Well, there it is. It’s almost time to officially bid farewell to 2023 and to a stunning stock market performance. The S&P 500 is seeing out the year up by 24% but even that is small change compared to the tech-heavy NASDAQ’s 43% return.

There’s no doubt it has been the year of the tech giant, with the stocks dubbed the Magnificent 7 driving the bullish narrative. So, can we expect more of the same in 2024 or will it more closely resemble 2022’s bear market? While that remains to be seen, Wedbush analyst Dan Ives thinks another vintage year for tech is about to play out. “In our opinion the new tech bull market has now begun and tech stocks are set up for a strong 2024 with tech stocks we expect to be up 25% over the next year,” the 5-star analyst said.

And right at the top of that pyramid sits the biggest Big Tech of them all. Following 2023 gains of 48%, Ives expects another show of strength for Apple (AAPL) in 2024. “Apple remains our Top Tech Pick with a strong iPhone 15 upgrade cycle playing out with a strong and no drama (vs. last December supply chain agita) holiday season which appears humming into 2024 despite the growing noise and Huawei competition in China,” he explained.

Despite what Ives terms the “iPhone China demise narrative,” based on his Asia supply chain checks, that is nothing more than a “great fictional story” cooked up by the bears and does not reflect “underlying mainland China growth” which has remained strong in the December quarter.

iPhone aside, Ives thinks the increasingly important Services segment has now returned to “steady double-digit growth,” believing that on a standalone basis, the business is worth between $1.5 trillion to $1.6 trillion. “In a nutshell,” Ives summed up, “2024 is the year for Cook & Co. to show iPhone growth again and further monetize its golden installed base that Cupertino has built.”

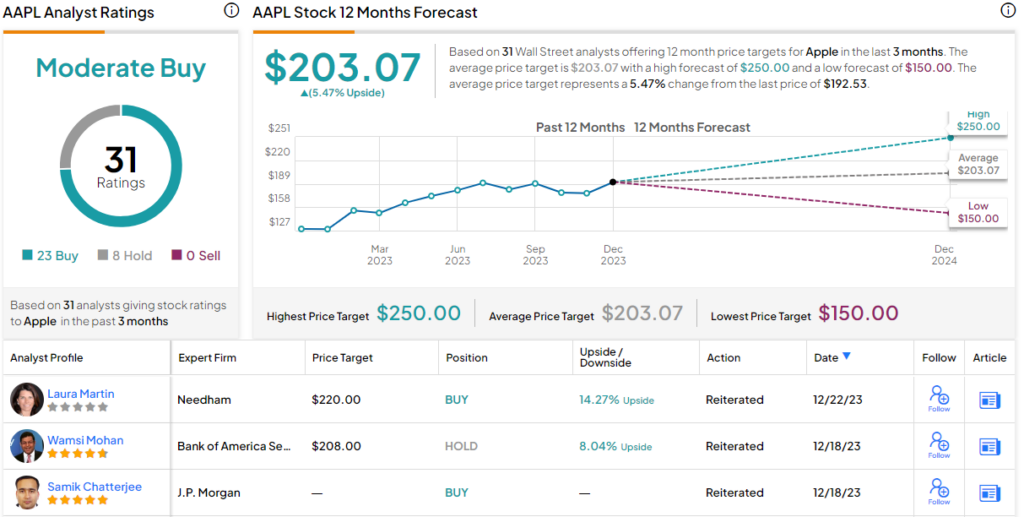

To this end, Ives maintained an Outperform (i.e., Buy) rating and Street-high $250 price target, suggesting the shares will post growth of another 30% over the next year. (To watch Ives’ track record, click here)

Elsewhere on the Street, the stock receives an additional 22 Buys and 8 Holds, all for a Moderate Buy consensus rating. Most appear to think the upside is now capped; going by the $203.07 average target, a year from now, the shares will deliver modest returns of 5.5%. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.