The AI ambitions of Apple (NASDAQ:AAPL) have been relatively muted compared to its peers in the FAANG basket. Undoubtedly, the $3 trillion tech titan isn’t just standing at the starting line of the AI race. The firm began its sprint a long time ago, even though many investors and analysts may not be aware of its current standing in the race.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Undoubtedly, it’s easy to conclude that Apple is neglecting the growth potential of cutting-edge generative AI technologies like Large Language Models (LLMs). Though Apple has not been nearly as vocal at its conference calls as the other tech titans, it’s a mistake not to consider the longer-term monetization potential of AI.

As Apple continues investing in the AI we can’t see (think the consumer-friendly AI-driven features we take for granted), I think shares of the iPhone maker could have more AI upside relative to its FAANG rivals, most notably Microsoft (NASDAQ:MSFT). As such, I’m staying bullish on AAPL stock.

Apple Beats on Q3 EPS, Sheds a Little More Light on AI Prospects

Apple revealed a decent third quarter after market close yesterday, beating modest analyst expectations on the bottom line while matching revenue estimates of $81.8 billion. Earnings per share (EPS) came in at $1.26, topping the consensus estimate of $1.20. Despite the beat, the most common headline I saw was that Apple revenues slipped for the third-straight quarter.

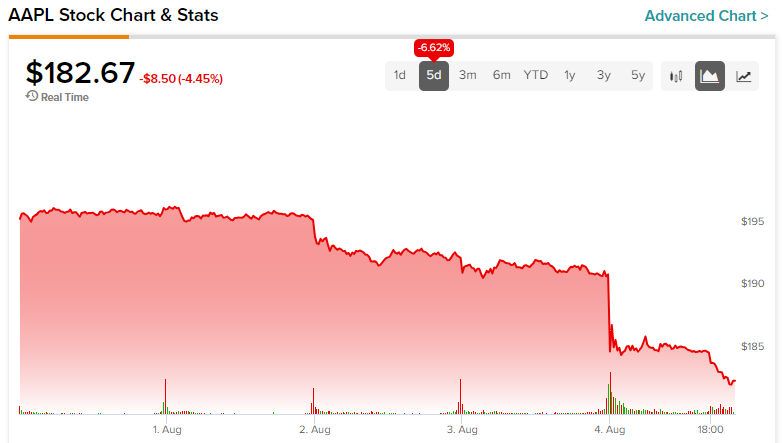

Indeed, investors didn’t seem too enthused by the numbers, as shares are currently lower today following the results. I believe the major headline that should have grabbed investors’ attention is the strong growth in Services, up 8%, and the insightful commentary on AI from Apple’s CEO, Tim Cook.

During the earnings call, Cook stated that Apple has been working on AI, including generative AI, for many years. Indeed, this is pretty unsurprising commentary from Apple’s top boss, who’s probably been hounded to shed more detail on the company’s longer-term AI plans.

Though Cook didn’t say anything game-changing or shocking about Apple’s AI ambitions, I do respect that he doesn’t appear to be trying to build up any AI hype, at least not to the magnitude of some of the other tech companies out there that can’t seem to go a few sentences without mentioning generative AI.

“We’re going to continue investing and innovating and responsibly advancing our products with these technologies to help enrich people’s lives,” said Cook. The key words here are “responsibility advancing.”

Enriching People’s Lives Ought to Come Before the Maximization of Profit

This isn’t the first time we heard Cook mention the goal of enriching people’s lives, and it probably won’t be the last. Indeed, it’s not hard to imagine companies may be getting a tad ahead of their skis when it comes to generative AI and LLMs. While AI can enrich people’s lives, there’s also the danger it could do some harm. Indeed, OpenAI’s ChatGPT and even Microsoft’s Bing AI have been called out for “hallucinating,” or in Lehman terms, just making stuff up!

Undeniably, LLMs like ChatGPT are definitely a work in progress, and there’s a lot of reputational risk on the line by putting a consumer-facing AI product out there. While Microsoft may be comfortable taking such risks to be an early mover in the AI race, Apple does not seem to be, at least not yet.

As AI regulations and potential downsides arise, I’d look for Apple to be more comfortable making a bigger splash into the uncertain AI waters. Until then, expect the company to keep tabs on the state of the emerging technology as it looks to incorporate various aspects to “enrich people’s lives.”

At the end of the day, Apple seems to be playing the long game with AI, putting people first rather than profits. Moving forward, I expect the company to do more of the same. The latest iOS update may not have AppleGPT, but it does have AI technologies (think the iOS 17’s AI-powered Auto-Correct) to help improve numerous aspects of the user experience.

Is Apple Stock a Buy, According to Analysts?

On TipRanks, AAPL stock comes in as a Strong Buy. Out of 31 analyst ratings, there have been 23 Buys and eight Hold recommendations assigned by analysts in the past three months. The average Apple stock price target is $206.80, implying upside potential of 13.35%. Analyst price targets range from a low of $150.00 per share to a high of $240.00 per share.

Indeed, some may view 13.35% as a modest return for the year ahead. Apple shares are trading on the expensive side of their historical range (the stock’s averaged a 25.5 times trailing price-to-earnings multiple over the last five years) at 31 times trailing price-to-earnings. Still, I expect price target hikes to come in as more analysts re-evaluate Apple’s longer-term potential in AI.

The Bottom Line

An AI-powered Auto-Correct feature may be a heck of a lot less ambitious than a ChatGPT rival. However, there’s no shame in releasing safe, responsible AI-based technologies before taking chances with a massive GPT-powered Siri update before it’s polished enough not to “hallucinate” or do something that could potentially hurt its consumers.

The way I see it, getting into the pool from the shallow end is far less risky than the deep end if you’re not sure what lies beneath the water. Although it may not seem like it, Apple’s a long-term AI winner, albeit a quiet one, for now!

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue