 average price target suggests an upside of 38% on the one-year horizon. (See TGI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.