It’s that time again. Wall Street’s quarterly earnings show is getting underway and before the month is out, Apple (AAPL) is expected deliver its fiscal third quarter report (June quarter, scheduled for July 28).

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

While investor concerns mostly center on the effect of high inflation and iPhone demand, Evercore’s Amit Daryanani believes that despite data points skewing to the negative – these include weak Chinese smartphone data (-9%), App Store growth slowing down to ~4%, and companies such as Micron noting “weakness” in smartphone/PC demand – AAPL has provided a conservative enough guide which will allow for another beat (although possibly a more modest one compared to prior ones) in the June quarter.

The Street is looking for ~1.4% growth, a display Daryanani believes should not be difficult to meet. While Apple did not give revenue guidance for the quarter, the company did suggest the quarter’s growth rate would have mirrored the March quarter (+9%), if not for several headwinds including an FX hit to the tune of 300bps, 150bps from Russia, and $4-$8 billion in supply constraints.

However, the analyst notes that Apple has “tended to overestimate supply headwinds over the past few quarters,” and therefore believes it is possible the supply and FX issues are “less severe than Apple assumed.”

That said, all eyes will be on the September quarter guide and here Daryanani is not quite so confident. Due to the “challenging f/x environment and evolving macro situation,” Daryanani thinks there’s potential for the September quarter guide to “qualitatively be below current expectations.”

As such, while the analyst has made no changes to the June quarter forecast, the September quarter estimates are lowered to revenue/EPS of $88 billion/$1.28, respectively. Both are below Street expectations, which stand at $90.3 billion/$1.32.

“Net/net,” Daryanani summed up, “we are relatively neutral this quarter as we think Apple is contending with numerous headwinds, but these risks should be adequately understood and reflected in expectations.”

To this end, Daryanani maintains an Outperform (i.e., Buy) rating along with a $180 price target. The implication for investors? Upside of 22% from current levels. (To watch Daryanani’s track record, click here)

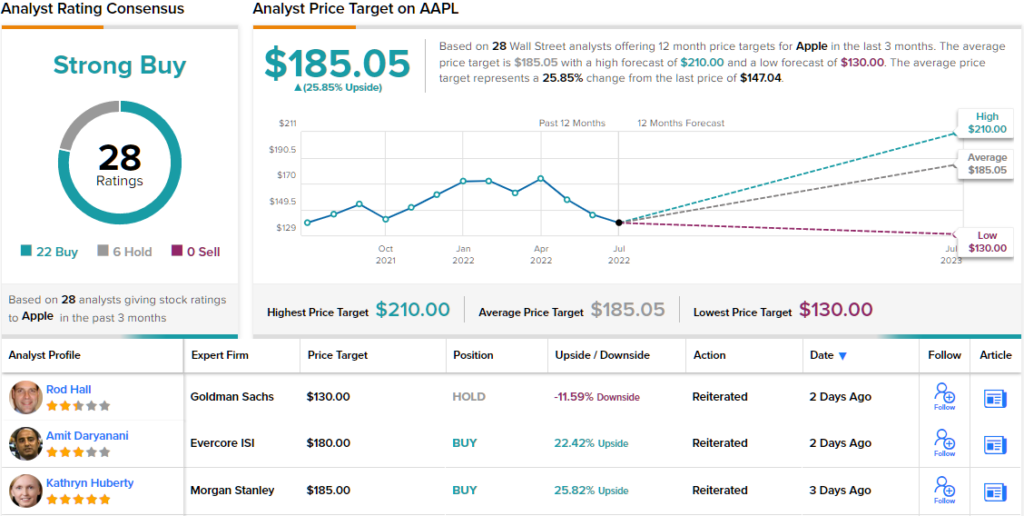

28 analysts have posted AAPL reviews during the past 3 months, which break down as 22 to 6 in favor of Buys over Holds, and all coalesce to a Strong Buy consensus view. Given the average price target clocks in at $185.05, the shares are expected to appreciate ~26% over the next 12 months. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.