The big reveal of the iPhone 12 was left out of Apple’s (AAPL) annual product event, but there was still plenty on the agenda for Apple’s global fanbase to savor.

The tech giant announced new iPad and Apple Watch models. The 8th generation iPad brings with it a faster A12 Bionic chip, while the new iPad Air boasts an updated design with smaller bezels, and the latest A14 processor – 40% faster than the A13.

The wearables lineup includes the Apple Watch Series 6, which boasts new blood oxygen monitoring features and a 20% faster processor. There will also be a personalized fitness product which will become available later this year called Fitness+, offering virtual studio-like workouts going for $10 per month.

Apple also revealed details of its Apple One services bundle, which ties together several Apple services into a monthly fee with a three-tier payment structure.

Canaccord analyst Michael Walkley views the new products and services as “further strengthening the Apple ecosystem.” However, it is all mainly a “warm-up act” for the main event – the launch of the 5G enabled iPhone 12. Walkley estimates that over the next 2 years, the new model could drive between 300 million to 400 million current iPhone users to upgrade to a new 5G iPhone.

Summing up the event, the 5-star analyst said, “While we were impressed with the new products and features Apple launched earlier today, we await the new 5G iPhone product launch next month that should have a much greater impact to earnings. We anticipate continued double-digit growth for all hardware products except iPhones during Q4/F20 and this is due to new iPhones slightly delayed and facing a difficult growth comparable. Starting in Q1/F21, we believe Apple is well-positioned to benefit from the 5G upgrade cycle and anticipate strong iPhone growth to contribute to overall strong growth trends as 5G smartphones ramp and Apple continues to grow its installed base and higher-margins services revenue.”

To this end, Walkley reiterated a Buy rating on AAPL shares along with a $145 price target. What’s the implication for investors? Upside of 36% from current levels. (To watch Walkley’s track record, click here)

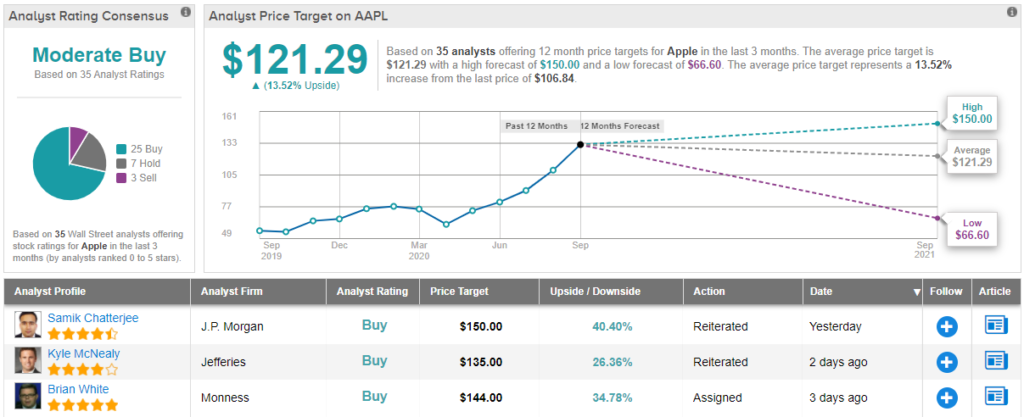

Apple has solid backing from the rest of the Street, although not all are in agreement on its projected trajectory. AAPL’s Moderate Buy consensus rating is based on 25 Buys, 7 Holds and 3 Sells. The analysts expect shares to appreciate by 13.5% over the next 12 months, given the $121.29 average price target. (See Apple stock-price forecast on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.