While the Street is avidly looking towards Thursday and Apple and Amazon’s latest earnings reports to provide a general indicator for the overall strength of the tech space, in the interim, there are other interesting financial statements that will be released. One of those will be today after the close when Advanced Micro Devices (NASDAQ:AMD) will dial in its Q2 report.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

According to Northland analyst Gus Richard, investors are in for a good readout from the chip giant.

“We expect a strong quarter and a positive outlook,” says the 5-star analyst. “We believe that client revenue bottomed last quarter, AMD still has market share momentum in data centers, and embedded likely had a strong Q2 relative to a historically usually weak Q2. We also expect it is well-positioned to gain a share in the market for GPUs used in AI.”

Richard thinks AMD will “likely beat” consensus revenue estimates. He is calling for sales of $5.4 billion, against the Street’s $5.3 billion forecast, expecting potential upside from embedded ($1.5 billion), client ($946 million), and data center ($1.3 billion).

Based on a similar product mix to last quarter, Richard expects non-GAAP gross margins of 49.9%. At the bottom-line, that will lead to adj. EPS of $0.55, which is a bit below consensus at $0.57.

Looking ahead, Richard expects “robust sequential guidance driven by data center demand, particularly GPUs for AI and HPC.” Richard believes the El Capitan supercomputer shipments kicked off during the quarter and will continue in Q3, before “rolling off” in Q4.

As for the AI race, while Nvidia remains the chipmaker in pole position, Richard says AMD’s MI300 and MI300x – the hybrid processors designed to support generative AI models – will likely “leapfrog” Nvidia’s performance, before Nvidia’s new product will probably skip past AMD’s offerings by next year. This is similar to the GPU wars between NVDA and ATI back “in the good old days,” says Richard, who sees AMD as an “attractive second source.”

All told, ahead of the print, Richard maintains an Outperform (i.e., Buy) rating on AMD shares, backed by a $150 price target. If Richard is correct in his prognosis, investors will be sitting on gains of 28% in a year’s time. (To watch Richard’s track record, click here)

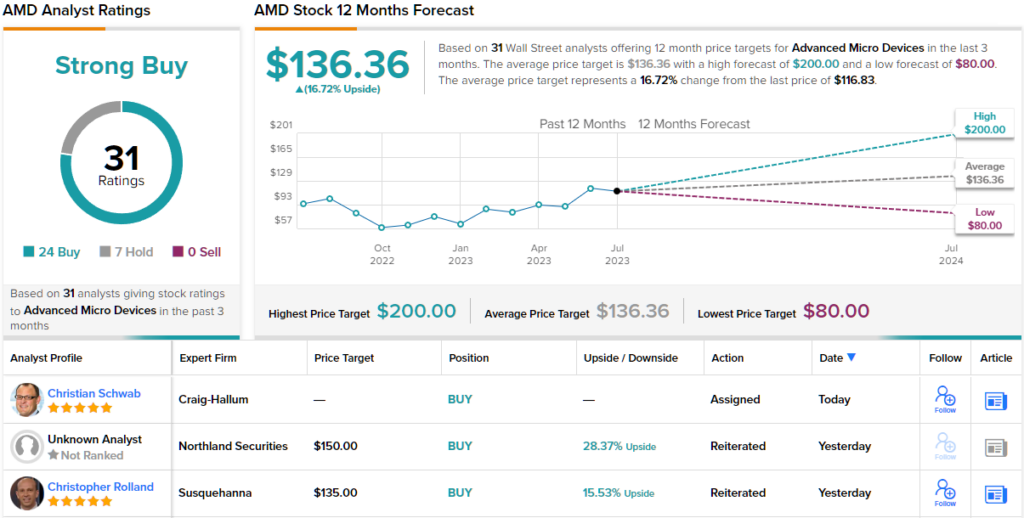

Overall, 31 analysts have chimed in with AMD reviews over the last 3 months, with the ratings breaking down into 24 Buys and 7 Holds, all culminating in a Strong Buy consensus view. The forecast calls for one-year returns of ~17%, considering the average target stands at $136.36. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.