In this piece, I evaluated two software stocks, Appian (NASDAQ:APPN) and Pegasystems (NASDAQ:PEGA), using TipRanks’ comparison tool to determine which is better.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Appian is an enterprise and cloud computing software company that sells a platform-as-a-service for building enterprise software applications. Pegasystems develops software for customer relationship management and managing business processes.

Both stocks have exploded in 2023, with Appian up nearly 50% and Pegasystems gaining more than 40%. However, those rallies have largely just been recoveries from steep selloffs, as Appian is up only 6% over the last 12 months, while Pegasystems has gained only 4%.

Neither company is profitable, so that’s a big consideration when estimating value. The U.S. software industry is trading around its three-year average price-to-sales (P/S) ratio of 10.4. However, the application software industry is trading at a P/S of 7.7 versus its three-year average of 10.1.

Appian (NASDAQ:APPN)

At a P/S of 7.8, Appian is trading in line with the application software industry but below the broader software industry. Its five-year mean P/S is 14.4, although that’s largely due to a six-month spike in its valuation, which soared between November 2020 and May 2021. The rest of the time, Appian has usually traded at a P/S between five and 12. Combining its valuation with its financial standing and other factors, a bearish view looks appropriate.

While Appian has been treated as a growth stock off and on, its revenue growth isn’t spectacular at current sales levels, although that growth did accelerate slightly to 27% in 2022. However, the company’s losses are widening, as demonstrated by its net income margin falling from -11% in 2020 to -34% over the last 12 months.

Appian has also been issuing debt at a time when interest rates continue to rise, taking out $212 million in new debt over the last 12 months. Its balance sheet isn’t all that great either, with $254.5 million in cash and short-term investments versus $323.8 million in current liabilities. Appian’s free cash flow margins are also becoming increasingly negative, falling from -3% in 2020 to -25% over the last 12 months.

Meanwhile, the company has a market capitalization of $3.5 billion despite its low revenue and worsening financial situation.

What is the Price Target for APPN stock?

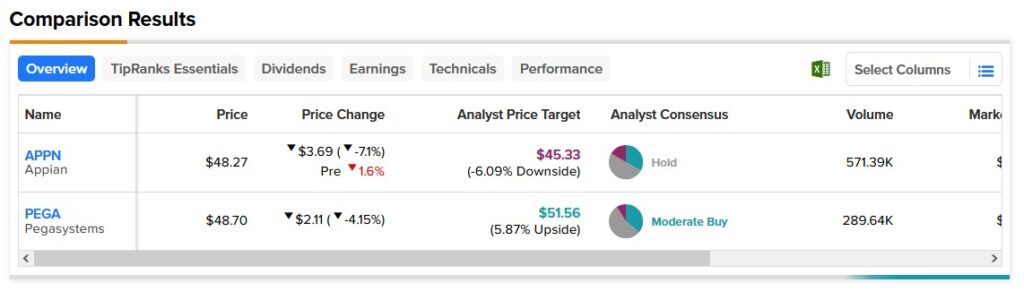

Appian has a Hold consensus rating based on two Buys, three Holds, and one Sell rating assigned over the last three months. At $45.33, the average Appian stock price target implies a downside potential of 6.09%.

Pegasystems (NASDAQ:PEGA)

At a P/S of 3.3, Pegasystems looks far more reasonably valued, especially considering its five-year mean P/S of 6.5. It’s similar to Appian in some ways, although it’s in a slightly better financial position. In fact, Appian guided for a small profit in 2023 in its last earnings report, suggesting a bullish view could be appropriate despite the massive rally.

What makes Pegasystems so compelling right now is its low valuation relative to its industry and history and its expectation of a full-year profit this year. In fact, the company’s widening annual losses may be hiding its long-term potential. Pegasystems’ net income margin tumbled from -11% in 2020 to -34% for the last 12 months, but management’s guidance calls for an annual net profit of 2 cents per share in 2023.

The company has also been avoiding issuing any debt as interest rates have risen, demonstrating prudence. It’s been alternating between slightly negative and slightly positive free cash flow, reporting $35 million in free cash flow for the last 12 months, which suggests it could be turning a corner.

Finally, Pegasystems is generating over $1 billion in annual revenue versus Appian’s less than $500 million, but its market cap is only $300 million more than Appian’s. Pegasystems even pays a small dividend and has been raising it annually for at least the last 14 years.

What is the Price Target for PEGA stock?

Pegasystems has a Moderate Buy consensus rating based on four Buys, six Holds, and one Sell rating assigned over the last three months. At $51.56, the average Pegasystems stock price target implies an upside potential of 5.87%.

Conclusion: Bearish on APPN, Long-Term Bullish on PEGA

Both companies exemplify the growth-at-any-cost mindset, and both stocks have surged in 2023 because of their work and commentary around generative AI, a much-hyped subject currently.

Both stocks plummeted last year because the market thought software stocks were overvalued, but they’ve recovered to roughly that same level. Thus, investors are left considering what’s changed since then that makes them deserve a return to last year’s prices.

In Appian’s case, it’s reporting widening losses and rising debt as interest rates rise, but Pegasystems has guided for a full-year profit. Despite that guidance, the company’s P/S remains low relative to its industry and history, suggesting this could be a good entry point for investors.