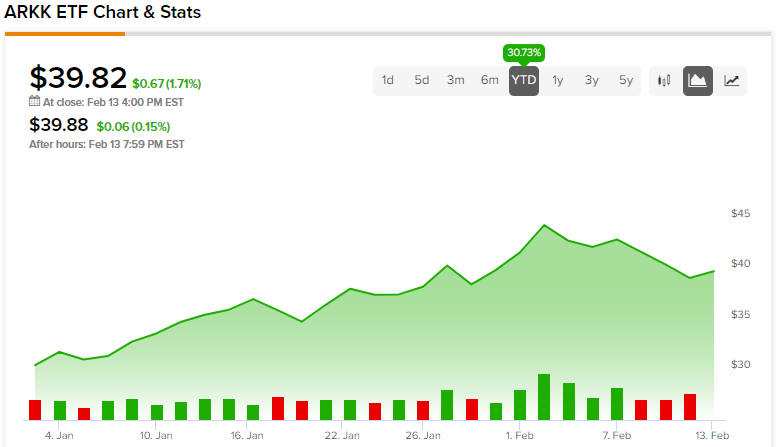

Cathie Wood‘s ARK Innovation ETF (ARKK) heated up in a big way to start the year. Even after last week’s modest pullback, ARKK is up just north of 31% year-to-date. Despite the explosive rally that sparked the ETF’s best-ever month, questions linger as to what comes next for the basket of innovative stocks Wood views as “the new Nasdaq.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Undoubtedly, high interest rates and calls for recession have caused ARKK to feel far more pain than the market averages. With the recent hype surrounding ChatGPT and next-generation artificial intelligence (AI) products, it certainly seems that innovation is finally getting a moment to shine, even with the tides turned so heavily against tech. I think innovation can still power solid gains, even in today’s less accommodating environment.

Of course, not all innovators are built the same and can stack up with the disruptive capabilities of an AI chatbot like ChatGPT. Further, there’s also the risk that recent “AI hype” could be overdone and lead to more tears for investors chasing a bounce with less consideration for the fundamentals.

As for the ARK Innovation Fund, I do think most of the pain has already been dealt. Wood continues to stick with hyper-growth stocks, even as the Federal Reserve continues applying pressure with every interest rate hike.

Despite the risk of a sudden reversal, I remain mildly bullish on ARKK. Wood’s continued dip-buying could pay off as inflation backs down, allowing the Federal Reserve to hit the pause button. Perhaps a course correction may be needed, with a few rate cuts thrown into the mix at a later date.

In any case, I think it’s a dangerous game to play rate cuts or a rate pause at this juncture. It’s too hard to predict the Fed when not even they know with great certainty what they’ll be doing a few months down the road.

ARK Innovation Fund: Cathie Wood Continues to Buy the Dip

Cathie Wood has been a busy buyer of tumbling tech stocks over the past year. Whether we’re talking about topping up Tesla (NASDAQ:TSLA) or scooping up some of the lesser-known small-caps, it’s clear that Wood has its sights set on where the puck is headed next.

It’s no mystery that Tesla stock significantly contributed to ARKK’s rise and fall. Wood’s latest round of purchases signals that Tesla still possesses the innovative edge to keep up-and-coming EV rivals at bay. Beyond EVs, Tesla also seems to have a dataset and AI capabilities to help it keep powering higher.

Recently, Wood noted that she sees firms with “proprietary datasets” as “hidden gems that will benefit most from artificial intelligence.” I think Wood is right to look at the data as a sign of future AI strength.

Tesla is an EV pioneer that arguably has one of the richest datasets in the industry. A rich trove of data can be viewed as food for its forward-looking innovations like autopilot.

For now, there’s not much clarity on when self-driving vehicles will be ready for prime time, and it’s difficult to determine which EV player has the early edge. Further, datasets may not necessarily translate into AI dominance. Datasets are an important input, but a firm’s ability to effectively leverage such data is arguably more important.

In the meantime, investors shouldn’t hold their breath waiting for an autonomous vehicle (AV), as its “ChatGPT moment” may be many years off.

Small Cap Bets Look Very Intriguing

Looking forward, I think small-cap tech exposure is a reason to prefer Cathie Wood’s ARK line of funds over constructing one’s own hyper-growth portfolio. Such small caps are incredibly risky. However, with Wood’s expertise, I do think ARK ETFs can improve the risk/reward for investors as she looks to uncover “hidden gems” across an ocean of pain.

Recently, Wood scooped up 3D metal printing firm Velo3D (NYSE:VLD) and oncology firm Repare Therapeutics (NASDAQ:RPTX) for the ARK Autonomous Technology and Robotics ETF (ARKQ) and ARK Genomic Revolution ETF (ARKG), respectively. Shares of both small-cap firms are battered, but Wood hasn’t shied away from names that many investors have left behind after tech’s brutal 2022.

The Bottom Line on ARK Innovation

It’s about time that ARK ETFs felt a bit of relief. After such a brutal year, I’d not be shocked if hyper-growth tech’s relief rally has more room to go. In any case, investors should proceed cautiously as nothing less than volatility should be expected with any of the ARK funds — ARKK boasts a 1.38 beta, meaning shares are more volatile than the S&P 500 (SPX).