Amid the bank crisis, investors received a rude awakening that their wealth may suddenly evaporate. As a result, despite significant vagaries about future monetary policy, asset streaming specialist Wheaton Precious Metals (NYSE:WPM) may represent an enticing opportunity. Fundamentally, the company provides indirect and convenient exposure to the gold market. I am bullish on WPM stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What WPM Does and Why Its Attractive

Unlike other precious metals enterprises, Wheaton focuses on streaming. This business model represents an agreement whereby a streaming firm purchases part of or all of a mining entity’s metals production at a predetermined price. In exchange, the streaming company provides upfront capital to the miner. Though such arrangements may limit ultimate upside potential, they provide revenue predictability.

Adding to the burgeoning interest in WPM stock stands the upwardly mobile price of gold. Gold recently poked its head above the $2,000/oz mark before pulling back slightly. Enticingly, in the past week, gold has gained 7.3%. In contrast, the benchmark S&P 500 index (SPX) lost about `1.5% during the same period.

While gold offers universally recognized intrinsic value – a critical attribute amid this banking sector crisis – it’s dense and heavy. In addition, lugging around gold bricks represent an inconvenient form of wealth protection. Fortunately, investing in WPM stock provides a more sensible approach for investors not interested in the doomsday bunker mentality.

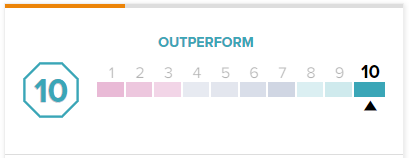

Aiding the bull case, on TipRanks, WPM stock has a ‘Perfect 10’ Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

WPM Stock Aligns with What’s “Real”

One of the scariest components of the recent failures of two major financial institutions stems from the fact that bank runs symbolize incidents that happened in the far past or to nations with underdeveloped financial architectures. They’re not supposed to happen here. In addition, the arbitrary nature of the implosions rattled investors. Fortunately, a gold-focused investment like WPM stock may mitigate concerns due to its exposure to “real” assets.

Specifically, the U.S. government responded immediately to the bank failures, guaranteeing depositors their money back. While this move helped instill confidence in the financial system, it also worried investors of banking enterprises. That’s because shareholders of the two major failed banks will not receive governmental support.

In fairness, under a standard liquidation process, common shareholders typically stand last in line to receive compensation if anything remains. However, the bank runs that occurred seemingly happened overnight. Retail investors had little warning that they would lose everything.

What separates the underlying asset of WPM stock centers on its hard asset profile. Essentially, it’s impossible to have a bank run on gold. It’s a physical commodity. While it might not post earnings, hire workers, or pay dividends, it stands as an emergency asset or currency.

Historically, of course, gold long represented a hedge against inflation. Moving forward, it could be a hedge against broader economic turmoil. Again, while gold may be a zero-yielding asset, what good is a dividend stock if the issuing enterprise utterly collapses?

Sure, it’s a draconian way of looking at gold. However, that’s where people are at this juncture.

Wheaton Offers Solid Financials

Another factor benefiting WPM stock centers on its robust financials. For example, Wheaton benefits from significant strengths in its balance sheet. Aside from a cash-rich position, the company’s equity-to-asset ratio stands at 0.99 times, outboxing the sector median value of 0.83 times. Also, its Altman Z-Score (a solvency metric) hit triple digits, indicating extremely low bankruptcy risk.

Operationally, Wheaton commands a three-year EBIT growth rate of 60.4%, higher than the 14.7% average for the materials sector. As well, its book value growth rate during the same period pings at 8.8%, outpacing 62.58% of its peers.

Finally, the company benefits from strong profitability metrics. In particular, its net margin is a whopping 63.19%, outpacing almost 96% of the industry. And while it’s not the most generous enterprise in terms of passive income, Wheaton does offer a dividend yield of 1.26%.

Is WPM Stock a Buy, According to Analysts?

Turning to Wall Street, WPM stock has a Strong Buy consensus rating based on nine Buys, one Hold, and zero Sell ratings. The average WPM stock price target is $48.01, implying 4.55% upside potential.

The Takeaway: It’s Time for WPM Stock to Shine

Generally speaking, gold-related investments haven’t performed well because of their volatility. However, with the banking sector demonstrating that its individual members can similarly go to zero without warning, the yellow metal looks very interesting. For Wheaton, the advantage centers on its business predictability, allowing comfortable and credible exposure to gold. Therefore, WPM stock looks like a Buy.