Lukewarm reviews for its new iPhone 15 (great phone, but the improvements are only incremental) left Apple (NASDAQ:AAPL) stock mostly unchanged this week. But one top analyst believes that the initial reception might be overshadowed by what’s to come.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

In a gushing endorsement of Apple stock on Friday, Wedbush’s Daniel Ives, a 5-star analyst rated in the top 2% of the Street’s stock pros, opened with a description of the “long lines already seen in China, Europe, and the US” as evidence of “the retail excitement for this new generation smartphone from Cupertino.”

As Ives points out, some 250 million iPhone users around the world haven’t upgraded their phones in four or more years. So even if improvements between iPhone 14 and iPhone 15 are only incremental, improvements between iPhones 11 and 15 make a much stronger case for making a sale.

What’s more, those quarter-billion-plus Apple fans who’ve been saving their pennies for four years straight now seem to have amassed sufficient savings with which to splurge. Despite Apple raising the price tag for its top-of-the-line phone (this year, that’s the iPhone 15 Pro Max) by $100, to $1199, Ives notes that in New York City at least, it’s the iPhone 15 Pro Max model that people most want to buy. And the fact that there’s some growing scarcity for the phone in the supply chain adds further impetus to these high margin sales.

Simply put, nothing makes consumers more eager to pay up for something than the fear of missing out on it — FOMO.

So what does all of this mean, in cold, hard numbers? Ives sees pre-orders for iPhone 15s rising 10% to 12% in comparison to pre-orders for the prior iPhone 14 release last year. And with pre-orders “skewed” towards the higher-end phones, the analyst is forecasting that average sales prices (ASPs) for Apple could be as high as $925 — up 12% from ASPs for Apple’s last iteration of the iPhone.

And suffice it to say that if unit sales growth is 10% to 12%, and the prices of each individual unit rise a further 12%, then… consensus analyst estimates for mere 6% sales growth for Apple in 2024 could turn out to be very conservative indeed. In Ives’ opinion, Apple’s likely to edge out consensus forecasts for $383.3 billion in sales this year, and then go on to blow 2024 estimates ($404.9 billion) quite out of the water, delivering sales of perhaps $414 billion next year.

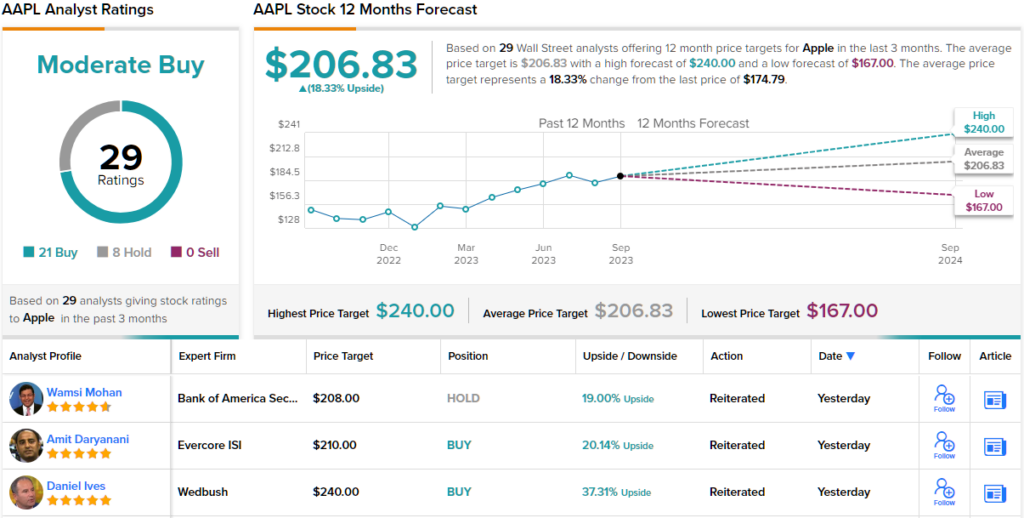

Little wonder, then, that Ives rates Apple stock “outperform” with a $240 price target that implies 37% profit potential. (To watch Ives’ track record, click here)

Turning now to the rest of the Street, where Apple stock has robust support among Ives’ colleagues. Based on 21 Buys and 8 Holds, AAPL has a Moderate Buy consensus rating. The $206.83 average price target implies the stock will be changing hands at ~18% premium over the following months. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.