Arista Networks (ANET) shares are down more than 35% year-to-date as the market sentiment was not favorable for technology companies. Surprised by the turn of events that have weighed on their shares, investors are now wondering when this slide will finally be over.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Arista Networks is a solid stock and could have a strong recovery, but shareholders need to be patient, as it might take some time for that to happen. So, I wouldn’t stray from maintaining my neutral stance on the stock.

About Arista Networks

Arista develops and markets networking equipment and solutions designed for data centers in North America and internationally.

Arista Networks is headquartered in Santa Clara, California.

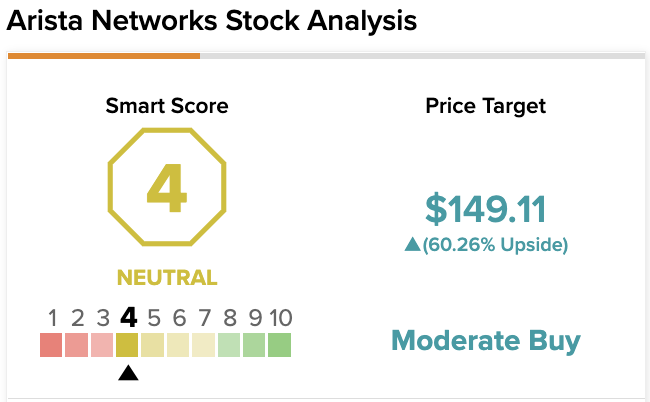

On TipRanks, ANET scores a 4 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in line with the broader market.

Reasons for Not Buying

There’s no doubt that the company has good fundamentals, including a solid financial situation and strong revenues, but that won’t be enough to push the stock back up as the current headwinds are too strong, even for Arista.

Given the global economy and its likely trajectory through monetary and fiscal policies against record inflation, the current bearish sentiment could continue, with Arista stock unlikely to escape the effects.

How Macroeconomics Weigh on Arista

The difficulties in the regular supply of raw materials due to the war in Ukraine and the restrictions needed to contain the resurgence of COVID-19 are currently ugly beasts for business activities.

The above events result in sales not growing as they should – while incurring higher costs for purchasing technical components.

Unfortunately for its shareholders, Arista Networks can’t entirely avoid this either. While sales are resilient despite headwinds from supply chain issues, higher operating costs weigh on profit margins, which cannot grow faster.

Trends From Q1-2022 Financial Results Report

In the first quarter of 2022, revenue reached $877.1 million, up 31.4% year-over-year, surpassing the analysts’ median projection by $20.7 million and surpassing the highest target of Arista by $17.1 million.

Its non-GAAP gross margin was 65.2% in the first quarter of 2022 versus 64.7% in the first quarter of 2021, reflecting a jump of 50 basis points (bps).

Its non-GAAP operating margin was 38.4% or an increase of only 30 bps year-over-year.

Outlook

In the near future, sales should increase further, but profit margins are expected to deteriorate significantly.

For the second quarter of 2022, Arista expects revenue of between $950 million and $1 billion, representing a growth of 34.3% to 41.4% compared to the same quarter of 2021.

The company also forecasts a non-GAAP gross margin of 60% to 62%, which will be a decline of 520 to 320 bps year-over-year.

While the non-GAAP operating margin is expected to be between 37% and 38%, or down about 140 to 40 bps year-over-year.

Deteriorating profitability is another drag on buying this stock, potentially putting further downward pressure on share prices.

An increase in selling price to pass higher operating costs on to customers could affect the demand for network equipment and solutions. It doesn’t look like the company is willing to take that risk for a higher profit margin.

As sales trends suggest, the growth strategy would instead focus on taking market share from competitors, and while this could lead to a lower margin temporarily, priority will be given to a long-term perspective. However, it will take some time before the positive effects show up.

Arista’s Financial Condition

The company’s financial condition looked robust at the end of the first quarter of 2022. The balance sheet had $3.4 billion in cash on hand, equivalents, and marketable assets, vastly exceeding the total debt of $57.5 million. Total debt consists of operating lease liabilities.

Additionally, the stock has an Altman Z-Score of 11.31, indicating the “safe zone” from a financial strength perspective. The financial indicator measures the probability that a company will go bankrupt. A value equal to or greater than 3 indicates an extremely low probability of insolvency, which is the case for Arista Networks.

Wall Street’s Take

In the past three months, eleven Wall Street analysts have issued a 12-month price target for ANET. The stock has a Moderate Buy consensus rating based on seven Buys and four Hold ratings.

The average Arista Networks price target is $149.11, implying a 60.26% upside potential.

Valuation

Shares are changing hands at $94.47 as of the writing of this article for a market cap of $28.03 billion, a price/earnings ratio of 31.1, and a price/sales ratio of 8.97.

The stock’s price has fluctuated between a low of $85.18 and a high of $148.57 over the past 52 weeks. So currently, the share price is trading below the middle point of the 52-week range. It is also below its 50-day moving average price of $109.64 and below its 200-day moving average price of $116.46.

While they may seem attractive compared to the recent past, these price levels do not lead to a Buy approach yet, as bearish sentiment is expected to prevail in the market for some time. Thus, share prices may fall further than current levels, providing an opportunity in the future to add Arista shares at a more favorable price.

Conclusion

Arista has strong foundations and a long-term growth-focused strategy.

While the industry’s policy of raising prices to cope with high input costs persists, Arista prefers to gain market share, even at the expense of margins.

The market’s reluctance to lower margins and the generally unfriendly sentiment towards tech stocks could continue to hurt Arista. Due to prolonged triggers, this can last for several weeks.

Additional setbacks in the price of Arista cannot be ruled out.