Considering his status, only a brave financial prognosticator would tell investors to ignore some advice from Warren Buffet. That, however, is what Bank of America’s Savita Subramanian currently recommends investors should do.

While the investing sage has often said that the best strategy for retail investors is to purchase and hold an index fund that keeps track of the S&P 500, Subramanian, who is the head of US equity and quantitative strategy at BofA, does not think that is the best way forward right now.

Funds tracking the bellwether index remain “overcrowded,” and the large-cap stocks’ best days are in the rear-view mirror, she says. What investors really should do to maximize returns is to lean into small-cap value stocks.

“I think what you want to do for the long haul is buy small-cap value [and] set it and forget it,” the strategist opined. “We’re at a good point right now where the small-cap value benchmark is at record cheapness versus large-caps.”

With this in mind, we dipped into the TipRanks database and pulled out two names that fit a certain profile; both are small-cap members of the Russell 2000 index and both are rated as Strong Buys by the analyst consensus. Not to mention substantial upside potential is on the table here.

RAPT Therapeutics, Inc. (RAPT)

Small cap stocks with big upside potential will naturally lead us to the biotech sector. With a market cap of just under $990 million, RAPT Therapeutics is one such name. The clinical-stage biopharma’s goal is a big one; to eradicate inflammatory and cancer diseases within our lifetime. This it intends to do by leveraging its proprietary drug discovery engine and develop small molecules that target the chemokine receptor CCR4 in both oncology and inflammatory conditions.

As with any small biotech company, it’s the pipeline that matters, and so far two of the company’s drug candidates have advanced to clinical development.

On the inflammation side, the lead candidate is RPT193; In the Phase 1b study in patients with atopic dermatitis, RPT193 displayed a clinically meaningful improvement in a number of exploratory endpoints. The drug is currently undergoing testing in the ongoing Phase IIb study, with a data readout anticipated in 2H23.

The lead oncology drug candidate, FLX475, is in development for various tumors and has now advanced to a two-stage Phase II study in which it is being assessed as both monotherapy and combo therapy (with Merck’s Keytruda (pembrolizumab)).

For Guggenheim analyst Yatin Suneja, the bull-case rests mainly on the potential of RPT193. He writes: “With solid biological rationale, a favorable oral profile with promising initial Phase Ib data and a relatively low bar for success in Phase IIb (does not need to be as potent as Dupi), we are optimistic for ‘193’s success in atopic derm (we expect Phase IIb data in 2H23; a key value-driving potential catalyst for the stock) and asthma (Phase IIa starting in 1Q23).”

“If approved,” Suneja went on to add, “we estimate ~$2B in global peak sales for RPT-193 in atopic dermatitis (~$1.2B risk-adjusted), with additional upside potential driven by success in asthma and additional Th2 indications for ‘193 and by additional pipeline assets coming out of their discovery program.”

Accordingly, based on the above, Suneja rates RAPT shares a Buy, while his $55 price target makes room for one-year gains of ~90%. (To watch Suneja’s track record, click here)

All of Suneja’s colleagues agree with his bullish thesis; based on a full house of Buys – 7, in total – the stock earns a Strong Buy consensus rating. Going by the $43.50 average target, the shares are set to generate 12-month gains of ~50%. (See RAPT stock forecast)

Kura Oncology, Inc. (KURA)

We’ll stay in the biotech segment for our next small-cap stock. As the name suggests, Kura Oncology is another company targeting therapies for cancer; this it does by harnessing the power of precision medicines to target cancer cells selectively. The aim is to not only increase clinical benefit but to also focus on areas where the unmet need is greatest.

The pipeline’s candidates include treatments for solid tumors and blood cancers. The leading candidate is Ziftomenib (KO-539), a potent and selective menin inhibitor, which right now is being assessed in a Phase 1b clinical study (KOMET-001) for patients with relapsed/refractory acute myeloid leukemia (including patients with NPM1 mutations or KMT2A rearrangements).

