The Boeing Company (NYSE:BA), Raytheon Technologies Corporation (NYSE:RTX), and Lockheed Martin Corporation (NYSE:LMT) are the three prominent defense players in the United States that could intrigue prospective investors amid rising geopolitical tensions across the globe. Interestingly, U.S. politicians have traded (bought and sold) in these companies in the past three months.

It is worth noting that these defense players might gain from the U.S. Government’s commitment to sell defense products and technologies worth $1.09 billion to Taiwan. This decision was taken after Democrat and Representative California Nancy Pelosi visited the Asian island in August 2022.

On Friday, the United States Department of State revealed that the $1.09 billion deal would include the sale of $355 million worth of Harpoon missiles (air-to-sea), $85 million worth of Sidewinder missiles (air-to-air), and $655 million worth of logistics support to Taiwan. The logistic package would help strengthen the surveillance radar system of Taiwan against China.

In this article, we will discuss how Boeing, Raytheon, and Lockheed Martin might benefit from this deal. Also, we will take a look at the trading activities of some U.S. politicians and take into account analysts’ views on these stocks. A consolidated chart of the three stocks prepared using TipRanks’ Stock Comparison tool is provided below.

The Boeing Company (NYSE:BA)

The Chicago, IL-based company has expertise in making anti-ship missiles (Harpoon), military aircraft, unmanned vehicles, satellites, defense systems, and other products and technologies.

In the past three months, shares of this $90.15-billion company were purchased twice by a Representative of California, Alan Lowenthal. Both the Buy transactions of the Democrat were valued within the $1,000-$15,000 range.

Is BA Stock a Buy Now?

If you consider U.S. politicians’ interest and the optimism of analysts on TipRanks, BA stock seems to be a good investment option for now. The company has a Strong Buy consensus rating based on 11 Buys and two Holds.

BA’s average price target of $213.33 represents 40.52% upside potential from the current level. The highest price target is $281, and the lowest is $170. Over the past three months, shares of Boeing have grown 9% to close at $151.82 on Friday.

Raytheon Technologies Corporation (NYSE:RTX)

The $129.3-billion company is known for its missiles, especially Sidewinder missiles, and defense radar systems and technologies. Headquartered in Waltham, MA, the company’s other operations include providing services to aircraft manufacturers, designing aviation systems, and supply of aircraft engines.

U.S. politicians, including Kathy Manning (a Representative of North Carolina), Kevin Hern (a Representative of Oklahoma), and Diana Harshbarger (a Representative of Tennessee), have purchased shares of Raytheon Technologies in the past three months.

While Democrat Kathy Manning bought 11 to 165 RTX shares for $1,000 to $15,000 in July, Republicans Kevin Hem and Diana Harshbarger conducted one Buy trade each in June. Both transactions were valued within the $1,000-$15,000 range.

Is RTX a Good Stock to Buy?

With solid prospects, Raytheon Technologies, which is already in the good books of U.S. politicians, could be an attractive investment option for prospective investors.

In addition to U.S. politicians, analysts on TipRanks are also optimistic about the prospects of Raytheon Technologies. Notably, the company has a Strong Buy consensus rating based on seven Buys and one Hold.

RTX’s average price forecast stands at $112, which mirrors 27.87% upside potential from the current level. The highest price target is $120 while the lowest is $98. Shares of Raytheon Technologies have declined 9.4% in the last three months. Raytheon’s last closing price was $87.59.

Lockheed Martin Corporation (NYSE:LMT)

Lockheed Martin’s surveillance systems, missiles, military aircraft, and defense technologies are very popular. The Bethesda, MD-based company is also known for its unmanned aerial vehicles, helicopters, and cyber solutions.

Democrat Kathy Manny purchased three to 38 shares of LMT for $1,000 to $15,000 in July. Manny also conducted one Sell trade, valuing in the range of $1,000-$15,000, in the same month.

Further, Republicans Kevin Hem and Diana Harshbarger bought shares of Lockheed Martin in June. The value of both the Buy trades was in the $1,000-$15,000 range.

Meanwhile, Deb Fischer, a Senator from Nebraska, sold LMT shares in June. The Republican’s transaction was worth $50,000-$100,000.

Is LMT Stock a Buy or Sell?

For now, a wait-and-watch approach could be a good idea for investors interested in LMT stock.

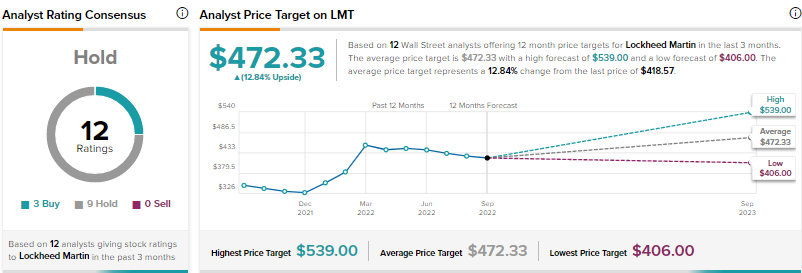

On TipRanks, analysts have a Hold consensus rating on the stock, which is based on three Buys and nine Holds. Also, U.S. politicians conducted both Buy and Sell trades on the stock in the past three months.

LMT’s average price prediction of $472.33 suggests 12.84% upside potential from the current level. The highest price target is $539 and the lowest price target is $406. In the past three months, shares of LMT have declined 5%. Lockheed Martin closed at $418.57 on Friday.

Concluding Remarks

With the defense market worth trillions of dollars and rising political tensions among a few nations, the long-term prospects of Boeing, Raytheon Technologies, and Lockheed Martin seem to be solid. Also, all three defense companies sport a Smart Score of ‘9 out of 10,’ which mirrors their potential to outperform the broader market. Investors willing to gain exposure to the U.S. defense industry could take tips from the trading activities of U.S. politicians.

Read full Disclosure