Apple (AAPL) recently posted its Fiscal Q3 earnings, revealing a series of bullish indicators alongside a notable concern. In this article, we will explore five key bullish signs emerging from Apple’s latest results that highlight its growth potential and overall financial strength. At the same time, I will address one red flag that could negatively influence the stock’s investment case. For this particular reason, I remain neutral on AAPL stock despite its otherwise attractive characteristics.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Highlight #1: Revenues Keep Reaching New Records

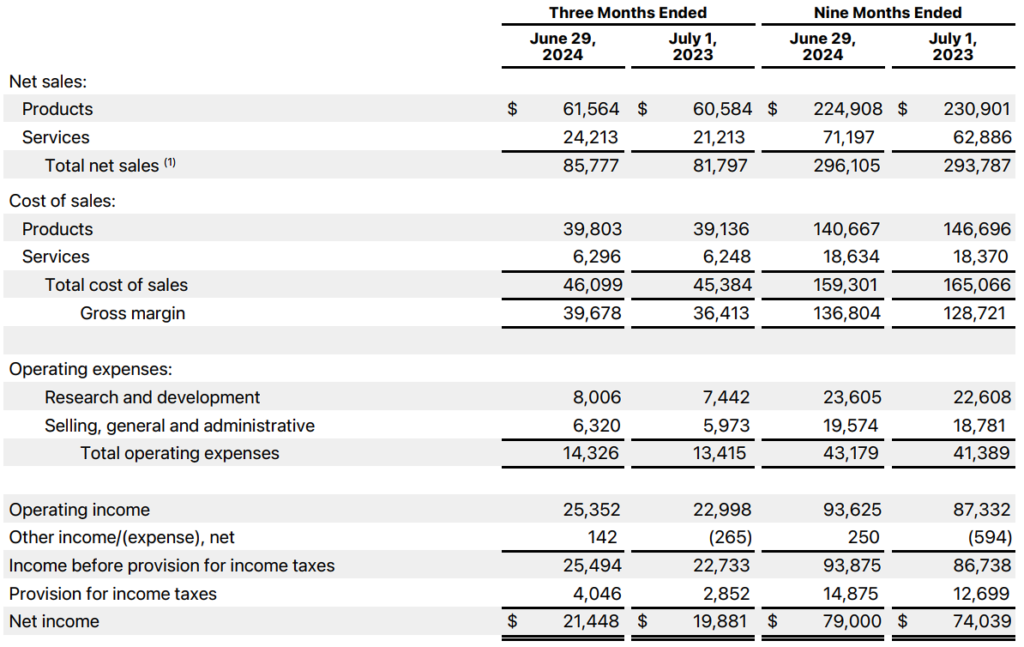

The first and most apparent highlight from Apple’s Fiscal Q3 report was that the company’s revenues hit a record $85.8 billion, marking a 5% increase compared to last year. Notably, this figure beat Wall Street’s expectations by a significant $1.85 billion, despite the company facing a 230 basis point headwind from foreign exchange fluctuations.

CEO Tim Cook highlighted that Apple achieved revenue records in over two dozen countries, including major markets like Canada, France, and India. Considering the prevalent sentiment that Apple’s growth has lagged lately, seeing decent single-digit growth and records across different geographies is certainly quite encouraging.

Highlight #2: Acceleration in Services Revenue Growth

The second highlight from Apple’s Q3 report is the acceleration in revenue growth from Services. Services revenue hit a record $24.2 billion, marking a 14% rise from the previous year and an acceleration from last year’s growth of 8%. The growth in Services helped drive this quarter’s revenue growth mentioned earlier, while reflecting strong performance across advertising, cloud, and payment services.

Notably, the number of paid subscriptions skyrocketed to over one billion, with Apple more than doubling this figure from just four years ago. I believe the continued growth in Service revenues emphasizes the growing consumer reliance on Apple’s ecosystem of services, from Apple TV+ to Apple Music, among others.

Highlight #3: Impressive Growth in iPad and Mac Segments

Another highlight revolving around Apple’s growth was tied to the iPad and Mac divisions, which showed notable growth during the quarter. iPad revenue surged 24% year-over-year to $7.2 billion, driven by the launch of the new iPad Pro and iPad Air models, which feature significant upgrades like the M4 chip and enhanced AI capabilities. Meanwhile, Mac revenue grew 2% to $7 billion, fueled by the success of the M3-powered MacBook Air.

