Here’s a technology stock pick for enterprising investors who can follow the data instead of giving into fear and crowd-think. Autodesk (NASDAQ:ADSK) stock got slammed today, and you might wonder whether there’s something seriously wrong with the company. Yet, a clear-minded analysis will show that Autodesk is doing just fine, so I am definitely bullish on ADSK stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Headquartered in San Francisco, Autodesk provides software for computer-assisted design, including 3D applications. As we’ll discover, the experts on Wall Street are fairly optimistic about Autodesk’s future prospects.

On the other hand, short-term stock traders aren’t too pleased with Autodesk today. Still, when you relax and just stick to the facts, you might find opportunities where other investors only see problems.

Autodesk Stock Hits Hard Resistance Again

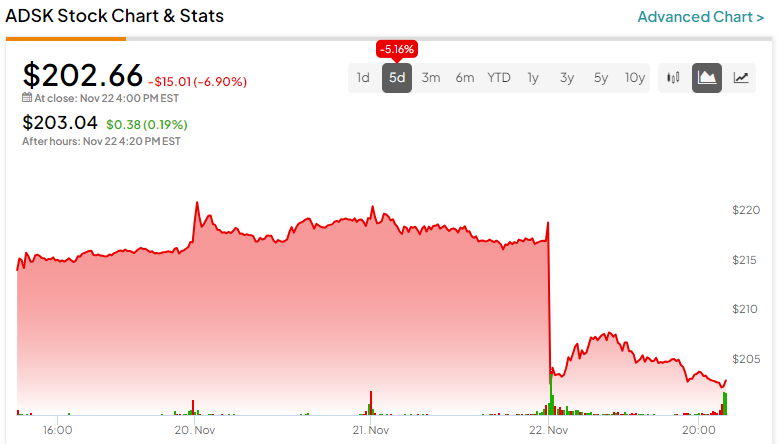

Perhaps traders should have seen today’s share-price drop coming. After all, Autodesk stock has had a tendency to fall when it hits the $220 resistance level.

There’s a specific reason why ADSK stock dropped today, though. Specifically, Autodesk released its results for the third quarter of Fiscal Year 2024. So, were the company’s earnings data so bad that investors needed to panic sell their shares?

Actually, Autodesk had a perfectly acceptable quarter. First of all, Autodesk’s revenue grew by 10.2% year-over-year to $1.41 billion. This top-line result exceeded the consensus estimate by $20 million. A highlight was Autodesk’s Subscription Plan revenue, which accelerated by 11% year-over-year to $1.314 billion.

Furthermore, Autodesk reported earnings of $2.07 per share, whereas analysts had only expected the company to earn $1.99 per share. To top it all off, Autodesk’s GAAP-measured operating margin grew by 4 percentage points year-over-year to 24%.

Given these facts and figures, ADSK stock ought to move higher in a perfectly rational market. Yet, of course, the market isn’t perfectly rational – but then, that’s why stocks can temporarily be mispriced.

In this instance, it was Autodesk’s forward guidance that put short-term stock traders in a bad mood. Let’s not make any assumptions, though. Just because the market had an adverse reaction, it doesn’t necessarily mean Autodesk’s outlook is pessimistic.

Autodesk’s Expectations vs. Wall Street’s Estimates

In Autodesk’s quarterly press release, CFO Debbie Clifford declared that the company is “raising revenue, earnings per share, and free cash flow guidance.” Hence, it sounds like Autodesk’s outlook is actually quite positive.

Getting down to the details, Autodesk expects its Fiscal Year 2024 revenue to increase approximately 9% to $5.45 billion- $5.465 billion. Moreover, the company guided for full-year GAAP EPS of $3.88-$3.94 and free cash flow totaling $1.2 billion-$1.26 billion.

What about the current quarter? Concerning that, Autodesk guided for revenue of $1.422 billion-$1.437 billion, which is roughly in line with Wall Street’s call for $1.43 billion.

Here’s where Autodesk’s current-quarter outlook apparently fell short. The company guided for non-GAAP earnings of $1.91-$1.97 per share, which was less than the consensus estimate of $2.01 per share.

Thus, we finally found something that today’s stock traders could object to. It just goes to show that panicky investors can find a problem anywhere if they look hard enough.

Wall Street’s experts aren’t losing faith in Autodesk, however. For example, William Blair analysts Dylan Becker and Faith Brunner observed Autodesk’s “continued healthy pipeline activity evidenced throughout the duration of the year.” This, the William Blair analysts contend, “highlights both the strategic importance of the company’s tools and resiliency of its diversified end market exposure, which remains well positioned to support several years of digitization momentum.”

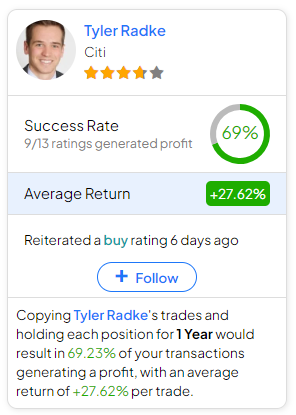

Meanwhile, Tyler Radke of Citigroup (NYSE:C), certainly hasn’t given up hope for Autodesk. “With a high single-digit growth target we believe there could be room for upside, especially if macro trends stabilize or recover,” Radke explained. Notably, Becker and Brunner assigned a Buy rating to ADSK stock, and Radke gave the stock an Outperform rating.

Is ADSK Stock a Buy, According to Analysts?

On TipRanks, ADSK comes in as a Moderate Buy based on 11 Buys, eight Holds, and one Sell rating assigned by analysts in the past three months. The average Autodesk stock price target is $229.45, implying 13.2% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ADSK stock, the most accurate analyst covering the stock (on a one-year timeframe) is the aforementioned Tyler Radke of Citigroup, with an average return of 27.62% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider ADSK Stock?

Autodesk’s actual results were fine, and the company raised its full-year outlook. Still, the market took issue with Autodesk today, probably because the company’s current-quarter EPS guidance came in below what Wall Street had anticipated.

That’s a silly reason to sell ADSK stock if you ask me. Instead of nitpicking, I believe that investors should conduct their due diligence on Autodesk and, if they like what they’re seeing, consider picking up a few shares for the long term.