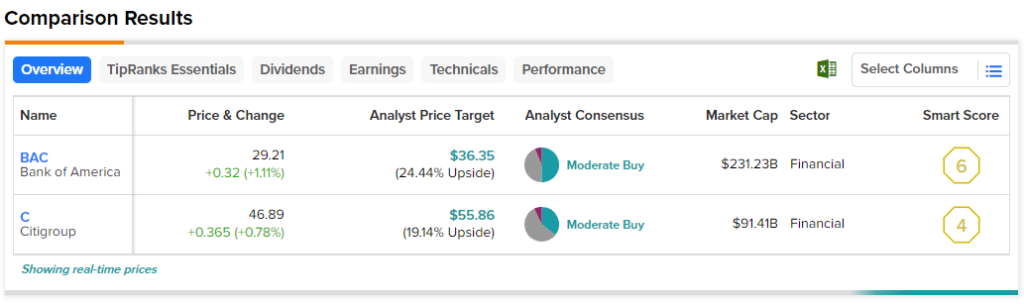

In this piece, I evaluated two big bank stocks, Bank of America Corp. (NYSE:BAC) and Citigroup Inc. (NYSE:C), using TipRanks’ comparison tool to determine which is better.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Citigroup has held up much better than Bank of America, gaining 3.5% year-to-date to bring its 12-month performance to about flat. Meanwhile, Bank of America is off 12% year-to-date, extending its 12-month decline to 16%.

Traditionally, recessions used to be very harsh for bank stocks because consumers would be less able to repay their loans, and interest rates would decline, squeezing banks’ revenues. However, big banks’ staying power and the institution of “too big to fail” measures after the Great Financial Crisis in 2008 have made them a formidable force capable of withstanding a recession.

Thus, some investors have come to view big bank stocks as somewhat recession-resistant. In fact, Wells Fargo (NYSE:WFC) said toward the end of last year that some recession-ready bank stocks could rally 50% in 2023.

Additionally, the Federal Reserve has emphasized its intention to hike interest rates until inflation reaches its 2% target — no matter what happens in the economy. As a result, some investors like BlackRock (NYSE:BLK) expect the Fed to hike the U.S. economy right into a recession.

The delay in cutting interest rates further supports big banks at a time when it looks like a recession is just around the corner. Finally, the regional banking crisis is having somewhat of an impact on the big banks even though they face little danger. Thus, the recent sell-off may present some buy-the-dip opportunities, but some big banks look better than others, so let’s examine.

Bank of America (NYSE:BAC)

In February, Bank of America approached $50 a share, coming close to its peak in the leadup to the 2008 financial crisis. However, even after its recent decline, it looks fairly valued based on several key multiples. This suggests a neutral view might be appropriate, although it’s still a worthy addition to a dividend portfolio.

The bank sector is trading at a price-to-earnings (P/E) ratio of 8.3, versus its three-year average of 12.1 and at a price-to-sales (P/S) ratio of 3.1 versus its three-year average of 2.2. Meanwhile, Bank of America is trading at a P/E of 8.6 and a P/S of 2.4, suggesting it’s fairly valued.

However, with bank stocks, there’s another multiple that should be considered, which is the price/book ratio. A price/book ratio of 1.0 suggests the bank is fairly valued, and Bank of America’s price/book is about 0.9, also suggesting a fair valuation.

Bank of America’s dividend yield of 2.92% is solid, making it an attractive dividend pick, all else notwithstanding. However, insiders dumped over $60 million worth of the bank’s shares over the last three months, a major red flag calling for caution.

What is the Price Target for BAC Stock?

Bank of America has a Moderate Buy consensus rating based on eight Buys, seven Holds, and one Sell rating assigned over the last three months. At $36.35, the average Bank of America stock price target implies upside potential of 24.4%.

Citigroup (NYSE:C)

Many saw Citigroup as the poster child of the Great Financial Crisis due to its aggressive risk-taking, so investor sentiment is down as a recession looks imminent. However, several key multiples suggest it could be undervalued. Thus, a bullish view looks appropriate, especially considering its attractive dividend yield of 4.3%.

Citigroup is trading at a P/E multiple of 6.4, a P/S multiple of 1.3, and a price/book multiple of 0.5, all of which suggest it could be undervalued. Given its reputation for risk-taking during turbulent economic periods, it’s understandable that Citigroup’s mean price/book ratio over the last five years is only 0.7 instead of being closer to 1.0.

However, its price/book also suggests undervaluation, especially considering management’s cautious tone, which runs counter to the bank’s aggressive pre-financial-crisis tone. Citigroup hasn’t come anywhere close to the over-$500-a-share price it enjoyed before the financial crisis, so its stock looks less risky compared to Bank of America.

While it could take some time for the Street to come around on Citigroup, its attractive dividend yield makes it worth the wait.

What is the Price Target for C Stock?

Citigroup has a Moderate Buy consensus rating based on five Buys, eight Holds, and one Sell rating assigned over the last three months. At $55.86, the average Citigroup stock price target implies upside potential of 19.2%.

Conclusion: Neutral on BAC, Bullish on C

In the long run, Bank of America and Citigroup both have staying power sufficient enough to withstand a recession. However, valuation multiples give Citigroup the edge, with the caveat that it may take some time for Wall Street to recognize the changes the bank’s post-financial-crisis management has made.