Looking for the next international chipmaking superstar? Be careful, as there’s plenty of hype surrounding Arm Holdings (NASDAQ:ARM) but the results just don’t measure up. Arm might have a great future, but I am neutral on ARM stock until I see more positive financial data and guidance.

U.K.-based Arm Holdings mainly designs chips to be used in smartphones. It was a September to remember for Arm this year, as the company had the biggest U.S. technology-industry IPO of 2023 at that time.

However, now it’s time for Arm Holdings to “put up or shut up,” as they say. IPO hype can only carry a company so far, and when the chips are down and the results are out, prudent investors should pay more attention to the numbers than the talk.

ARM Stock Costs an Arm and a Leg, but Not for Long

Arm Holdings priced its IPO at $51 per share, but the stock jumped to $65 soon after its public debut. Without a doubt, financial traders were enthused about Arm, as the company supplies tech-component designs to companies like Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA).

The excitement over Arm may have gotten another quick boost when the company announced a strategic investment in Raspberry Pi Ltd. Reportedly, the two companies agreed to “collaborate to deliver solutions for the Internet of Things developer community.”

However, perhaps the most hype-fueled announcement for Arm occurred when Reuters revealed that Nvidia is going to use Arm-based processors for personal computers. That news item from October really got the trading community in a risk-on mood.

On top of all that, KeyBanc analysts initiated their coverage of ARM stock with an Overweight rating. For a while, it felt like Arm Holdings would be the darling of the market for the rest of 2023. Would this feeling reflect reality, though?

The Other Shoe Drops for Arm Holdings

I could spend all day talking about IPO pop-and-drop stocks. Apparently, it’s a lesson that many stock traders will have to learn the hard way in the 2020s.

ARM stock is currently down by around 6% today, trading near $51, which is significantly below the $65 price target previously issued by Keybanc analysts. This is a textbook example of what can happen when expectations run hot and an IPO stock moves too high, too soon.

Here’s what happened. Arm Holdings just released its first post-IPO quarterly financial report, which covered Arm’s Fiscal Q2-2024 results (the quarter ended in September). In some ways, Arm’s results lived up to analysts’ expectations.

Specifically, Arm’s revenue increased by 28% year-over-year to $806 million, beating the consensus estimate of $744.3 million. Meanwhile, Arm’s quarterly adjusted EPS of $0.36 easily exceeded Wall Street’s call for $0.26.

Note, however, that this is adjusted EPS. If we instead use GAAP-measured net income, Arm swung from net income of $114 million in the year-earlier quarter to a net loss of $110 million in Q2 2024. Over that same time frame, Arm swung from $0.11 to -$0.11 in diluted EPS.

Additionally, Arm guided for current-quarter revenue of $720 million to $800 million and adjusted EPS of $0.21 to $0.28. The midpoints of those ranges fell short of the consensus estimates of $776 million in revenue and 27 cents in adjusted EPS.

Is ARM Stock a Buy, According to Analysts?

On TipRanks, ARM comes in as a Moderate Buy based on 16 Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average Arm Holdings stock price target is $61.86, implying 21.2% upside potential.

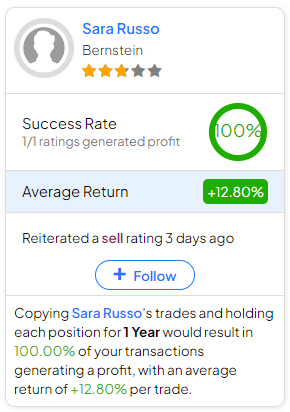

If you’re wondering which analyst you should follow if you want to buy and sell ARM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Sara Russo of Bernstein, with an average return of 12.8% per rating. Click on the image below to learn more.

Conclusion: Should You Consider ARM Stock?

All in all, Arm Holdings had a good quarter, and there’s nothing major to complain about. It’s a problem, however, that overeager stock traders got too excited about Arm during and immediately after the company’s public market debut.

Now, the other shoe is dropping, and folks who got caught buying ARM shares during the peak hype phase are stuck underwater. Therefore, it’s wise to stay neutral on ARM stock and wait for the next round of financial results to come in. Then, investors can reassess the company and its stock with more information and good judgment.