Bank of America (BAC) is a good company, trading at a reasonable price.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Founded in 1904, Bank of America has been operating for over 100 years and has banking offices all around the country. The company is one of the most trusted banks, with 66 million consumer and small business clients served by 4,200+ banking offices. Bank of America provides many products and services to consumers, businesses, and institutional investors.

The Fed is raising rates to control inflation. The increase, the first by the Fed in three years, comes as it seeks to more effectively manage inflation. There are also six interest rate hikes coming up.

The financial sector has been just as sensitive to major changes in the economy over the last few years, but it has been especially sensitive to changes in interest rates.

At higher interest rates, the profit margins for banks, insurance firms, brokerage firms, and money managers will likely expand. Higher rates give these entities a lot of room to maneuver.

If the national bank increases rates by another seven times, banks with outstanding variable rate loans expect a huge boost in net interest income. Consequently, Bank of America will benefit massively since a large section of its portfolio is variable rate loans. I am neutral on the stock.

Net Beneficiary of Interest Rate Hikes

Bank of America is about to experience significant jumps in profit due to the increase in interest rates. That is because BAC is the most sensitive to interest rate hikes among the big banks.

Alastair Borthwick, the bank’s financial officer, recently noted on the company’s recent earnings call that the bank is seeing significant growth in its balance sheet. Additionally, it is twice as sensitive to changes in interest rates than when interest rates previously went up.

Furthermore, Bank of America has greatly improved its deposit base, which will allow it to increase margins when rates go up.

Based on the bank’s plans, the company is poised to take advantage of new market conditions. It anticipates holding expenses flat for this year, which should give it an edge over other competitors.

Digital Growth

Consumer demand for the best experience possible is fueling a digital transformation across the banking industry.

As one of the nation’s major financial institutions, Bank of America has witnessed how digital engagement rapidly grew for their customers. The Bank of America app has made 85% of its deposit transactions in recent years.

Bank of America has been making a lot of investments in tech. This translates into more users, which is a good indication of their product’s success.

Bank of America reported a 24% decrease in cash and checks in 2021. Brian Moynihan, BAC CEO, has noted that this demonstrates the shift to digital offerings.

It had 2 million more active digital banking customers in the fourth quarter than in previous periods, and 70% of its households actively used digital platforms. Furthermore, the company reported 1.5 million digital sales, up 46% year-over-year.

Rewarding Shareholders

Bank of America is a financial institution that has been around for a long time. It has a history of paying out dividends, and the stock repurchases are impressive.

When we look for a dividend stock, we want to find companies with both the power and the financial stability to sustain and increase their dividends.

BAC increased its quarterly dividend to 21 cents per share as of the third quarter, up 17%. The company’s regulatory stress testing showed it could handle the pressure.

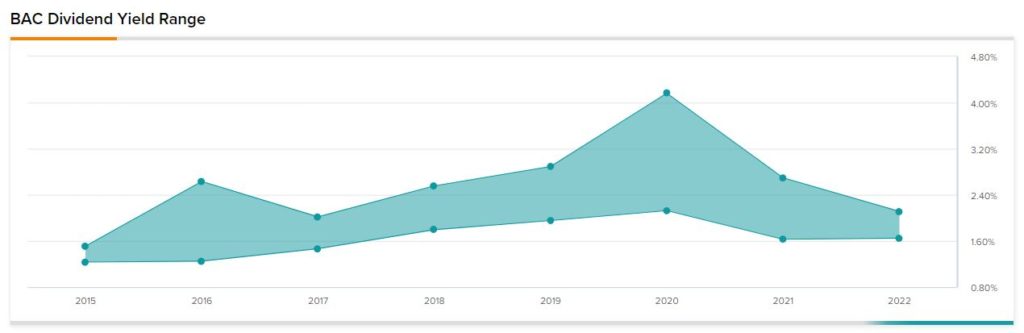

Bank of America sports a dividend yield of 1.85%, which is quite close to the industry average of 1.63%.

As you can see in this chart, the dividend yield suffered during the pandemic, but it’s now stable. The payout is also 22.67%, which is very conservative and easily covers the company’s dividend.

In addition, BAC has a strong history of share repurchases. Bank of America announced in April that it is planning to buy up to $25 billion worth of its own shares from the open market. So far, $14 billion of shares have been purchased by the end of Q3 2021.

Wall Street’s Take

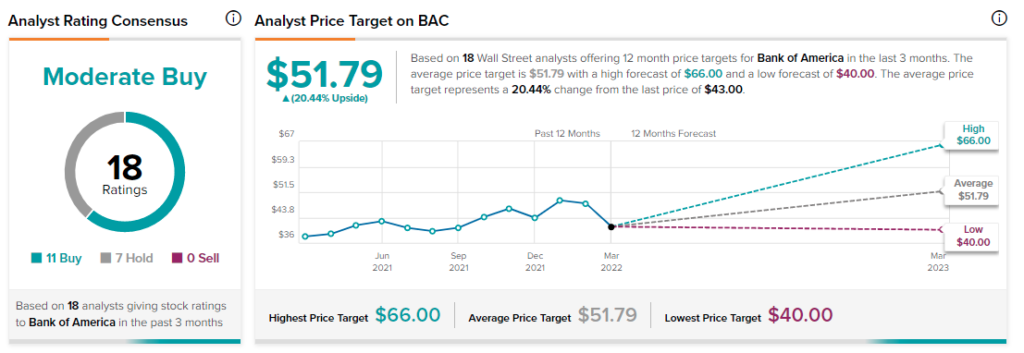

Bank of America has been trading at a discount for the last few months due to the larger macroeconomic factors and geopolitical issues at play.

Shares of the multinational investment bank sport a Moderate Buy consensus rating, based on 11 Buy ratings and seven Hold ratings in the last three months.

The average BAC price target is $51.79, which implies upside potential of 20.4%.

Bottom Line

Moynihan has done a stellar job at transforming the Bank of America under the tumultuous times of financial crisis. The bank went from one of the organizations struggling to maintain viability to a leaner organization with excellent asset quality, and state-of-the-art technology.

According to the financial report released by Bank of America, its status is extremely healthy and strong for the future. If you add the dividends and strong prospects, you have the recipe for a lot of success.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.