Mastercard SpendingPulse’s preliminary insights showed that U.S. retail sales (excluding automotive) increased by 3.1% this holiday season (from November 1 through December 24). As consumers spend more, investors should keep a close watch on the shares of the e-commerce giant (NASDAQ:AMZN) and the world’s largest retailer, Walmart (NYSE:WMT).

Mastercard SpendingPulse assesses retail sales both in physical stores and online, encompassing various payment methods.

According to a Goldman Sachs survey, Amazon and Walmart will likely emerge as top shopping destinations during this holiday season. With this background, let’s look at what analysts recommend for AMZN and WMT stocks.

What is the Prediction for Amazon Stock?

Amazon stock is up approximately 83% year-to-date. Moreover, Wall Street analysts see further upside in AMZN stock from current levels. Amazon’s focus on fast delivery and enhancing Prime membership benefits drive shoppers to its platform. Furthermore, strength in cloud and advertising business and investments in Artificial Intelligence (AI) bodes well for future growth.

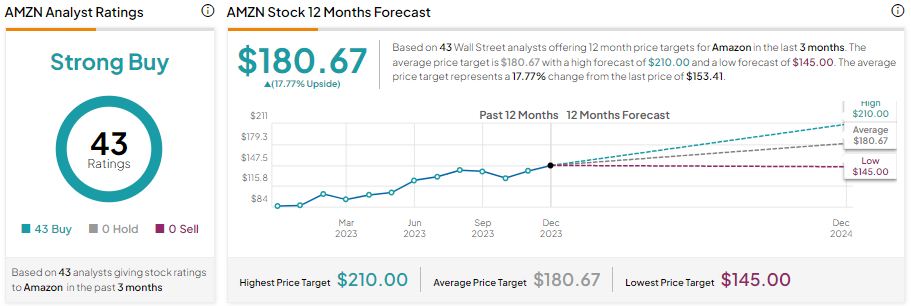

With 43 unanimous Buy recommendations, AMZN stock has a Strong Buy consensus rating. Further, the analysts’ average price target is $180.67 on AMZN stock, implying 17.8% upside potential from current levels.

Is Walmart a Buy or Sell Right Now?

Walmart stock is a Buy right now based on analysts’ consensus rating. Its value pricing strategy drives shoppers to its stores and online platform. Moreover, the expansion of its pickup and store-fulfilled delivery service and initiatives such as early access to the best savings events throughout the holiday season is likely to boost its top line in Q4.

WMT stock has a Strong Buy consensus rating, reflecting 25 Buy and five Hold recommendations. Walmart stock has gained about 12% year-to-date. Moreover, analysts’ average price target of $180.79 implies 15.59% upside potential from current levels.

Bottom Line

These retailers’ focus on offering value pricing and improving membership benefits makes them a favorite destination for shopping. Thus, they remain well-positioned to capitalize on higher holiday spending.