Tipifarnib, the company’s second candidate, is a potent, selective and orally bioavailable farnesyl transferase inhibitor (FTI). This drug has been given Breakthrough Therapy Designation for the treatment of patients with HRAS mutant HNSCC. A Phase 1/2 study (KURRENT-HN) of tipifarnib together with the PI3Kα inhibitor alpelisib, to address bigger genetic subsets of HNSCC patients, is currently taking place. A Phase 1 study (KURRENT-LUNG) of tipifarnib combined with osimertinib in treatment-naïve, locally advanced/metastatic, EGFR mutant non-small cell lung cancer has also been initiated.

The company also recently announced that the FDA has given the all-clear for the Investigational New Drug (IND) application of KO-2806, Kura’s next-gen farnesyl transferase inhibitor (FTI), indicated to treat advanced solid tumors. The company expects to kick off a Phase 1 study in 3Q23.

Kura’s pipeline has attracted the attention of Stifel’s Bradley Canino. While the analyst highlights the potential pitfalls ahead, he sees reason to be optimistic.

“We expect ziftomenib to be approved 1 year after Syndax in R/R NPM1m AML, which negatively impacts our initial ziftomenib forecasts,” Canino said. “However, we believe Kura has the ability to equalize its valuation and sales over time with the rapid development of ziftomenib combinations. We see first combination data, potentially in 2H23, as lifting the overhangs on KURA’s stock about differentiation syndrome and competitive timelines. We still believe KURA’s farnesyl transferase inhibitor (FTI) program is a small part of the valuation and requires patience, but are optimistic that early proof-of-concepts can be generated with select targeted therapies.”

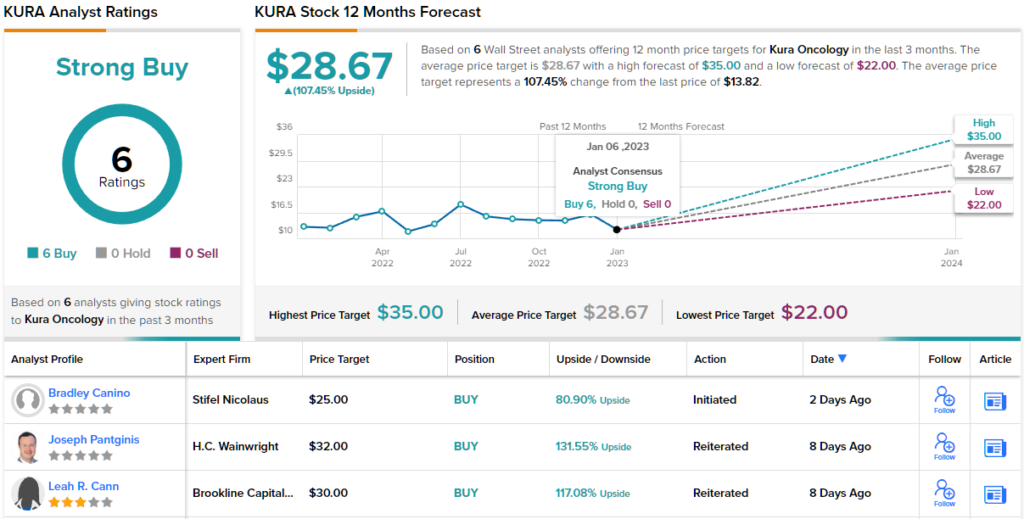

So, how does this all translate to investors? Canino rates KURA shares a Buy, while his $25 price target implies ~81% upside from current levels. (To watch Canino’s track record, click here)

This is another stock getting the Street’s full support; with a total of 6 Buys, the analysts’ view is that KURA is a Strong Buy. The average target is an exuberant one; at $28.67, the figure makes room for one-year share appreciation of 107%. KURA has a market cap just under $950 million. (See KURA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.