Sure, demand for Apple’s devices tends to be cyclical. For example, iPad sales are likely to dip following this year’s strong surge. Still, Apple’s growth across these two divisions highlights its continued appeal in both personal and professional computing.

Highlight #4: Customer Satisfaction and Device Install Base at All-Time Highs

Another bullish indicator highlighted by Apple’s management during the post-earnings call is the company’s outstanding customer satisfaction, as demonstrated by its record-breaking installed base of active devices. Management reported that its installed base reached an all-time high across all products and geographic segments.

Notably, customer satisfaction metrics for Apple products remained extremely high, with the iPhone 15, iPad, Mac, and Apple Watch all receiving top ratings. For example, iPhone 15 satisfaction was reported at 98% in the U.S., while customer satisfaction for iPad and Apple Watch stood at 97%.

While these numbers don’t directly reflect Apple’s underlying financials, they suggest that demand and sales volumes regarding future device releases should remain robust. Evidently, Apple expects very strong sales for the upcoming release of iPhone 16.

Highlight #5: Financial Strength and Shareholder Returns

Last but not least, Apple’s Fiscal Q3 report reminded us of its remarkable financial strength, which enables it to sustain superb shareholder returns. The company ended the quarter with $153 billion in cash and marketable securities, with its net cash standing at $52 billion. Apple continued to buy back shares at a rapid pace, which was in line with management’s long-term goal of reaching a neutral net cash position.

The company repurchased $69.9 billion worth of stock during the first nine months of this fiscal year, up from $56.5 billion last year. The company is currently on track to repurchase $100 billion worth of stock for the year. While at Apple’s current humongous market cap, even such a large amount translates to a thin buyback yield of just 3%, it is still likely to support the stock’s upward momentum.

Apple’s One Red Flag – Its Valuation

Despite Apple celebrating several positive developments in its Fiscal Q3 results, its report exposed the one red flag that investors should be wary of — its valuation. The company continued to post notable revenue growth, while earnings per share also grew by a remarkable 10.2% to $1.70. Yet, it’s hard to justify the forward P/E ratio of 32.3x based on this year’s consensus EPS estimate of $6.71 and Apple’s current stock price.

Wall Street is confident that Apple can maintain double-digit EPS growth over the medium term, with the upcoming iPhone 16 potentially serving as a major catalyst. This release could mark the beginning of a new era for Apple as it introduces truly AI-powered smartphones. I’ve explored this topic in more depth in another article, which I encourage you to check out if you’re interested.

However, even with Wall Street’s optimistic projections, Apple stock is currently trading at a hefty forward P/E ratio of 20.6x its expected 2027 EPS. In my view, this high multiple could limit Apple’s upside potential in the future, thus hindering its investment case.

Is AAPL Stock a Buy, According to Analysts?

Despite the stock’s hefty valuation, Wall Street remains relatively bullish on Apple. Specifically, AAPL stock features a Moderate Buy consensus rating based on 24 Buys, seven Holds, and one Sell assigned in the past three months. At $248.78, the average AAPL stock price target implies 12.4% upside potential.

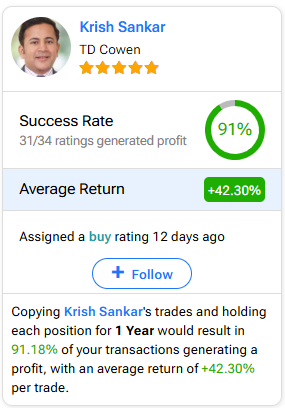

If you’re wondering which analyst you should follow if you want to buy and sell AAPL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Krish Sanka of TD Cowen, with an average return of 42.3% per rating and a 91% success rate. Click on the image below to learn more.

The Takeaway

Apple’s Q3 results showed developments and growth across the board, including solid revenue growth, particularly in Services, and an ever-expanding device install base. However, despite these positives, the stock’s high valuation poses a concern. While Apple’s financial strength and robust product demand are clear, its forward P/E ratio suggests that future upside may be limited. As a result, I remain neutral on Apple stock, acknowledging its strengths but cautious of its potential for overvaluation.