Major chip stocks have rallied this year due to the generative artificial intelligence (AI) boom. Advanced chips are needed for developing and training AI models. While Nvidia (NASDAQ:NVDA) is seen as the frontrunner in the AI race, other chip companies are working on innovative products that can capture growth opportunities in the AI market. We used TipRanks’ Stock Comparison Tool to place Broadcom (NASDAQ:AVGO), Nvidia, and Intel (NASDAQ:INTC) against each other to find the best chip stock, as per Wall Street analysts.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Broadcom (NASDAQ:AVGO)

Broadcom shares have rallied 51% year-to-date, as the company is expected to benefit from the generative AI wave. However, the company’s Q4 FY23 revenue growth guidance of 4% disappointed investors, especially after Nvidia issued a market-crushing outlook.

Moreover, a report by The Information that tech giant Alphabet (NASDAQ:GOOGL, GOOG) is thinking about ditching Broadcom as its supplier of AI chips as early as 2027 further impacted investor sentiment. The report also said that Marvell Technology (NASDAQ:MRVL) could replace AVGO as one of Google’s AI chip development partners.

Despite all this noise, Wall Street analysts remain bullish on Broadcom, as they see it as the next big semiconductor play to immensely gain from AI-induced demand, trailing only Nvidia. The company expects generative AI to account for over 25% of its semiconductor revenue in FY24, up from 10% in FY22.

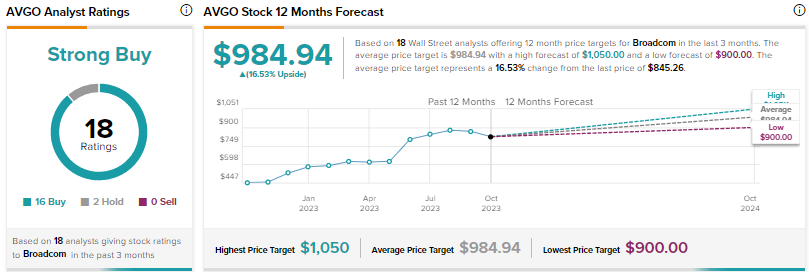

What is the Price Target for AVGO?

Last month, Truist Financial analyst William Stein reiterated a Buy rating on AVGO stock and raised the price target to $995 from $942. The analyst noted that while the company’s traditional chip business is stabilizing, its AI revenue is accelerating and supporting a more stable and “growthy” model.

Stein thinks there is more room for upside to both Broadcom’s fundamentals and the stock over time, given continued dividend growth, potential M&A benefits, and revenue growth looking possibly higher than the mid-single-digit level.

With 16 Buys and two Holds, Broadcom stock earns a Strong Buy consensus rating. At $984.94, the average price target implies 16.5% upside.

Nvidia (NASDAQ:NVDA)

Nvidia shares have skyrocketed 213% so far this year, as the semiconductor giant is seeing a spike in demand for its graphics processing units (GPUs) from companies that are aggressively pursuing their generative AI ambitions.

The company’s Q2 FY24 revenue jumped 101%, while adjusted EPS surged 429%, mainly driven by a 171% rise in the data center segment’s revenue. The data center segment includes the HGX platform, which is witnessing robust demand from cloud services providers and large consumer internet companies like Amazon (NASDAQ:AMZN), Alphabet, Meta Platforms (NASDAQ:META), and Microsoft (NASDAQ:MSFT).

Looking ahead, the company expects its Q3 FY24 revenue to increase 170%, as clients are seeking the company’s advanced GPUs to build and run AI applications.

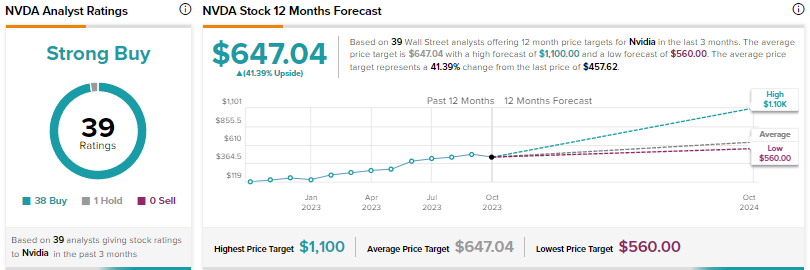

Is Nvidia a Good Stock to Buy Now?

On October 2, Goldman Sachs analyst Toshiya Hari added Nvidia to its Conviction Buy List. Hari views the company as the principal “shovel supplier” in the AI wave. Also, the analyst believes that NVDA will maintain its position as the “accelerated computing industry standard for the foreseeable future given its competitive moat and the urgency with which customers are developing and deploying increasingly complex AI models.”

Wall Street’s Strong Buy consensus rating on NVDA stock is based on 38 Buys and one Hold. The average price target of $647.07 implies 41.4% upside.

Intel (NASDAQ:INTC)

Intel shares have risen 37% year-to-date, as investors are appreciating the company’s turnaround efforts. After two consecutive quarters of losses, the company returned to profitability in the second quarter despite continued weakness in the top line.

Persistent weakness in the PC market has significantly impacted Intel’s revenue. Moreover, cloud companies and several other enterprises are more interested in securing graphics processors for generative AI than Intel’s central processors. Against a tough demand backdrop, the company delivered improved earnings driven by its cost reduction efforts.

The company is taking several initiatives to turn around its business. Earlier this week, the company announced its intention to separate its Programmable Solutions Group (PSG) into a standalone business. The PSG unit, which makes programmable chips for defense, telecommunications, and other end markets, will eventually be spun out through an IPO. The move follows the company’s Mobileye (NASDAQ:MBLY) spin-off last year.

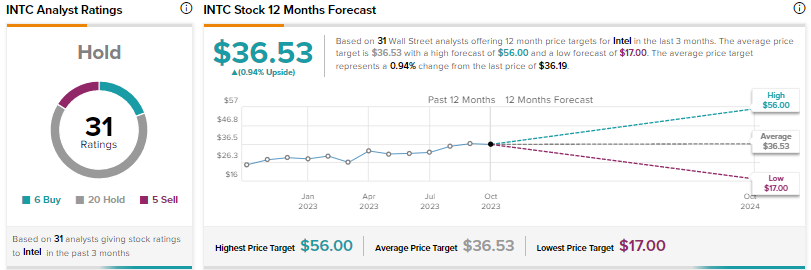

Is Intel a Buy, Sell, or Hold?

While several analysts cheered Intel’s PSG announcement, Barclays analyst Blayne Curtis is skeptical about it and reiterated a Hold rating on the stock on October 4. “If it’s about accountability, then it’s unclear why PSG was folded into [Data Center and AI Group] when times were good during the pandemic and it’s being broken off when the business is turning negative,” said Curtis.

Curtis said that he appreciates Intel’s turnaround efforts but remains on the sidelines as he is doubtful about the company’s ability to execute on its roadmap. Further, he expects some downside to the Q4 2023 and Q1 2024 estimates.

Wall Street’s Hold consensus rating on INTC stock is based on six Buys, 20 Holds, and five Sells. The average price target of $36.53 indicates that the stock could be range-bound at current levels.

Conclusion

Analysts are bullish on Nvidia and Broadcom, while they are sidelined on Intel. Nvidia has outperformed Broadcom and Intel so far this year and yet Wall Street expects the highest upside in NVDA stock from current levels. The company’s advanced GPUs and innovative technology are expected to drive continued strength in its performance.