Did Apple (AAPL) just do some flexing? While all its big tech brethren were taking massive hits in this giant-killing earnings season, Apple emerged unscathed from the carnage and delivered a healthy F4Q report, even while iPhone sales came in soft.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

There were beats on both the top-and bottom-line. The company delivered record sales in the September quarter, as revenue rose by 8.1% year-over-year to reach $90.15 billion, coming in $1.38 billion above Street expectations. EPS hit $1.29, 2 cents higher than the $1.27 the analysts had predicted.

It was not all plain sailing, however; iPhone revenue increased by 9.67% from the same period last year to $42.63 billion but came in shy of the $43.21 billion estimated on Wall Street, while Services revenue also missed, climbing 4.98% higher to $19.19 billion vs. The $20.10 billion the analysts had in mind. These misses were somewhat offset but strong showings elsewhere, with Mac revenue rising by 25.39% year-over-year to $11.51 billion, some distance above the $9.36 billion predicted. And Other Products revenue came in at $9.65 billion vs. the $9.17 billion estimate, up 9.85% year-over-year

As has become customary at Apple, no official guidance was offered for FQ1 (December quarter) which normally accounts for the biggest sales season of the year. However, management said it expects year-over-year revenue won’t grow as much as the 8.1% seen during the September quarter.

Nevertheless, considering the disastrous showings on offer elsewhere, Deutsche Bank’s Sidney Ho highlights how Apple stands out from the crowd.

“AAPL has executed well in a tough environment and its earnings power seems more sustainable than large-cap tech peers,” the 5-star analyst said. “We see a slightly above-average valuation vs. peers as fair when we compare AAPL’s total growth potential and earnings power with the growth expectations of the peer group. With steady gross and operating margins and a solid balance sheet, we see the potential reward from stock outperformance as skewed positively when compared with the company’s risk profile.”

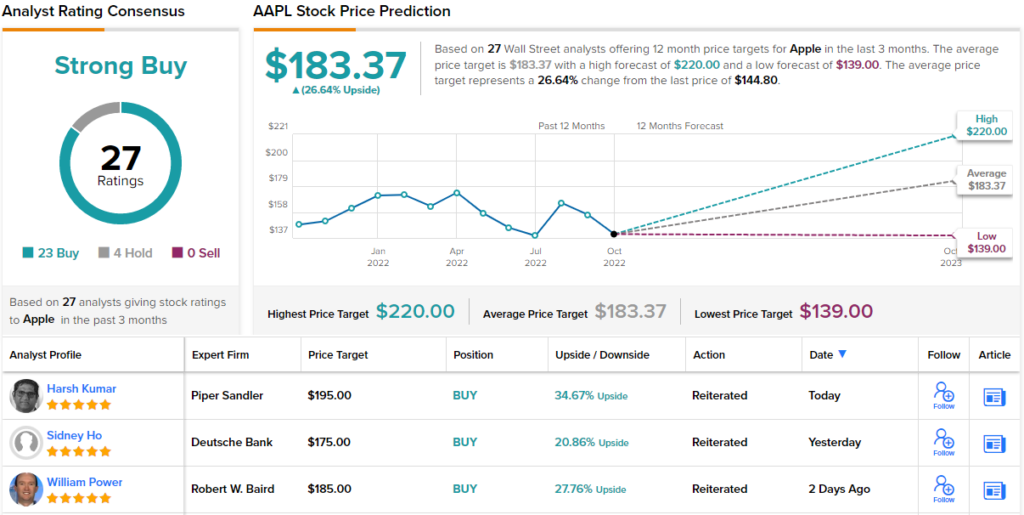

With a risk-reward profile which “remains attractive,” Ho reiterated a Buy rating, although taking a prudent approach, the price target is lowered from $175 to $170. There’s upside of 17% from current levels. (To watch Ho’s track record, click here)

Overall, Apple has garnered 27 reviews over the past 3 months, with 23 Buys outpacing the 4 Holds, making for a Strong Buy consensus rating. The average target stands at $183.37, suggesting shares will climb 27% higher in the year ahead. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.